Plan Smarter Loans: A Step-by-Step Guide to Using a Personal Loan EMI Calculator

A Personal Loan EMI Calculator is a free online financial tool that helps you estimate how much you’ll need to repay every month on a personal loan. It gives you an instant breakdown of your EMI (Equated Monthly Installment), total interest, and overall cost of the loan based on the loan amount, interest rate, and tenure you choose.

If you’re planning to take a personal loan — whether for education, travel, medical needs, or a wedding — knowing your EMI in advance can help you plan better and avoid surprises. According to the RBI’s consumer credit trends, personal loan demand has increased steadily in India.”

Why You Should Use a Personal Loan EMI Calculator

Here are five key reasons why this tool is a must-use before you apply for any loan:

1. Instant Results Without Manual Math

Manually calculating EMI using formulas can be confusing and time-consuming. This tool gives you quick results in seconds.

2. Helps Compare Different Loan Offers

You can try different combinations of interest rates, loan amounts, and tenures to see what works best for your monthly budget.

3. Avoid Over-Borrowing

By knowing your monthly payments, you’ll avoid borrowing more than you can handle comfortably.

4. Plan Prepayments Easily

If you want to make extra payments to reduce your loan faster, the calculator shows how that will affect your EMI and interest.

5. 100% Free and No Sign-Up Needed

Use the tool as many times as you want without creating an account or paying a fee.

How to Use the Personal Loan EMI Calculator (Step-by-Step)

Using the EMI Calculator on our website is super easy. Follow these easy steps:

Step 1: Enter Loan Amount

Use the number box or the slider to select how much you want to borrow (e.g., ₹1,00,000 to ₹10,00,000). This is the total personal loan amount.

Step 2: Enter Interest Rate

Use the slider or input field to enter the interest rate offered by the lender (e.g., 8.5%). If you’re unsure, you can try different rates to compare.

Step 3: Set Loan Tenure

Choose how long you’ll take to repay the loan — either in years or months (e.g., 5 years or 60 months). Use the dropdown and slider to switch between time formats.

Step 4: Add Prepayment (Optional)

If you want to make an extra monthly payment to reduce your loan faster, check the “Add Extra Monthly Payment” option. Then enter how much extra you can pay each month.

Step 5: Click “Calculate”

Once all details are entered, click the “Calculate” button. You’ll instantly see:

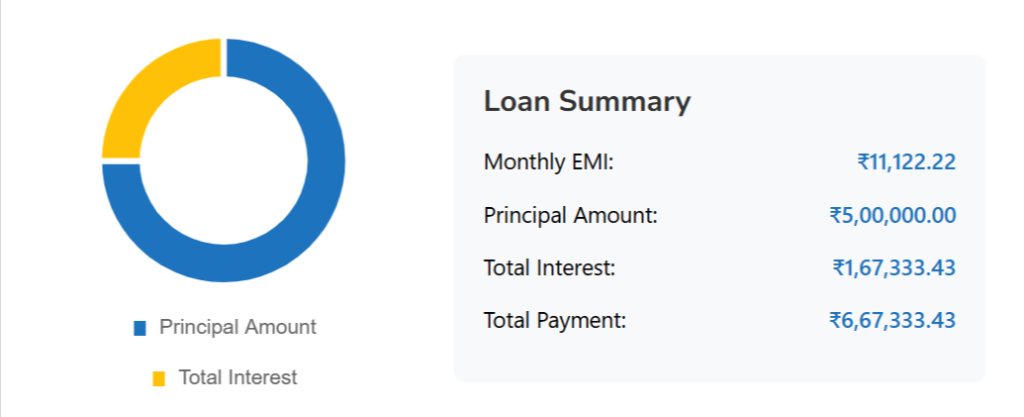

- Monthly EMI

- Total Interest

- Total Loan Cost

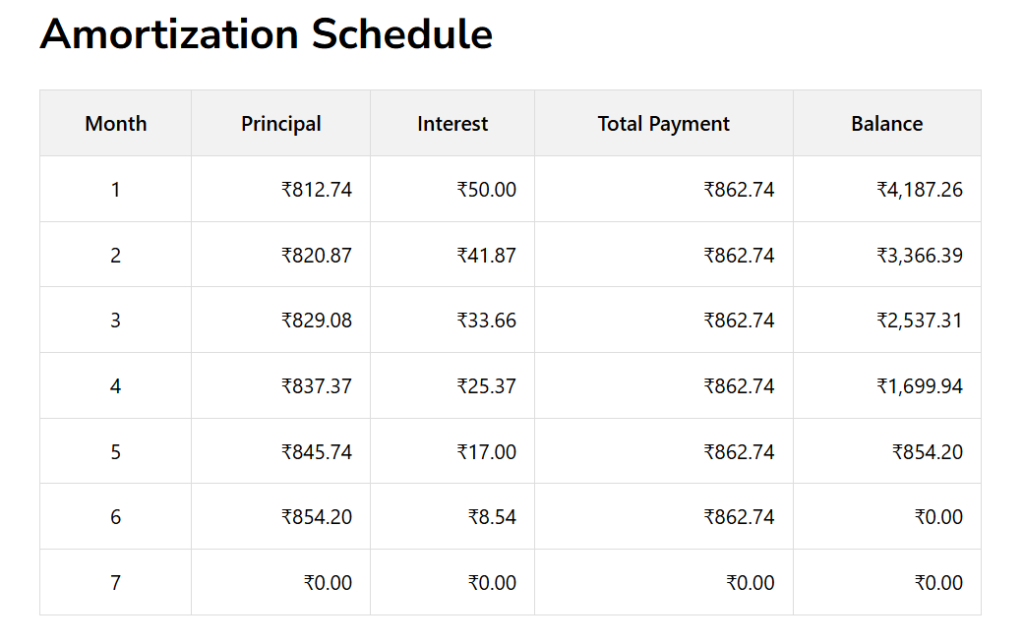

- Amortization Table (Breakdown of payments by month)

- Interactive Chart (Principal vs. Interest)

Step 6: Export or Print Your Results

You can also:

- Export as CSV for future reference

- Print your plan to discuss with a loan officer or family

- Reset and try other scenarios easily

What the Results Tell You

When you calculate, you’ll see a table like this:

You also get a loan amortization schedule, showing month-by-month how much goes to interest and how much to principal. This helps you understand how your loan reduces over time.

Who Should Use EMI Calculator?

This tool is for anyone planning to take a personal loan, including:

- Salaried professionals comparing loan offers

- Students checking education loan EMIs

- Small business owners exploring personal loans for business use

- Families planning medical expenses or weddings

- First-time borrowers trying to understand repayment

Key Benefits of Our Personal Loan EMI Calculator

| Feature | Benefit |

|---|---|

| No Sign-Up Required | Use it instantly, no registration |

| 100% Free | No charges, unlimited usage |

| Supports Prepayment Option | Plan extra payments with ease |

| Monthly or Yearly Tenure Option | Flexibility to choose format |

| Export & Print Option | Save or share your loan plan |

| Interactive Chart + Table | Easy-to-read visuals and breakdown |

Try Different Scenarios for Better Planning

One of the best parts of using this calculator is how flexible it is. You can try:

- Lower interest rates to compare lenders

- Shorter or longer tenures to manage EMIs

- Higher prepayments to see how much you save on interest

- Adjusting the loan amount to match your repayment ability

This kind of “what-if” planning makes it much easier to stay in control of your loan.

Frequently Questions About Personal Loan EMI Calculators

Is this calculator accurate?

Yes. The calculator uses standard EMI formulas used by banks and financial institutions.

Can I use it for other loans too?

While it’s designed for personal loans, you can use it for any simple fixed-rate loan — just enter the amount, rate, and tenure.

Will it affect my credit score?

No. Using this tool is completely private and has no impact on your credit report.

Related Tools to Help You Further

Use these additional tools to build a clearer financial picture:

- Net Worth Calculator – Track all your assets and liabilities in one place to measure your true financial health.

- Brokerage Calculator – Estimate all charges before making stock market trades or mutual fund investments.

Final Thoughts

A Personal Loan EMI Calculator is more than just a tool — it’s a financial planning assistant. It helps you:

- Understand your loan clearly

- Avoid costly surprises

- Plan your budget

- Save money through smarter repayment strategies

The calculator uses the standard EMI formula followed by all major banks. Learn more about EMI calculations on this Investopedia guide.

And the best part? It’s free, fast, and requires no sign-up. Whether you’re just exploring loan options or ready to apply, take a moment to use this calculator and get confident about your next financial step.