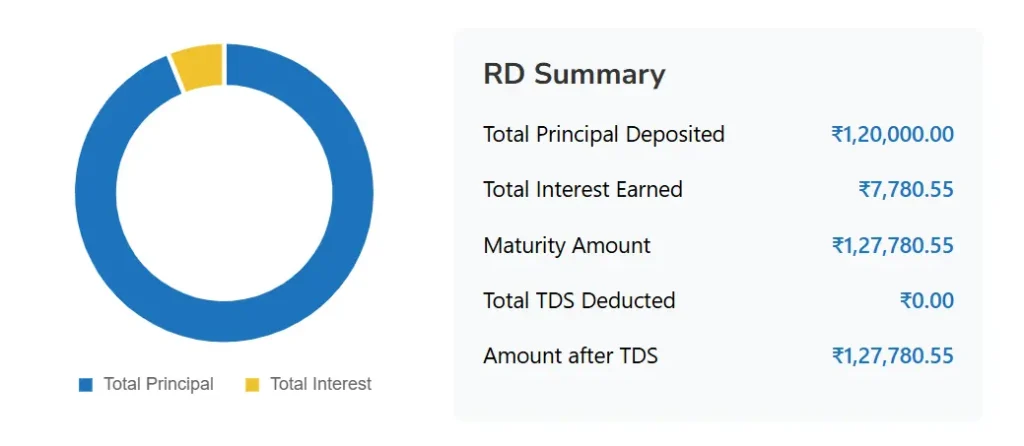

RD Summary

Total Principal Deposited

Total Interest Earned

Maturity Amount

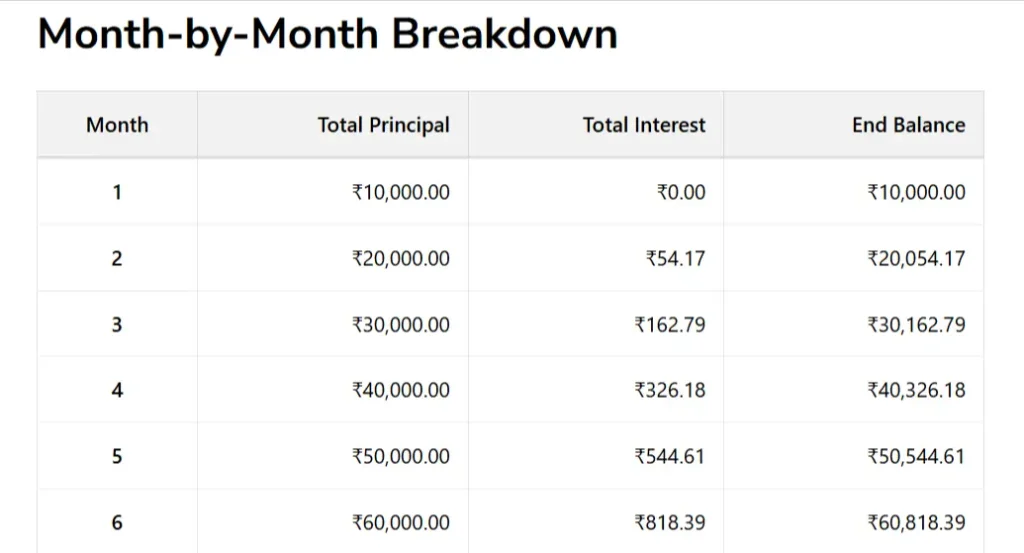

Month-by-Month Breakdown

| Month | Total Principal | Total Interest | End Balance |

|---|

RD Return Calculator: Calculate Your Recurring Deposit Maturity Instantly

Recurring Deposits (RDs) are a popular saving instrument in India, especially for individuals who prefer disciplined monthly savings with a guaranteed return. Whether you’re investing in an RD scheme from a bank or through a government-backed option like the Post Office, understanding your returns is essential. Our RD Return Calculator helps you do exactly that—quickly, accurately, and without any registration.

In this guide, you’ll learn how to use our tool effectively, the logic behind the RD calculator formula, and how it compares across various schemes like the SBI recurring deposit calculator, Post Office RD calculator, and more.

What Is an RD Return Calculator?

An RD Return Calculator is a financial tool that lets you estimate the maturity amount and interest earned on your recurring deposits. By entering the monthly investment amount, interest rate, and tenure, the tool provides you with a clear breakdown of your total principal, total interest, and final maturity value.

Whether you’re saving for a goal or comparing banks, this calculator makes your planning easier and data-driven.

How to Use Our RD Return Calculator

Our tool is designed for ease of use, even for non-finance users. Here’s how you can make the most of it:

Step-1. Enter Monthly Installment (₹)

Input the fixed amount you plan to deposit every month.

Step-2. Annual Interest Rate (%)

Enter the expected or actual RD rate. For example, many banks offer 6.5% to 7.5% currently. Check SBI’s official RD rates for the latest values.

Step-3. Tenure (Years)

Specify the number of years you’ll continue the RD.

Step-4. Compounding Frequency

Although most RDs compound quarterly, our calculator works out the return assuming standard bank practices.

Step-5. Senior Citizen Option

Tick this if applicable. Senior citizens often receive 0.25% to 0.50% higher interest rates.

Step-6. Include TDS Deduction

Check this option if you want to factor in tax deducted at source (TDS). If your interest exceeds ₹40,000 annually (₹50,000 for senior citizens), banks deduct 10% TDS (or 20% if no PAN is provided). Learn more at the Income Tax Department’s website.

Step-7. Click Calculate

The tool instantly displays:

- Total Principal Deposited

- Interest Earned

- Maturity Amount

- TDS (if applicable)

- Month-by-Month Breakdown

Step-8. Export or Print

Use the Export to CSV or Print Results buttons for easy recordkeeping.

RD Calculator Formula Explained

The standard formula used in most recurring deposit calculations is:

M = P × [(1 + r/n)^(nt) – 1] / (1 – (1 + r/n)^(-1/3))

Where:

- M = Maturity Amount

- P = Monthly deposit

- r = Annual interest rate (in decimal)

- n = Compounding frequency (usually 4 for quarterly)

- t = Tenure in years

This may look complex, but our tool handles this instantly in the backend for you.

Why Use Our RD Calculator Instead of Manual Calculation?

- No complex math or Excel sheets

- Instant, accurate results

- TDS and senior citizen options included

- Visual breakdown charts

- Mobile and desktop responsive

- Free, no sign-up needed

Compare Popular RD Options

SBI Recurring Deposit Calculator

State Bank of India is one of the most trusted banks for RDs. Our tool works great as an SBI RD Calculator when you input SBI’s interest rates. Visit SBI RD official page for latest data.

Post Office RD Calculator

For people preferring government-backed schemes, the Post Office RD Calculator option helps you estimate maturity from a 5-Year Post Office Recurring Deposit, currently offering 6.7% annual interest (as per India Post).

Yearly Recurring Deposit Calculator:

If you’re contributing once per year, adjust the monthly amount and tenure accordingly in our calculator. While most RDs are monthly, this feature gives flexibility.

Other Financial Tools That Help You More

While planning your financial future, don’t stop at RDs. Explore other essential calculators:

- FD Return Calculator – Estimate fixed deposit returns with compounding and TDS options.

- Personal Loan EMI Calculator – Know your monthly payments and interest burden.

- Net Worth Calculator – Assess your financial position by tracking assets and liabilities.

- Brokerage Calculator – Know what charges eat into your stock market profits.

- SIP Calculator – Plan long-term mutual fund investments. (Coming Soon)

FAQs About RD Return Calculator

What is an RD Return Calculator?

It is a digital tool that calculates the maturity amount and interest earned on a recurring deposit based on inputs like monthly investment, interest rate, and tenure.

Can I use this tool for SBI RD calculation?

Yes. Just input SBI’s RD interest rate and other values to use this as your SBI Recurring Deposit Calculator.

Does it support Post Office RDs?

Absolutely. Use the current RD interest rate for Post Office and tenure to estimate your maturity accurately.

How is interest calculated on RDs?

Interest is compounded quarterly based on your monthly contributions. Our calculator automates this using the industry-approved RD calculator formula.

Is TDS deducted on RD returns?

Yes. If your interest income from RDs exceeds the exemption limit (₹40,000 per year), TDS is deducted by the bank. Our calculator includes an option to factor this in.

Is the tool mobile-friendly?

Yes. All features work seamlessly on mobile devices.

Can I export or print my results?

Yes. You can download your results as CSV or print them for future reference.

Is the RD calculator free?

Yes. The tool is 100% free and requires no login.

Final Thoughts

If you’re serious about building a disciplined savings habit, a Recurring Deposit is a great place to start. And using our RD Return Calculator ensures you stay informed and prepared.

Try it today, adjust your values, and plan confidently — whether you’re comparing SBI, Post Office, or any other RD scheme.