Are you looking for Sharekhan brokerage charges? Look no further! In this blog post, we will cover everything you need to know about Sharekhan’s AMC, trading charges, and more.

Whether you’re a seasoned investor or just starting out, Sharekhan offers a variety of brokerage plans to suit your needs. But with so many options to choose from, it can be difficult to know which plan is right for you.

That’s where this blog post comes in. We’ll break down Share-khan brokerage charges in a clear and concise way, so you can make an informed decision about which plan is best for you.

So stay tuned and learn everything you need to know about Share-khan brokerage charges in 2024!

Sharekhan is a popular stockbroker in India that offers various financial services. They are known for their wide range of investment options, including stocks, commodities, bonds, mutual funds, and more.

Sharekhan is backed by the BNP Paribas Group and has been in the business for over 23 years, earning a good reputation and trust from customers.

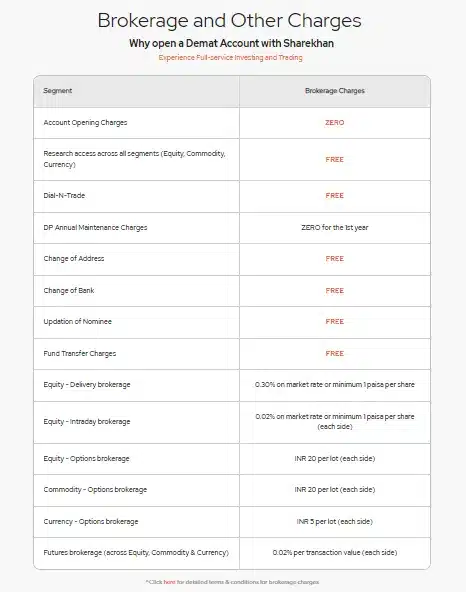

Account Opening Charges:

- Trading Account Opening Charges (One Time): Rs 0 (Free)

- Demat Account Opening Charges (One Time): Rs 0 (Free)

Share-khan doesn’t charge any fees for opening a trading or Demat account, which is great news for new investors as there are no upfront costs to get started.

Annual Maintenance Charges (AMC):

- Trading Annual Maintenance Charges (AMC – Yearly Fee): Rs 0 (Free)

- Demat Account Annual Maintenance Charges (AMC – Yearly Fee): Rs 400 (Free for the 1st year)

Sharekhan also offers a favorable fee structure when it comes to annual maintenance charges. They do not charge any yearly fees for maintaining your trading account.

However, for the Demat account, there is an annual maintenance fee of Rs 400, but this fee is waived for the first year, giving you some initial cost savings.

In summary, opening a trading and Demat account with Share-khan is cost-effective, with no charges for account opening, and the first year of Demat account maintenance is also free.

Also Read: Groww App Review: Is Groww App Safe?

1. Securities Transaction Tax (STT):

- Equity Delivery: 0.1% on both Buy and Sell

- Equity Intraday: 0.025% on the Sell Side

- Equity Futures: 0.01% on the Sell Side

- Equity Options: 0.05% on the Sell Side (on Premium)

- Commodity Futures: 0.01% on the Sell Side (Non-Agri)

- Commodity Options: 0.05% on the Sell Side

- Currency F&O: No STT

- On Exercise transaction: 0.125%

- Right to entitlement: 0.05% on the Sell Side

2. Goods and Services Tax (GST):

- 18% on (Brokerage + Transaction Charge + SEBI Fee)

3. SEBI Charges:

- 0.0001% (₹10/Crore) of the turnover (except for Agri futures where it is Rs 1 per crore)

4. Stamp Duty:

- (On the buy side only)

- Equity Delivery: 0.015%

- Intraday: 0.003%

- Equity Futures: 0.002%

- Equity Options: 0.003%

- Currency F&O: 0.0001%

- Commodity Futures: 0.002%

- Commodity Options: 0.003% (MCX)

These charges and taxes are important to consider when trading with Share-khan as they can impact the overall cost of your transactions.

It’s essential to be aware of these fees to make informed investment decisions and manage your trading expenses effectively.

Keep in mind that tax rates and charges may vary based on the type of trade and the financial instruments involved.

- Sharekhan charges Rs 0 (Free) for opening a Demat account, which means there are no initial fees to get started.

Annual Maintenance Charges (AMC):

- Scheme A: Rs 400

- Scheme B: Rs 500

- Scheme C: Rs 350

- Scheme D: Nil

- Scheme E: Rs 100

- Scheme F: Rs 500

- Scheme H: Rs 1000

- Scheme G: Nil (holding Value <= Rs 50000) or Rs 100 (holding Value from Rs 50001 to Rs 200000) or Rs 400 (holding Value > Rs 200000)

Schemes A, C, E & H are free for the first year.

Demat Debit Transaction Fee:

- Scheme A & B: Sales through Sharekhan: Rs 0, Else 0.03% of the value of the transaction (minimum Rs 30).

- Scheme C & D: Sales through Sharekhan: Rs 6 per transaction, Else 0.03% of the value of the transaction (minimum Rs 30).

- Scheme E & H: Sales through Sharekhan: 0.03% of the value of the transaction (minimum Rs 29 for E and Rs 30 for H), Else 0.03% of the value of the transaction (minimum Rs 49).

- Scheme F: 0.03% of the value of the transaction (minimum Rs 30).

- Scheme G: 0.03% of the value of the transaction (minimum Rs 49).

Demat + Courier Charges:

- Sharekhan charges Rs 5 per certificate (minimum Rs 50 per request for Tariff A, B, C, D, E, F & H) and a minimum of Rs 100 per request for Tariff G.

Other Demat Charges:

- Remat: Rs 50 per certificate or Rs 50 for every hundred securities.

- Pledge Creation: 0.03% of the value of the transaction (minimum Rs 100 per transaction).

- Pledge Creation Confirmation: Nil

- Pledge Invocation: Nil

- Failed Transactions: Nil

- Freeze / De-freeze: Rs 25 per request

- Stock lending & Borrowing: 0.02% of the value of the transaction per request (minimum Rs 100)

- Client Master changes: Rs 30 per request for Tariff G.

These charges are important to consider when using Sharekhan’s Demat account services.

Make sure to choose the scheme that best suits your needs and be aware of transaction fees for buying and selling securities, as well as other associated charges.

Also Read: Zerodha Kite Review: Is Zerodha Kite Free?

| Segment | Transaction Fee |

|---|---|

| Equity Delivery | NSE: Rs 325 per Cr (0.00325%) | BSE: Rs 275 per Cr (0.00275%) (each side) |

| Equity Intraday | NSE: Rs 325 per Cr (0.00325%) | BSE: Rs 275 per Cr (0.00275%) (each side) |

| Equity Futures | NSE: Rs 190 per Cr (0.0019%) | BSE: Rs 50 per Cr (0.00035%) (each side) |

| Equity Options | NSE: Rs 5000 per Cr (0.05%) | BSE: Rs 50 per Cr (0.0005%) (on premium) |

| Currency Futures | NSE: Rs 135 per Cr (0.00135%) | MCX: Rs 130 per Cr (0.00130%) |

| Currency Options | NSE: Rs 4220 per Cr (0.04220%) | MCX: Rs 3220 per Cr (0.03220%) (on premium) |

| Commodity (Non-Agri) | MCX: Rs 230 per Cr (0.0023%) |

| Commodity (Agri) | MCX: Rs 95 per Cr (0.00095%) |

These Transaction Charges represent the fees associated with trading various financial instruments on different exchanges.

It's important to be aware of these charges as they can impact the overall cost of your trades on Share-khan's platform. The fees vary depending on the segment and exchange you are trading on.

Sharekhan Classic Account:

| Segment | Monthly Fee (Fixed) | Brokerage Fee |

|---|---|---|

| Equity Delivery | – | 0.50% |

| Equity Intraday | – | 0.10% |

| Equity Futures | – | 0.10% |

| Equity Options | – | Rs 50 per lot |

| Currency Futures | – | 0.10% |

| Currency Options | – | Rs 30 per lot |

| Commodity Futures | – | 0.03% |

| Commodity Options | – | 0.03% |

Sharekhan Prepaid – Rs 1 Lakh:

| Segment | Monthly Fee (Fixed) | Brokerage Fee |

|---|---|---|

| Equity Delivery | Rs 1,00,000 per year | 0.10% |

| Equity Intraday | – | 0.015% |

| Equity Futures | – | 0.015% |

| Equity Options | – | 0.05% or Rs 63 per lot |

Sharekhan Margin – Rs 1 Lakh:

| Segment | Monthly Fee (Fixed) | Brokerage Fee |

|---|---|---|

| Equity Delivery | Rs 1,00,000 margin | 0.25% |

| Equity Intraday | – | 0.05% |

| Equity Futures | – | 0.05% |

| Equity Options | – | 1% or Rs 70 per lot |

These brokerage charges represent the fees you pay when trading different types of financial instruments within various segments.

Sharekhan offers different account types, each with its own fee structure, allowing you to choose the one that aligns with your trading preferences and volume.

It's essential to consider these charges as they directly impact your trading costs on the Sharekhan platform.

Sharekhan calculates brokerage fees using a percentage-based model, where the brokerage fee is a percentage of the trading value.

The specific percentage is determined by the brokerage plan you choose, and each plan and trading segment may have its own minimum brokerage criteria.

It’s important to note that the brokerage fee charged will always be equal to or higher than the minimum brokerage criteria or the actual brokerage, whichever is higher.

Additionally, Sharekhan charges brokerage separately for each leg of a trade. A buy order is considered one leg, and a sell order is considered another leg.

Therefore, you are required to pay brokerage fees for each leg separately.

For example,

let’s say you buy 100 shares of a company at a price of Rs 300 per share, and your brokerage plan is a Classic account with a 0.50% brokerage fee for equity delivery trades.

To calculate the brokerage fees:

Brokerage Fees = (100 shares x Rs 300 per share) x 0.50% = Rs 150

In this case, you would need to pay a brokerage fee of Rs 150 when buying the stock. When you sell the same stocks, you will be required to pay another Rs 150 as brokerage fees.

It’s important to keep in mind that in addition to brokerage fees, you will also have to pay government taxes, exchange charges, demat charges, SEBI charges, and other applicable fees. These charges can add to the overall cost of your trades.

Also Read: Zerodha Coin Review: Is Zerodha Coin good for Mutual Funds?

Tip-1. Choose the right brokerage plan

Sharekhan offers a variety of brokerage plans with different features and benefits. Some plans offer lower brokerage charges than others.

It is important to compare the different plans and choose the one that best suits your needs and trading style.

Tip-2. Trade in bulk

Sharekhan offers discounts on brokerage charges for bulk trades. If you are trading in large quantities, you can negotiate with Sharekhan to get a lower brokerage rate.

Tip-3. Use a prepaid brokerage plan

Sharekhan offers prepaid brokerage plans that can help you save on brokerage charges. With a prepaid brokerage plan, you pay a fixed amount upfront and then get a certain number of trades at a discounted rate.

Tip-4. Use a discount broker

Discount brokers typically offer lower brokerage charges than traditional brokers. However, they may not offer the same level of features and services.

Tip-5. Avoid trading too often

The more you trade, the more brokerage charges you will pay. Try to trade only when you have a strong conviction about a stock.

Tip-6. Use limit orders

Limit orders allow you to specify the maximum price you are willing to pay or the minimum price you are willing to sell at. This can help you avoid paying higher brokerage charges.

Tip-7. Use a stop-loss order

A stop-loss order allows you to sell a stock at a predetermined price if it falls below that price. This can help you limit your losses and reduce your overall brokerage charges.

Yes, Sharekhan is Registered with SEBI. It’s SBI registration number is INZ000171337.

Recommended Articles:

- Best Trading Apps in India: Know why they best?

- Fyers Trading App Review: Explore It’s Brokerage Charges, Features and So on

- Olymp Trade Review: Is Olymp Trade SEBI registered?

- IND Money Review: Is IND money safe?

- IIFL Securities Review: Is IIFL Securities Safe?

FAQs

Sharekhan is owned by BNP Paribas, a leading European bank. BNP Paribas acquired Sharekhan in 2016. Sharekhan is now a wholly-owned subsidiary of BNP Paribas.

The intraday fee in Sharekhan is 0.03% of the total trade value, with a minimum brokerage charge of Rs 20.