Today, we’ll be providing IND Money Review for the year 2024. INDmoney is a financial advisory company that offers a variety of investment products, including mutual funds, stocks, and US stocks.

It is a SEBI-registered company, which means that it is regulated by the Securities and Exchange Board of India.

But is INDmoney really safe? In this blog post, we will take a closer look at INDmoney and its safety features to help you decide whether or not it is the right investment platform for you.

Stay tuned for our comprehensive IND money review!

What is IND Money?

INDmoney is a financial technology platform based in India that offers a range of financial services and tools to help individuals manage their money and investments. It offers a variety of financial products and services, including:

- Investing: INDmoney users can invest in stocks, mutual funds, and US stocks through the app. The app also offers features such as fractional investing, SIPs, and goal-based investing.

- Neo banking: INDmoney offers neo banking features such as a savings account, debit card, and UPI payments.

- Deposits: INDmoney users can deposit their money in fixed deposits and recurring deposits through the app.

- Financial life tracking and management: INDmoney helps users to track their finances, set financial goals, and create budgets.

INDmoney is a SEBI-registered financial advisory company and is backed by reputed foreign institutional investors such as Tiger Global, Steadview Capital, Dragoneer, and Sixteenth Street Capital.

INDmoney is a popular choice for investors in India because it offers a wide range of investment products and services at a competitive price. The app is also user-friendly and easy to navigate.

IND Money Features/Benefits

The INDmoney app has several useful features:

- US Stock Investment: You can invest in American stocks and ETFs, even if you don’t have a lot of money. For example, if you want to buy a pricey stock like Tesla, you can invest as little as Rs 1,000. They partner with Vested, a US brokerage, for this.

- Indian Stock Investment: INDmoney now offers Indian stock trading at a discounted rate. They charge a small fee of 0.05% or Rs 20 per trade, and there are no account opening or maintenance fees. However, they don’t support options, currency, or commodities trading.

- Direct Mutual Funds: You can invest in mutual funds directly without paying any commission. They offer various fund categories like tax-saving and high-return options.

- Zero Balance Savings Account: They have a partnership with Federal Bank, offering a zero balance savings account with no forex conversion charges. You can also get attractive fixed deposit rates, up to 7.5% per year.

- Money Tracking: Link your bank and investment accounts to the app, and it will automatically categorize and analyze your transactions. It provides insights into your financial health, tax suggestions, and offers different investment plans.

- Health and Life Insurance: INDmoney now provides health and term insurance plans. They work with trusted companies like HDFC Ergo, Care, and Max Life to offer insurance options tailored to your financial situation.

- InstaCash: You can get a personal loan based on your credit score. The interest rate is around 13-15% per year, and there are no charges for repaying the loan early.

So, INDmoney offers a wide range of financial services, including US and Indian stock trading, mutual fund investments, banking, financial tracking, insurance, and personal loans.

IND Money Charges

Here’s a list of different-2 charges taken by IND Money:

IND money charges a variety of fees for its different products and services. Here is a summary of the most common fees:

- Trading and Demat Account: ₹0 Account Opening Fee and ₹0 Annual Maintenance Charges (AMC)

- Equity Brokerage: 0.05% of order value or Rs. 20, whichever is lower

- F&O Brokerage: ₹20 per executed order

- STT: 0.1% of order amount for equity delivery orders (both buy and sell) and 0.025% of order amount for equity intraday orders (charged only on the sell order)

- Transaction Charge: ₹2.76

- SEBI Charges: ₹0.08

- GST: ₹7.71

- DP Charge: ₹15.93

- Stamp Duty: Varies across different Indian states

INDmoney also charges a fee for US stock investments. The fee is 0.5% of the order value, with a minimum fee of $1.

IND Money Brokerage Charges

1. Equity Delivery:

- Charge: 0.05% of the transaction value or up to ₹20, whichever is lower.

2. Equity Intraday:

- Charge: 0.05% of the transaction value or up to ₹20, whichever is lower.

3. Currency Futures:

- Charge: 0.05% of the transaction value or up to ₹20, whichever is lower.

4. Currency Options:

- Charge: 0.05% of the transaction value or up to ₹20, whichever is lower.

5. Equity Futures:

- Charge: 0.05% of the transaction value or up to ₹20, whichever is lower.

6. Equity Options:

- Charge: 0.05% of the transaction value or up to ₹20, whichever is lower.

INDmoney offers competitive and affordable brokerage charges across various trading segments.

Whether you’re into long-term equity investments, intraday trading, currency trading, or options and futures, their pricing structure allows investors to choose options that align with their specific investment and trading needs.

You can easily calculate the brokerage charges for different types of securities and quantities using the INDmoney brokerage calculator.

This transparent fee structure can be advantageous for both novice and experienced investors looking to manage their trading costs effectively.

IND Money Account Charges | IND Money AMC Charges

Account Type: Demat Account

- Opening Charges: ₹0

- AMC (Annual Maintenance Charges): ₹0

Account Type: Trading Account

- Opening Charges: ₹0

- AMC (Annual Maintenance Charges): ₹0

INDmoney Online provides demat and trading accounts to its customers, and the good news is that there are no charges for opening these accounts.

Moreover, you won’t have to worry about annual maintenance charges (AMC) for both your demat and trading accounts.

This fee structure makes it more accessible for individuals to get started with their investment journey without incurring any initial or ongoing account-related expenses.

It’s a cost-effective option for those looking to manage their investments and trading activities.

Also Read: Motilal Oswal App Review 2024: Is Motilal Oswal Reliable?

IND Money Demat Account Opening Process

To open a demat account with INDmoney, you can follow these steps:

- Visit the INDmoney website or download the INDmoney app.

- Click on the “Open Demat Account” button.

- Enter your basic details such as name, email address, and mobile number.

- Verify your mobile number and email address.

- Enter your PAN and Aadhaar details.

- Complete the KYC process.

- Upload the required documents such as PAN card, Aadhaar card, and bank statement.

- Review and sign the account opening form.

- Pay the account opening fee (if applicable).

- Your demat account will be activated within a few days.

Here are some of the documents that you will need to open a demat account with INDmoney:

- PAN card

- Aadhaar card

- Bank statement

- Passport-size photograph

Once your demat account is activated, you can start investing in stocks, mutual funds, and other securities.

IND Money Customer Care Number

INDmoney offers customer support to its users. If you need assistance, you can contact their support team by raising a ticket.

However, on their website, they don’t provide email addresses or phone numbers for direct contact with customer support.

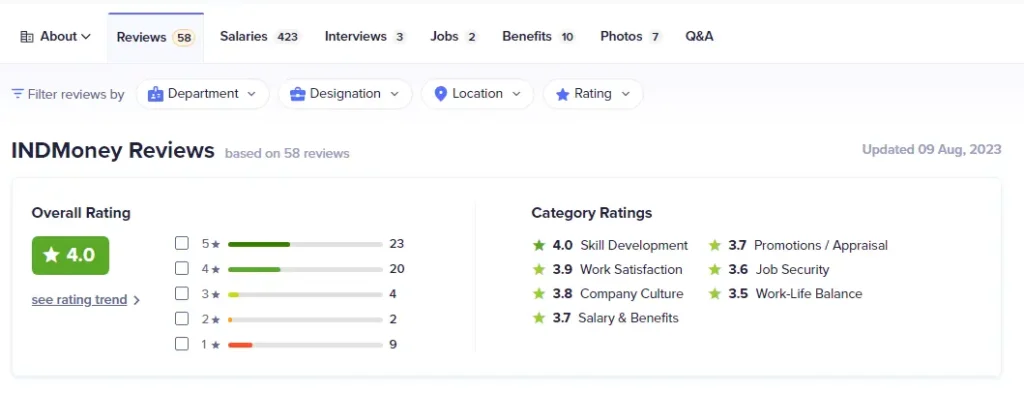

IND Money Reviews on Ambitionbox

Is IND Money safe? | Is IND Money SEBI Registered?

Yes, IND Money is a safe and SEBI-registered company.

INDmoney is registered with the Securities and Exchange Board of India (SEBI) as an investment advisor under SEBI (Investment Advisors) Regulations, 2013.

INDmoney also has a number of security features in place to protect its users’ data and money.

- 256-bit encryption for all data transmission and storage

- Two-factor authentication for all logins and transactions

- Regular security audits by third-party firms

In addition, INDmoney is a member of the NSE and BSE, which are the two largest stock exchanges in India. INDmoney’s users can be confident that their trades are being executed fairly and efficiently.

Overall, INDmoney is a safe and reliable platform for investing in stocks, mutual funds, and US stocks. It is a SEBI-registered company with a number of security features in place to protect its users’ data and money.

Also Read: Dhan Trading App Review 2024: Special Offer 50% Off on Brokerage

What is Super Save Account in IND Money?

INDMoney has partnered with the State Bank of Mauritius, and the Reserve Bank of India has given the green light for this collaboration. As a result, users of the app receive a 2-in-1 account, which comes with many advantages.

These include having a zero balance account, not having to pay fees for converting foreign currency, and the opportunity to earn high fixed deposit rates of up to 7.5% per year. Users can also use the app to manage their wealth and invest in US stocks.

Why SEBI’s Approval Matters?

SEBI is like a protector for the stock market in India. It ensures that the market is fair and safe for people who invest their money. So, when an app like INDMoney gets approval from SEBI, it’s like a stamp of trust and safety.

Imagine you want to keep your money somewhere, and you find out it’s approved by a trusted authority. That makes you feel more secure, right? That’s why having SEBI’s approval is a big deal for INDMoney. It shows that they follow the rules and can be trusted by investors.

Also Read: 5Paisa App Review 2024: Features, Charges, Demat Account, Complete Guide

Conclusion: IND Money Review 2024

INDmoney is a Super Finance App that offers a wide range of financial products and services, including investing, neo banking, deposits, and financial life tracking and management.

It is a SEBI-registered financial advisory company and is backed by reputed foreign institutional investors.

INDmoney is a popular choice for investors in India because it offers a comprehensive financial platform at a competitive price. The app is also user-friendly and easy to navigate.

IND Money Pros and Cons

IND Money Pros | IND Money Advantages

- All-in-One App: INDMoney combines various financial functions into a single app, including investments, credit cards, expense management, and insurance plans, making it convenient.

- Loans: You can apply for different types of loans through the app, including property loans.

- Zero-Balance Bank Account: You can have a bank account with zero balance, which is not very common in other apps.

- US Stock Market Investment: You can invest in the US stock market without having to pay transfer fees, which can save you money.

- Low Withdrawal Fees: When you withdraw money from your US account, INDMoney charges lower fees compared to its competitors.

- High Fixed Deposit Rates: INDMoney offers competitive fixed deposit rates, which are among the best when compared to other similar apps.

- Security: The app is known for its safety and security, and it’s backed by SEBI, making it a trustworthy platform.

IND Money Cons | IND Money Disadvantages

- No In-House Chat: The app lacks an in-house chat feature, which some users might find inconvenient for communication.

- Average Premium Version: Reports suggest that the premium version of the app is considered average and may not be worth the cost for some users.

- Customer Support: Some users have experienced issues with the app’s customer support, which has left them unsatisfied at times.

Overall, INDmoney is a good option for investors who are looking for a comprehensive financial platform that offers a variety of products and services. It is a good choice for both beginners and experienced investors alike.

Whether or not INDmoney is safe depends on how you use it. INDmoney is a SEBI-registered company and has a number of security features in place to protect its users’ data and money.

However, it is important to be aware of the risks involved in investing and to take steps to mitigate those risks.

Alternatives:

- Angel One App Review 2024: Is Angel One Safe?

- Zerodha Trading App Review 2024: Is Zerodha SEBI Registered?

- Groww App Review 2024: Is Groww App Safe?

- Olymp Trade Review 2024: Is Olymp Trade SEBI registered?

FAQs

Is INDmoney legal in India?

Yes, INDmoney is legal in India. It is a SEBI-registered financial advisory company. INDmoney is also an Indian company, headquartered in Bangalore, Karnataka.

Is it safe to invest in INDmoney?

INDmoney is generally considered to be a safe platform to invest in. It is a SEBI-registered company and has a number of security features in place to protect its users’ data and money.

Is INDmoney an Indian company?

Yes, INDmoney is an Indian company. It was founded in 2018 by Ashish Kashyap and Shashank Kumar.

Who is owner of INDmoney?

Ashish Kashyap and Shashank Kumar are the co-founders and owners of INDmoney.