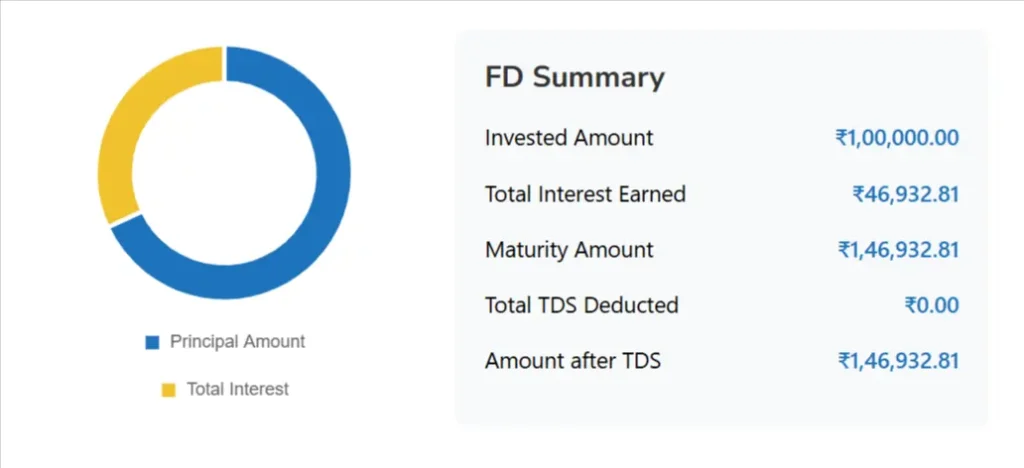

FD Summary

Invested Amount

Total Interest Earned

Maturity Amount

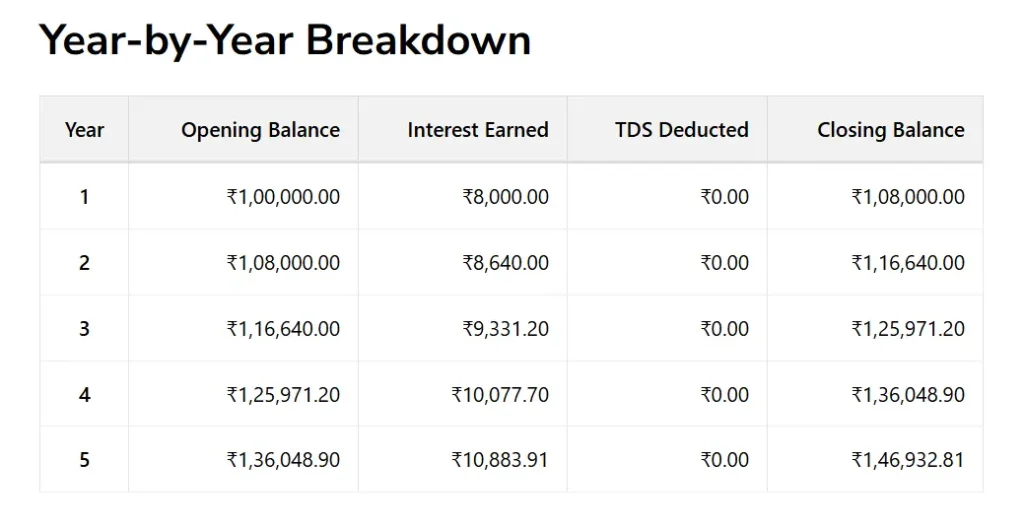

Year-by-Year Breakdown

| Year | Opening Balance | Interest Earned | TDS Deducted | Closing Balance |

|---|

Fixed Deposit Calculator Online: Estimate Returns Instantly for SBI, Post Office & More

Fixed Deposits (FDs) remain one of the most popular and trusted savings instruments for Indian investors. Whether you’re planning for a short-term goal or long-term wealth creation, FDs offer safety, predictability, and fixed returns. Our FD Return Calculator is designed to help you understand your maturity amount, interest earned, and even tax deductions—effortlessly and accurately.

What Is an FD Return Calculator?

An FD Return Calculator is an online tool that allows users to estimate the maturity amount and interest income from a fixed deposit. By inputting basic details like principal, interest rate, tenure, and compounding frequency, you can quickly see how much your money will grow over time.

Our tool also gives you options to factor in:

- Senior citizen benefits (higher interest rates)

- TDS (Tax Deducted at Source) impact on your returns

This makes the tool versatile for both regular investors and senior citizens.

Why Use Our FD Return Calculator?

Using our tool can help you:

- Compare FD options across banks or schemes

- Understand the impact of compounding (monthly, quarterly, yearly)

- Calculate post-tax returns using the TDS setting

- Plan goal-based investing for retirement, education, or travel

Whether you’re checking returns for an SBI FD, a Post Office FD, or any custom scheme, our calculator adapts to your input in real-time.

How to Use the FD Return Calculator

Here’s a step-by-step guide to help you use our tool:

1. Enter Your Principal Amount

- Input how much you want to invest in the “Investment Amount (INR)” field.

2. Input the Annual Interest Rate

- For example, SBI offers 6.5% for regular customers and up to 7.5% for senior citizens.

- You can verify current FD interest rates on the official SBI FD Rates Page.

3. Set the Tenure

- Enter the number of years you plan to stay invested.

4. Choose the Compounding Frequency

- Monthly, Quarterly, Semi-annually, or Annually. Generally, banks compound interest quarterly.

5. Enable Senior Citizen Option (If Applicable)

- If you are a senior citizen, check this option to apply higher interest rates, as offered by most banks.

6. Enable TDS Calculation (Optional)

- If you want to see how TDS affects your maturity amount, check “Include TDS Deduction”.

- Select 10% or 20% (for those without a valid PAN).

7. Click ‘Calculate’

- The tool will instantly show:

- Invested Amount

- Interest Earned

- Maturity Amount

- TDS Deducted (if selected)

- Post-TDS Maturity Value

8. View Year-by-Year Breakdown

- Scroll down to view the detailed amortization table to see interest and balance changes each year.

9. Download or Print

- Use the Export to CSV or Print buttons to keep a record.

Why FDs Still Matter in 2025

FDs are low-risk, government-backed instruments making them ideal for:

- Capital preservation

- Emergency fund parking

- Diversifying risky investment portfolios

As per RBI guidelines, deposit insurance covers up to ₹5 lakh per depositor per bank under DICGC. This makes FDs one of the safest savings choices.

Compare FD Options

Here’s how our tool helps you compare:

SBI FD Calculator

- Plan with India’s largest bank. Get accurate SBI return estimates.

Post Office FD Calculator

- Ideal for conservative investors seeking government-guaranteed returns. Rates vary based on tenure.

- Check official India Post FD rates.

Use our calculator with these rates to see returns instantly.

Internal Tools You Might Also Like

Looking to manage your finances smarter? Try these tools:

- Personal Loan EMI Calculator – Know your exact monthly loan burden before borrowing.

- Net Worth Calculator – Track your financial growth by calculating assets vs. liabilities.

- RD Return Calculator – Instantly Calculate your Recurring Depsoit.

- SIP Calculator – Plan your mutual fund investments efficiently. (Coming Soon)

- Income Tax Calculator – Estimate your tax liability with ease. (Coming Soon)

These tools together help you take control of every financial move.

When and Why You Should Recalculate

Use our FD Return Calculator:

- Before locking in funds for long tenure

- When comparing interest rates across banks

- To estimate post-TDS maturity

- When evaluating between FD vs. Mutual Funds

Remember: FD returns are fixed but may be lower than market-linked instruments. Always calculate and compare.

FAQs About FD Calculator India

Is login or registration required to use your tools?

No. All our tools — including the FD Calculator, Personal Loan EMI Calculator, Brokerage Calculator, and Net Worth Calculator — are completely free to use, with no login or sign-up required.

Do your tools work on mobile?

Yes, every calculator on our site is fully responsive. Whether you’re using a phone, tablet, or desktop, you’ll have a smooth experience with every tool.

Can I export or print the FD calculator results?

Yes. You can download your FD maturity details as a CSV file or print them directly. This makes it easy to keep a physical record or share with your financial advisor.

How often are the tools updated?

We keep our tools up-to-date with the latest formulas, financial rules, and user feedback. For instance, TDS rules and compounding logic are based on current government standards.

Are your calculations based on official sources?

Yes. Our formulas and assumptions follow guidelines by RBI, SEBI, and Income Tax Department wherever applicable. However, always consult your bank or financial advisor for specific FD terms.

Final Thoughts

FDs are dependable, and with our calculator, they become more transparent. You deserve to know exactly what your money earns. Whether it’s an SBI, Post Office, or private bank FD—get clarity before you commit.

Start using the FD Return Calculator today and plan your financial future with precision.

All rates and references are based on data from SBI, India Post, and RBI as of 2025.