Are you a new investor overwhelmed with the complexities of the investment world? You are not alone. Many investors exploring the stock market for the first time desire to find smart and fast ways of trading to secure their financial future. Demat Accounts are one way to go about it.

This article will help you understand the meaning of Demat accounts and how they can facilitate efficient investments. We’ll also discuss the types and benefits of Demat accounts, along with the account opening process.

What is a Demat Account?

Here, get a clear understanding of the meaning of Demat account, Demat Account is a repository that holds all your securities, such as stocks, mutual funds, bonds, and exchange-traded funds (ETFs) in electronic form. It acts as a portal to the investment world, granting you access to various trading opportunities and leverage on market fluctuations.

To open a Demat account, you have to select a Depository Participant associated with either of the depositories – NSDL or CDSL.

How Demat Accounts Can Facilitate Smart and Fast Investments?

- Research and Analysis – Many Demat account platform provides useful resources investors can leverage to make informed decisions. You can conduct thorough research using these resources to analyze financial reports, market trends, company performance, etc. It can help you identify potential investment opportunities.

- Diversification – Demat accounts allow investors to access multiple asset classes such as stocks, mutual funds, bonds, etc. You can diversify your portfolio by spreading your investments across different asset classes to reduce the risks associated with individual stocks or market segments.

- Monitor Regularly – Demat accounts make it convenient for investors to monitor their investment portfolio and track the performance of their holdings regularly. You can stay up-to-date with market fluctuations and keep track of your portfolio by using the portfolio tracking features of your Demat account.

- Stay Informed – Demat accounts offer various research tools and market insights to help investors keep themselves updated about the changes in stock markets. You can use these advanced tools to stay informed about the latest market trends, real-time financial data, economic indicators, etc. It helps in planning investment strategies and mitigating potential risks.

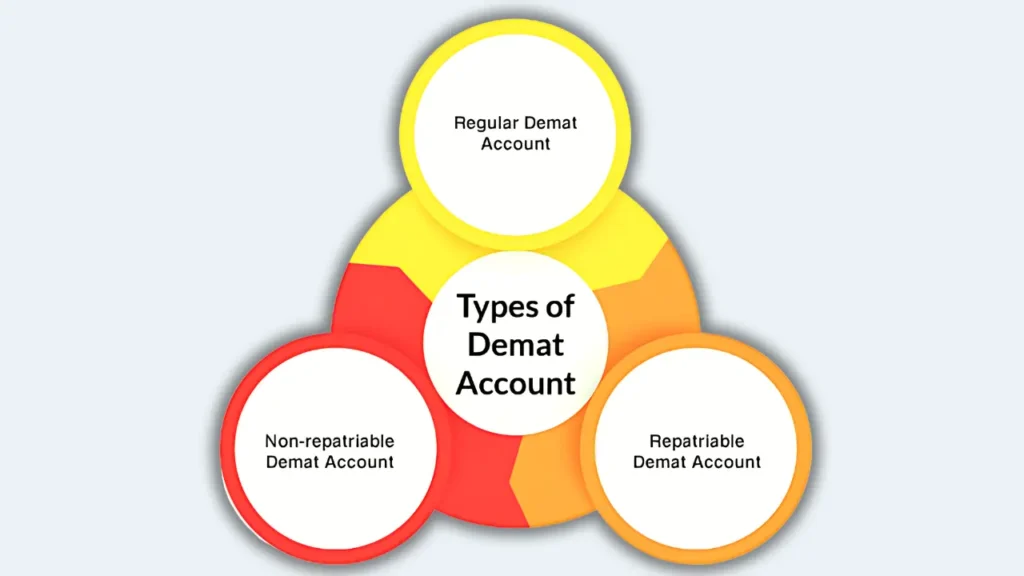

Types of Demat Accounts

- Regular Demat Account – This type of Demat account is ideal for citizens residing in India. It is mandatory for stock investments and equity trading.

Also, the Securities and Exchange Board of India (SEBI) has introduced the Basic

Services Demat Account (BSDA) for infrequent investors in 2012. It doesn’t charge any AMC charges for holdings valued under ₹50,000.

- Repatriable Demat Account – Non-Resident Indians (NRIs) can use this Demat account to invest in Indian stock markets. It allows international money transfers. Thus, it has to be linked to a Non-Resident External (NRE) bank account.

- Non-Repatriable Demat Account – This type of Demat account is also feasible for NRIs. It doesn’t allow international money transfers. Therefore, it is required to be linked to a Non-Resident Ordinary (NRO) bank account.

Benefits of Demat Accounts

- Convenience – With Demat accounts, investors can conveniently buy and sell stocks/securities digitally.

- Security – Demat accounts ensure the safety of your securities as it eliminates the need for physical certificates, which can be subjected to fraud, forgery, theft, etc.

- Efficiency – Demat accounts allow investors access to multiple markets. It increases efficiency in trading equities without much hassle.

- Easy Transfers – Demat accounts enable quick and easy transfers of securities, enabling smooth transactions.

Step-by-Step Process to Open an Online Demat Account

- Select a reliable stock broker or brokerage firm in India to open a Demat account.

- After you’ve selected the broker, visit their official website. Click on Open an Account.

- You’ll be presented with an online form where you have to fill in details like Name, Email, Mobile Number and State.

- After submitting the required details, you’ll need to fill in your PAN number and Date of Birth as per the PAN Card.

- Next, you’ll have to provide your bank account details.

- Once the details are filled, you’ll have to submit the following documents –

- PAN Card

- Aadhar Card

- Residence Proof

- Passport Size Photo

- Income Proof

- Bank Statement

- You’ll also be required to complete a video In-Person Verification (IPV) process using your webcam or smartphone.

- Based on your DP’s account opening protocols, you may be required to e-sign your application.

- The final step is to sign an agreement with your DP. The presented agreement will specify the rights and responsibilities of the depository participant and investor.

- Once the application is approved, you’ll receive a unique Beneficial Owner Identification Number (BO ID) to access your Demat account.

Conclusion

While having a Demat account is crucial for you to trade conveniently, it is vital to note that selecting the right Depository Participant to open your Demat account with is equally important.

Choosing a stock broker like Choice as your depository participant might help you maximise the chances of potential investment returns and mitigate various risk elements. Choice is a reputed brokerage firm in India with 30+ years of experience in providing best-in-industry products and services to assist individuals in achieving their financial goals.

Whether you want to invest in stocks or apply for Initial Public Offerings (IPOs), their professional team can guide you through every step.

Begin a seamless investment journey today by opening a free Demat account with Choice!

Disclaimer: Please note that while this article aims to provide accurate and up-to-date information, it should not be considered official financial advice. It is advisable to always consult a financial advisor before making investment decisions.