ETMoney Genius Review 2024: In today’s fast-paced world, it can be tough to keep up with the ever-changing market. That’s why many people are turning to AI-driven investment services like ETMoney Genius to help them make sound investment decisions.

If you’re considering using ETMoney Genius, you’re probably wondering if it’s worth the cost. In this review, we’ll take a close look at ETMoney Genius and see if it lives up to its promises.

We’ll cover the following:

- What is ETMoney Genius?

- How does ETMoney Genius work?

- What does ETMoney take charges?

- What are the benefits of using ETMoney Genius?

- What are the drawbacks of using ETMoney Genius?

- Is ETMoney Genius worth it?

By the end of this review, you’ll have a good understanding of whether or not ETMoney Genius is right for you.

What is ET Money Genius?

ET Money, an Indian fintech and wealth management platform under the ownership of Times Internet, a wholly owned subsidiary of Bennett Coleman & Co. Ltd., was established in 2015. Providing a range of financial products and services such as mutual funds, insurance, fixed deposits, NPS, and SIPs, the platform oversees and manages investments totaling US$3 billion (₹22,500 crore) as of March 2022.

Also Read: Top 10 Best Mutual Fund Investment Apps in India in 2024

ET Money Company Profile

ET Money, formerly known as Smartspends, operates in the FinTech industry and was founded in 2015 by Mukesh Kalra. The company, headquartered in Gurgaon, Haryana, India, exclusively serves the Indian market. Mukesh Kalra currently serves as the CEO, while Santosh Navlani holds the position of COO.

ET Money offers a diverse range of financial products and services, including insurance, SIP, mutual funds, loans, cards, fixed deposits, and the National Pension Scheme (NPS). As of the latest available data, the platform manages assets under management (AUM) totaling $3 billion (₹22,500 crores). Times Internet is the owner of ET Money, with Bennett Coleman & Co. Ltd. being its parent company.

| Company | ET Money |

|---|---|

| Formerly Known As | Smartspends |

| Industry | FinTech |

| Founded | 2015 |

| Founder | Mukesh Kalra |

| Headquarters | Gurgaon, Haryana, India |

| Area served | India |

| Key people | Mukesh Kalra (CEO), Santosh Navlani (COO) |

| Products | Insurance, SIP, Mutual funds, Loans, Cards, Fixed deposit, National Pension Scheme |

| Market Cap | $3 billion (₹22,500 crores) |

| Owner | Times Internet |

| Parent | Bennett Coleman & Co. Ltd |

| Website | www.etmoney.com |

Also Read: Cryptocurrency 2024: Is Crypto Legal in india?

Why ET Money Genius is a Genius?

The five key ingredients that make ET Money Genius a genius:

Personalized Investment Plan: Genius creates a personalized investment plan that balances risk and return based on your individual circumstances and goals.

Dynamic and Diversified Allocation: Genius dynamically allocates your investments across equity, debt, and gold based on market conditions and your risk tolerance.

Risk Management: Genius monitors your portfolio 24/7 and alerts you when your risk score exceeds your desired level.

Monthly Portfolio Rebalancing: Genius automatically rebalances your portfolio monthly to ensure it stays aligned with your target asset allocation.

1-tap Execution: Genius makes it easy to implement your investment plan with its 1-tap execution feature.

Also Read: What is trading: how do newbies learn trading in 2024?

How does ET Money Genius Work?

ET Money Genius Charges

Certainly! Genius operates on a quarterly subscription model. Your membership grants you unrestricted access to all Genius portfolios, allowing for unlimited transactions without any additional charges during the duration of your membership.

It’s important to note that standard brokerage fees may apply for stock transactions, and exit load charges may be incurred for mutual funds based on the respective terms and conditions.

Also Read: Varsity By Zerodha Review 2024: Is Zerodha Varisty Good?

ET Money Genius Portfolio Review

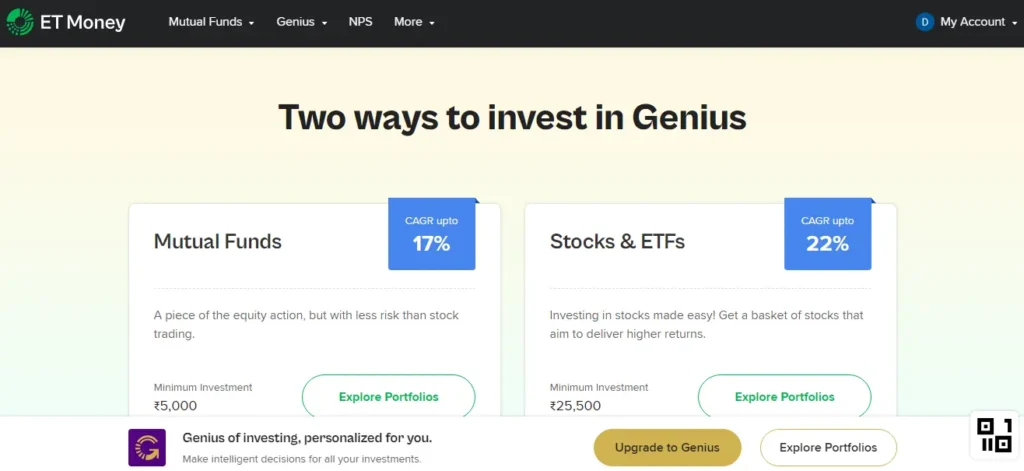

Genius presents a comprehensive selection of 12 portfolios, evenly split between 6 Mutual Funds portfolios and 6 Stocks+ETFs portfolios. All these portfolios are characterized by diversification and employ a consistent dynamic asset allocation strategy to determine distributions among Indian Equities, International Equities, Debt, and Gold.

Within the Mutual Fund portfolios, equity exposure is achieved through passive index funds. Conversely, in the Stocks+ETFs portfolios, the allocation to Indian equities is managed through an 8-stock portfolio, while international equities, debt, and gold exposure are facilitated through ETFs.

Genius Portfolios:

| Portfolio | Description | Mutual Funds CAGR | Stocks CAGR |

|---|---|---|---|

| Shield Portfolio | Min debt allocation of 70%, Rest can be in Equities & Gold | 9.5% p.a | 9.8% p.a |

| Stable Portfolio | Min debt allocation of 50%. Rest can be Indian, International, Gold | 11.2% p.a | 11% p.a |

| Balanced Portfolio | Min debt allocation of 25%. Rest can be Indian, International, Gold | 13.4% p.a | 14.1% p.a |

| Balanced+ Portfolio | Min debt allocation of 20% | 14.5% p.a | 16.3% p.a |

| Growth Portfolio | Invests in Indian & International equities with a moderate tactical allocation to Gold & Debt | 15.7% p.a | 18.4% p.a |

| High Growth Portfolio | Invests in Indian & International equities with a small tactical allocation to Gold & Debt | 17.3% p.a | 21.3% p.a |

ET Money Genius Subscription Review

ETMoney Genius Subscription Features:

- Unlimited Access to all Portfolios: Access all 12 Genius portfolios, including 6 Mutual Fund portfolios and 6 Stocks+ETFs portfolios.

- Unlimited Rebalancing: Your portfolio will be automatically rebalanced monthly to ensure it stays aligned with your risk tolerance and investment goals.

- Unlimited Investments: Make unlimited investments in your Genius portfolios.

- Invest via Mutual Funds or Stocks + ETFs: Choose the investment approach that is best for you.

Welcome Offer

Get ETMoney Genius for just ₹99 per month for the first 3 months. This is a savings of 60% off the regular quarterly price of ₹249.

Others Subscription details

- Billed quarterly.

- Cancel anytime.

Also Read: Motilal Oswal Mutual Fund 2024: Is MO Mutual Fund Best For You?

How to start using ET Money Genius?

The ET Money app is available for download on iOS and Android devices.

Here are the steps on how to download the ET Money app on iOS:

- Open the App Store on your iOS device.

- Search for “ET Money”.

- Tap on the “Get” button.

- Enter your Apple ID password when prompted.

- The ET Money app will now begin downloading.

- Once the download is complete, tap on the “Open” button to launch the app.

Here are the steps on how to download the ET Money app on Android:

- Open the Google Play Store on your Android device.

- Search for “ET Money”.

- Tap on the “Install” button.

- The ET Money app will now begin downloading.

- Once the download is complete, tap on the “Open” button to launch the app.

Once you have downloaded the ET Money app, you can create an account and start investing in mutual funds, stocks, and other financial products.

Also Read: Zerodha vs Groww 2024- A Detailed Comparsion of Features, Charges and Trading Plateforms

FAQs about ETMoney Genius Review 2024

Q. How much is the subscription for ETMoney Genius?

The subscription for ET Money Genius is ₹249 per quarter. However, there is a welcome offer available for new subscribers that reduces the price to ₹99 per month for the first three months.

Q. Is ETMoney genius?

ET Money Genius is an AI-driven investment service that offers personalized investment plans, dynamic asset allocation, and automated portfolio rebalancing. It can be a good option for investors who want a hands-off approach to investing and who are comfortable with the idea of using AI to make investment decisions.

Conclusion: ETMoney Genius Review 2024

If you are looking for a simple and convenient way to invest your money and are comfortable with using AI to make investment decisions, ET Money Genius is a good option to consider. However, if you have a high risk tolerance or complex investment goals, you may want to consider other investment options. It is always important to do your own research before investing in any financial product.

Also Read: Zerodha vs Angel One: A Detailed Comparison of its Features, Charges and Trading Plateforms

ET Money Genius Pros and Cons

Benefits of ET Money Genius:

- Personalized investment plans tailored to your individual circumstances and goals

- Dynamic asset allocation that maximizes returns and minimizes risk

- Automated portfolio rebalancing to keep your portfolio aligned with your target asset allocation

- Ongoing monitoring and support to help you reach your investment goals

Drawbacks of ET Money Genius:

- Relatively new service with a limited track record

- Fees can be high, especially compared to other investment options

- May not be suitable for all investors, particularly those with a high risk tolerance or complex investment goals

I hope this review has been helpful. Please let me know if you have any other questions.