To avoid loss, you must sell at:

Master Your Trades: Understand Charges, Taxes & Profits with a Brokerage Calculator

Whether you’re a beginner or an experienced investor, calculating your net profit or loss from stock trades isn’t always straightforward. That’s because various charges—like brokerage fees, STT, GST, SEBI fees, and stamp duty—quietly eat into your profits.

That’s where a Brokerage Calculator becomes essential.

This free tool helps you understand the true cost of your trades, accurately calculate your earnings, and plan smarter trades. In this article, you’ll learn:

- What a brokerage calculator is

- Why you should use it before placing any trade

- How to use our tool step-by-step

- How fees differ between brokers, exchanges, and trade types

- And how to make the most of your results

Let’s start by understanding the basics.

What Is a Brokerage Calculator?

A Brokerage Calculator is an online tool that helps traders and investors determine:

- All applicable charges on a stock trade

- Final net profit or loss

- Break-even price for a trade

- Total taxes and fees deducted

It works by taking your buy price, sell price, quantity, transaction type, exchange, and broker, and then automatically computing all charges involved in the trade.

Why You Need a Brokerage Calculator

Most traders look at the difference between buy and sell price and assume that’s their profit.

But in reality, you need to factor in brokerage fees, taxes, and exchange charges that can shrink or even wipe out your profit.

Here’s why every Indian stock market trader should use a brokerage calculator:

1. Know Your Real Profit

The tool tells you your net earnings after charges, not just gross gains.

2. Avoid Surprise Losses

Hidden fees can turn a profitable trade into a loss. Avoid that with a clear breakdown.

3. Plan Smarter Trades

Compare different brokers, exchanges, and strategies to see what works best for you.

4. Find Your Break-Even Point

Know the minimum price you must sell at to avoid a loss, based on current charges.

5. Build Long-Term Discipline

It helps in developing a cost-aware trading habit—a mark of a smart investor.

How to Use the Brokerage Calculator (Step-by-Step)

Our Brokerage Calculator is built for simplicity. Here’s how to use it correctly.

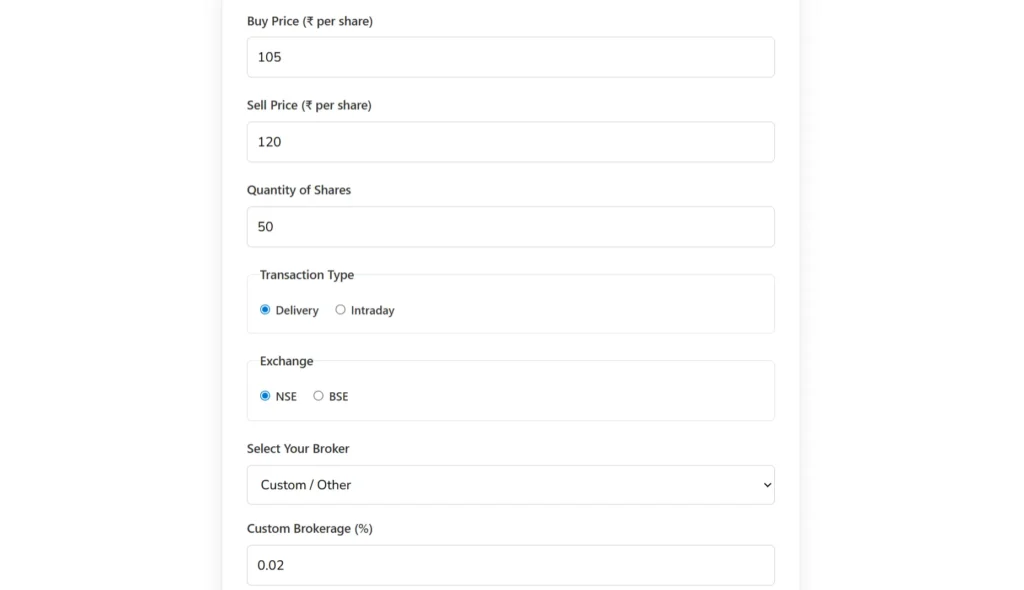

Step 1: Enter Your Trade Details

- Buy Price – The price per share at which you purchased the stock

- Sell Price – The price per share at which you sold the stock

- Quantity – Number of shares traded

Step 2: Select the Transaction Type

Choose between:

- Delivery – If you held the stock for more than one day

- Intraday – If you bought and sold the same stock on the same day

Tip: Intraday trades often have lower brokerage charges but higher tax implications.

Step 3: Choose the Exchange

Select where the trade happened:

- NSE (National Stock Exchange)

- BSE (Bombay Stock Exchange)

Charges slightly vary depending on the exchange, so this step ensures accurate results.

Step 4: Pick Your Broker

We’ve included popular brokers with their current fee structures, including:

- Zerodha

- Upstox

- Angel One

- Groww

Or choose “Custom / Other” to manually input your brokerage percentage.

Step 5: Click “Calculate”

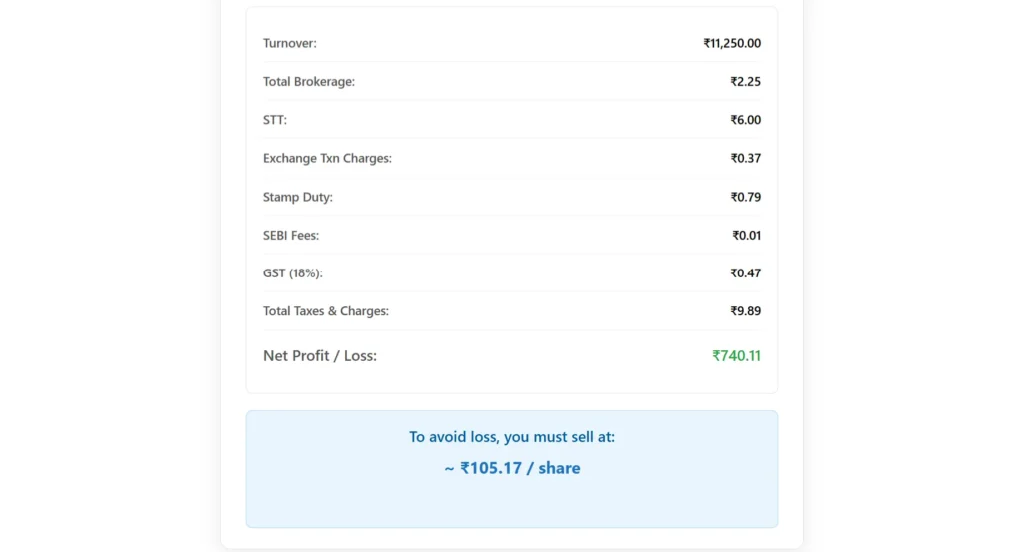

The calculator does all the heavy lifting. In one click, it shows:

- Turnover

- Total brokerage

- STT (Securities Transaction Tax)

- Exchange transaction charges

- Stamp duty

- SEBI fees

- GST (18%)

- Total deductions

- Net profit/loss

- Break-even price

Understanding Key Charges

Here’s a breakdown of what each cost means:

- Brokerage: Fee charged by your stock broker

- STT: Tax imposed by the government on securities transactions

- Exchange Charges: Charged by NSE or BSE

- SEBI Fees: Fee charged by the regulator (SEBI). Check out SEBI’s investor guide for how fees are structured.

- GST (18%): Tax on brokerage, exchange, and SEBI fees. You can verify updated tax rates on the SEBI knowledge base.

- Stamp Duty: Tax imposed by state governments on buying shares

Using Break-Even Price to Trade Smarter

The break-even price is a highlight of this tool. It tells you the exact price you must sell at to cover all costs. Knowing this helps you:

- Set more realistic price targets

- Avoid unintentional losses

- Improve trade timing

When to Use the Brokerage Calculator

Use this tool before placing any trade—especially for:

- High-volume trades

- Intraday strategies

- Testing brokers

- Comparing delivery vs. intraday profitability

Even seasoned traders use this tool to fine-tune their entries and exits.

FAQs About Brokerage Calculator

Is the Brokerage Calculator free to use?

Yes. It’s 100% free and doesn’t require sign-up or login.

Does it work for F&O or only equity trades?

This tool is built for equity intraday and delivery trades. A separate F&O calculator is coming soon.

What if my broker isn’t listed?

Choose “Custom” and enter your broker’s percentage manually.

How accurate are the calculations?

We stay updated with official brokerage slabs, STT rules, and exchange rates for accuracy.

Related Tools You Can Use Alongside

To make better financial decisions beyond trading, try these useful tools available on our site:

- Personal Loan EMI Calculator – Easily calculate your monthly loan repayments, interest costs, and total loan value before you borrow.

- Net Worth Calculator – Get a complete snapshot of your financial health by tracking your assets and liabilities.

Final Thoughts: Make Every Trade Count

Trading isn’t just about buying low and selling high—it’s about what you keep after all charges are paid. The Brokerage Calculator helps you see the full picture.

Before your next trade, use the calculator to:

- Plan your strategy

- Avoid surprise costs

- Maximize profits

- Find your break-even