Navi Personal Loan review: Navi Personal Loan is a popular loan option in India, offering attractive interest rates and flexible repayment terms.

In this blog post, we will discuss everything you need to know about Navi Personal Loan, including how to get a loan, the benefits of taking out a loan with Navi, the charges and fees associated with the loan, the eligibility requirements, the interest rate, and the repayment process.

Navi Personal Loan is a loan offered by Navi Finserv, a leading financial services company in India. The loan is available to individuals who meet certain eligibility requirements, and it can be used for a variety of purposes, such as consolidating debt, paying for medical expenses, or funding a major purchase.

- Instant disbursal: Once your loan is approved, the funds will be disbursed to your bank account within minutes.

- Flexible EMI options: You can choose an EMI tenure of up to 72 months (6 years) to suit your repayment capacity.

- Competitive interest rates: Navi offers interest rates starting from 9.9% p.a., which are among the lowest in the market.

- No collateral required: Navi Personal Loans are unsecured loans, so you don’t need to pledge any assets as collateral.

- Minimal documentation: You only need to provide a few basic documents to apply for a Navi Personal Loan, such as your PAN card, Aadhaar card, and bank statement.

- 100% paperless process: The entire loan application process is done online, so you don’t have to worry about filling out any paperwork.

Other features:

- Easy eligibility criteria: You can apply for a Navi Personal Loan even if you have a low credit score.

- 24/7 customer support: Navi offers 24/7 customer support, so you can get help with your loan anytime, day or night.

- Transparent terms and conditions: Navi’s terms and conditions are clear and transparent, so you know exactly what you’re getting into before you apply for a loan.

If you’re looking for a personal loan with a number of benefits, Navi is a good option to consider. The company offers competitive interest rates, flexible EMI options, and a 100% paperless process. You can also apply for a Navi Personal Loan even if you have a low credit score.

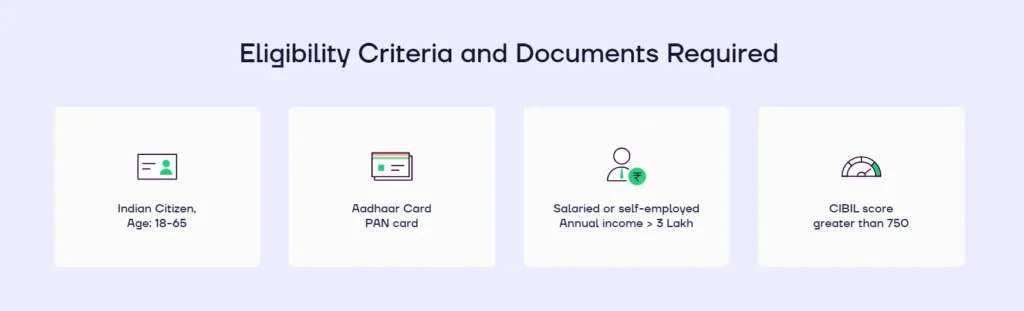

- Age: You must be between 18 and 65 years of age.

- Citizenship: You must be an Indian citizen.

- Income: You must have a minimum monthly income of Rs. 15,000 for salaried borrowers and Rs. 25,000 for self-employed borrowers.

- Credit score: Your credit score should be at least 675.

- Employment: You must be either salaried or self-employed with a steady source of income.

- Residence: You must be a resident of India.

In addition to these eligibility criteria, Navi may also consider other factors when assessing your loan application, such as your employment history, your debt-to-income ratio, and your other financial obligations.

To check your eligibility for a Navi Personal Loan, you can use the company’s online eligibility calculator. This calculator will ask you a few basic questions about your income, your credit score, and your employment status. Once you have answered these questions, the calculator will give you an estimate of whether you are eligible for a loan and how much you may be able to borrow.

If you are eligible for a Navi Personal Loan, you can apply for the loan online or through the Navi app. The entire application process is done online, so you don’t have to worry about filling out any paperwork.

The required documents to apply for a personal loan on Navi vary depending on your employment status.

However, the following documents are typically required for all borrowers:

- PAN card

- Aadhaar card

- Latest bank statement

If you are salaried, you will also need to provide the following documents:

- Salary slip

- Employer’s letter

If you are self-employed, you will also need to provide the following documents:

- Business registration documents

- Latest tax returns

- Bank statements for the last 6 months

In addition to these documents, Navi may also ask you to provide other documents, such as a passport, a driving license, or a utility bill.

You can upload these documents online when you apply for the loan. Navi will review your documents and let you know if you are approved for the loan. If you are approved, the funds will be disbursed to your bank account within minutes.

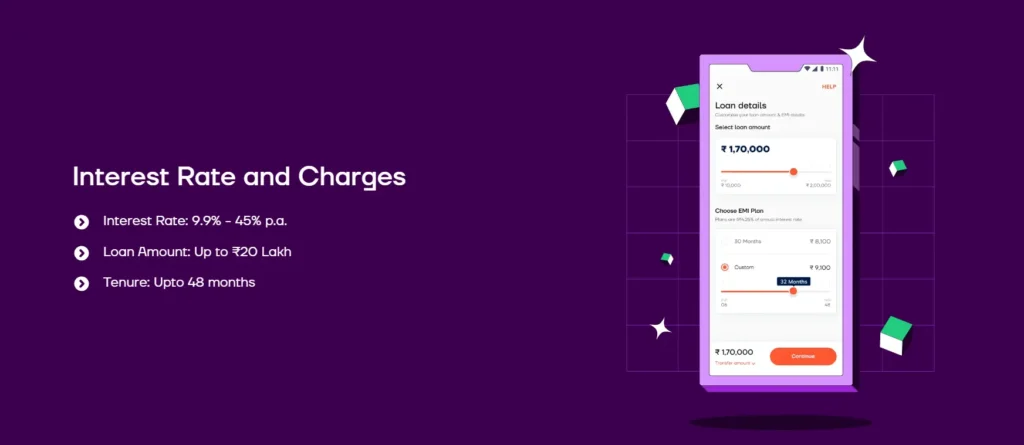

Navi Personal Loans have a few charges associated with them, including:

- Interest rate: The interest rate on a Navi Personal Loan will vary depending on your credit score, your repayment capacity, and the amount of the loan. The interest rate can range from 9.9% to 45% p.a.

- Processing fee: The processing fee for a Navi Personal Loan is 3.99% to 6% of the loan amount. The processing fee is payable upfront, before the loan is disbursed.

- Late payment charges: If you miss a payment on your Navi Personal Loan, you will be charged a late payment fee. The late payment fee is typically 2% of the outstanding amount.

- Prepayment charges: If you want to prepay your Navi Personal Loan, you may be charged a prepayment penalty. The prepayment penalty is typically 3% of the outstanding amount.

In addition to these charges, Navi may also charge other fees, such as a documentation fee or an insurance premium. These fees will vary depending on your individual circumstances.

It is important to carefully read the terms and conditions of your Navi Personal Loan before you apply for the loan. This will help you understand the charges that you will be responsible for.

The interest rate on a Navi Personal Loan will vary depending on your credit score, your repayment capacity, and the amount of the loan. The interest rate can range from 9.9% to 45% p.a.

For example, if you have a good credit score and you are applying for a loan of Rs. 1 lakh, you may be offered an interest rate of 9.9% p.a.

However, if you have a low credit score and you are applying for a loan of Rs. 5 lakh, you may be offered an interest rate of 45% p.a.

Don’t worry if you have lower credit score and want to improve it, just follow “10 Proven Tips to Increase Credit Score From 300 to 750.“

Follow these steps to apply for a Navi Personal Loan online:

- Download the Navi App from the Google Play Store or the Apple App Store.

- Open the app and click on the “Apply” tab.

- Enter your basic details, such as your full name, age, marital status, and pin code of residence.

- Enter your employment and income details.

- Enter your PAN number.

- Your loan will be instantly processed and your credit score and other details will be checked at the backend.

- If you are approved, your loan will be disbursed within 10 minutes.

Navi provides urgent loan in just 5 minutes. To apply for urgent loan on Navi follow these steps:

- Download the Navi app from the Google Play Store or Apple App Store.

- Enter your mobile number and generate an OTP to access the home page.

- Click on the “Cash Loan” tab to auto-install the cash loan app.

- Enter your personal details and KYC details (PAN or Aadhaar card).

- Select your preferred loan amount and tenure.

- Complete your KYC and click on “Apply“.

- Your loan will be processed and the exact amount will be transferred to your bank account in just a few minutes.

Also Read: What is Zest Money: how to get personal loan, eligibility, benefits, charges

9th Floor,

Vaishnavi Tech Square,

Iballur Village,

Begur Hobli,

Bengaluru 560102,

but unfortunately, the customer support number is not available publicly on navi website.

Yes, the Navi loan app is RBI approved. Navi Finserv Limited, the NBFC that provides loans through the Navi app, is a Systemically Important Non-Deposit Taking NBFC (ND-SI) that is registered with the Reserve Bank of India (RBI).

Navi Finserv Limited is subject to the RBI’s regulations and oversight, which helps to ensure that the company is operating in a safe and sound manner.

You can use Navi’s online eligibility calculator to get an estimate of the interest rate you may be offered. This calculator will ask you a few basic questions about your income, your credit score, and your employment status.

Once you have answered these questions, the calculator will give you an estimate of the interest rate you may be offered.

To calculate your EMIs, Try our Personal Loan EMI Calculator.

Also Read: Money View personal loan Review: Is money view approved by RBI?

FAQs

Navi personal loan is a real loan offered by Navi Finserv Limited. Navi Finserv Limited is a Systemically Important Non-Deposit Taking NBFC (ND-SI) that is registered with the Reserve Bank of India (RBI).

Yes, you can get a personal loan from Navi, but it depends on your eligibility criteria. The company has a set of requirements that you must meet in order to be approved for a loan.

The minimum income requirement for a Navi Personal Loan varies depending on your employment status. For salaried borrowers, the minimum monthly income requirement is Rs. 15,000. For self-employed borrowers, the minimum monthly income requirement is Rs. 25,000.

To be eligible for a Navi loan, you must be:

1. An Indian citizen

2. Between 18 and 65 years old

3. Have a minimum monthly income of Rs. 15,000 (salaried) or Rs. 25,000 (self-employed)

4. Have a credit score of at least 675

5. Have a stable employment history

6. Have a low debt-to-income ratio

The owner of Navi Personal Loan is Sachin Bansal and Ankit Agarwal. They are the co-founders of Navi Technologies Private Limited, the parent company of Navi Personal Loan.

The interest rate for a Navi personal loan can vary depending on your credit score, the amount of the loan, and the term of the loan.