Looking for Payme India Personal Loan Review 2025. PayMe India is a popular online lending platform that offers instant personal loans to borrowers in India.

In this blog post, we will take a detailed look at PayMe India personal loans, including how to get an instant loan, the benefits of borrowing from PayMe India, the eligibility criteria, interest rates, charges, and the repayment process.

What is Payme India?

PayMe India is a FinTech company that was founded in 2016. It offers a range of financial services to individuals and corporates, including instant personal loans, business loans, and investment products. PayMe India is committed to providing high-quality, affordable, and transparent financial products to everyone in society.

The company’s mission is to become the preferred choice of financial services provider in India. Its vision is to become a globally acknowledged FinTech brand by spreading “Financial Happiness” through the use of latest financial technologies.

PayMe India is led by Mahesh Shukla, who is the Founder and CEO. Shukla comes from a middle-class, rural family background and has always understood the issues plaguing rural India in terms of financial services. His personal goal is to make financial services easily accessible to the remotest of the villages, as internet penetration spreads across India.

PayMe India is a growing FinTech company with a bright future. It is well-positioned to become a leading provider of financial services in India and beyond.

Types of Loan Provided by Payme India

PayMe India offers three types of personal loans to meet the needs of different borrowers:

- PayMe Cruise (Long-Term Loan): This is a long-term personal loan that is ideal for borrowers who need a large amount of money for a long period of time. The loan amount for PayMe Cruise upto ₹5 lakhs, and the repayment period is up to 36 months.

- PayMe Jiff (Short-Term Loan): This is a short-term personal loan that is ideal for borrowers who need a small amount of money for a short period of time. It’s a quick and easy one-time loan for emergencies that requires minimal documentation.

- Empowerment Loan (Personal Loan For Women): This is a personal loan for women with the best interest rates. It’s available to working women in private and government sectors and self-employed women entrepreneurs.

All three types of personal loans offered by PayMe India are unsecured loans, It means that borrowers do not have to put up any collateral to secure the loan. It help borrowers to get a loan, even if they have a poor credit history.

Payme India Loan Features & Benefits

- Instant approval process: PayMe India offers a quick and easy approval process for personal loans. Once you submit your application, your loan will be reviewed and approved within minutes.

- Minimum documentation: PayMe India requires minimal documentation for personal loans. You will need to provide your PAN card, Aadhaar card, and bank statement.

- No restriction on fund usage: You can use the funds from your PayMe India personal loan for any purpose you like. There are no restrictions on how you can use the money.

- Flexible tenure: PayMe India offers flexible tenures for personal loans. You can choose to repay your loan over a period of 3 to 24 months.

- Low-interest rates: PayMe India offers competitive interest rates on personal loans. The interest rate you will be charged will depend on your credit score and the loan amount.

- Transparent terms and conditions: PayMe India is transparent about its terms and conditions. You will be able to read and understand the loan agreement before you commit to the loan.

- No collateral required: PayMe India does not require collateral for personal loans. This means that you do not have to put up any of your assets as security for the loan.

- Dedicated customer support: PayMe India has a dedicated customer support team that is available to help you with any questions or concerns you may have about your personal loan.

Overall, PayMe India offers a number of benefits and features that make it a good option for borrowers who are looking for a personal loan.

Payme India Loan Amount Limit

The loan amount limit for PayMe India personal loans is ₹500 to ₹5 lakh. However, the actual loan amount that you are eligible for will depend on your credit score, income, and other factors. You can check your eligibility for a PayMe India personal loan by applying online.

Payme India Loan Eligibility

PayMe India considers multiple factors when evaluating a borrower’s eligibility for a personal loan. If the borrower meets the requirements, they may apply for a loan.

| Criteria | Salaried Employees | Self-Employed |

|---|---|---|

| Age | 21 to 58 years | 22 to 55 years |

| Net Monthly Income | ₹15,000 | ₹25,000 |

| CIBIL Score | Above 650 | Above 650 |

| Minimum Loan Amount | ₹500 | ₹500 |

| Maximum Loan Amount | ₹5 lakhs | ₹5 lakhs |

Payme India Loan Interest Rates & Other Charges

interest rates on personal loans vary based on a number of factors, including your credit history, loan amount, lender, and the type of loan availed. PayMe India personal loans come with competitive interest rates, but the actual interest rate you will be charged will depend on your individual circumstances.

In addition to interest rates, it is also important to be aware of the fees and charges associated with personal loans. These fees can vary from lender to lender, so it is important to compare offers before you choose a loan.

Some of the fees that you may encounter with a personal loan include:

- GST charges: GST is a government tax that is applicable on all loans in India. The GST rate for personal loans is currently 18%.

- Verification fees: Lenders may charge a fee to verify your income and employment. This fee is typically around ₹500.

- Penalties: If you miss a loan payment, you may be charged a penalty. The penalty amount will depend on the lender and the terms of your loan agreement.

- Prepayment charges: If you pay off your loan early, you may be charged a prepayment charge. This charge is typically around 3% of the outstanding loan amount.

- Processing fees: Lenders may charge a fee to process your loan application. This fee is typically around 2% to 10%.

- Documentation fees: Lenders may charge a fee to process your loan documents. This fee is typically around ₹500.

It is important to factor in all of these fees and charges when comparing personal loan offers. The total cost of the loan may be significantly higher than the interest rate alone.

Payme India Loan Apply Online

- Go to the PayMe India website or download the PayMe app on your mobile phone.

- Click on the “Apply Now” button and enter your mobile number.

- You will receive a One Time Password (OTP) on your mobile phone. Enter the OTP to verify your mobile number.

- Provide your personal details, such as your name, email address, and date of birth.

- Upload your address proof documents, such as your PAN card, Aadhaar card, and bank statement.

- Provide a document as income proof (bank statement, salary slip, or an ITR depending on your employment type).

- Once your KYC is verified, your loan application will be processed.

- If your loan application is approved, the amount will be credited to your bank account within 24 hours.

Payme India Loan EMI Calculator

it is a good idea to calculate your EMI before taking a personal loan. This will help you understand how much you will need to repay each month and make sure that you can afford the monthly payments.

The PayMe Personal Loan EMI calculator is a great tool for calculating your EMI. It is easy to use and just requires you to enter a few details, such as the loan amount, interest rate, and repayment period.

Payme India Loan Customer Support

- On-call support: PayMe India offers 24/7 on-call support for customers who need help with their loans. You can call the customer support number at 0120 – 697 – 1400 to speak to a representative.

- Raise a request: You can also raise a request through the PayMe India website or app. This is a good option if you have a non-urgent query or if you want to track the progress of your request.

- Find a branch: If you prefer to speak to a customer support representative in person, you can visit a PayMe India branch. The nearest branch can be found using the “Locate Us” function on the PayMe India website or app.

Is Payme India Loan RBI Approved?

Yes, PayMe India Loan is RBI approved. PayMe India is a Non-Banking Financial Company (NBFC) that is registered with the Reserve Bank of India (RBI). This means that PayMe India is subject to the regulations and supervision of the RBI.

The RBI approval for PayMe India Loan is a sign that the company is a legitimate and reliable lender. It also means that PayMe India is subject to the same standards and regulations as other NBFCs, which helps to protect borrowers.

If you are considering taking out a personal loan from PayMe India, you can be confident that the company is a reputable lender and that your loan will be processed in accordance with RBI regulations.

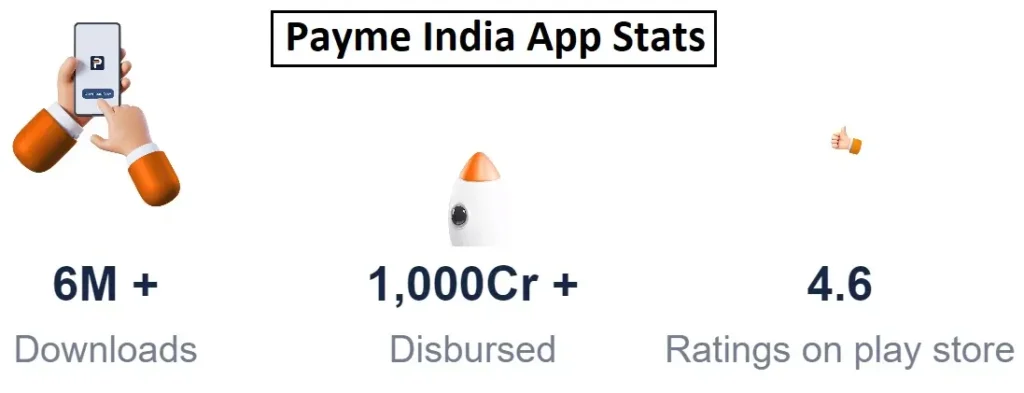

Payme India Loan App Stats

FAQs about Payme India Personal Loan Review

What is the interest rate for PayMe Personal Loan?

The interest rate for PayMe Personal Loan depends on a number of factors, including your credit score, loan amount, and repayment period. The interest rate will be disclosed to you during the application process.

What is the maximum loan amount for PayMe Personal Loan?

The maximum loan amount for PayMe Personal Loan is ₹5 lakhs. The exact loan amount will depend on your eligibility and the purpose of the loan.

What is the repayment period for PayMe Personal Loan?

The repayment period for PayMe Personal Loan is 3 to 24 months. The exact repayment period will depend on your loan amount and your repayment capacity.

How do I apply for PayMe Personal Loan?

You can apply for PayMe Personal Loan online or through the PayMe app. The application process is quick and easy.

How long does it take to get a PayMe Personal Loan?

The processing time for PayMe Personal Loan is typically 24 to 48 hours. However, it may take longer if your application is incomplete or if you need to provide additional documentation.

Recommended Posts:

- Dhani No EMI Personal Loan: Is Dhani Giving Personal Loan Without Interest?

- Nira Personal Loan: Is Nira Loan app real or fake?

- What is Navi Personal Loan: Is Navi loan app RBI approved?

- Kissht Personal Loan: Is Kissht Loan App RBI Registered?

- Fibe Personal Loan Review: Is Fibe app loan real or fake?