Welcome to our latest blog post, where we delve into a comprehensive analysis of the (Indian Energy Exchange) IEX Share Price Target 2024, 2025, 2030, 2040, and 2050. As we navigate the dynamic landscape of the energy market, this exploration aims to provide you with valuable insights into the potential trajectory of IEX shares over the coming decades.

Join us as we unravel the factors influencing these projections, taking a closer look at market dynamics, financial indicators, and broader trends shaping the future of the energy trading landscape. Whether you’re an investor, enthusiast, or industry observer, this analysis seeks to equip you with the information needed to navigate the evolving terrain of IEX’s share performance. Let’s embark on this journey of exploration and anticipation together.

About IEX Ltd.

The Indian Energy Exchange (IEX) is a regulated electronic power trading exchange in India overseen by the Central Electricity Regulatory Commission (CERC). Commencing operations on June 27, 2008, IEX played a pioneering role in shaping power trading in the country. Serving as an electronic platform, IEX facilitates participation from various stakeholders in the power market, including State Electricity Boards, Power producers, Power traders, and Open Access Consumers, both Industrial and Commercial.

As one of the two operational Power Exchanges in India, IEX has consistently maintained a significant market share since its inception. The exchange operates a day-ahead market characterized by closed auctions with double-sided bidding and uniform pricing. With over 3,800 registered clients, 300 private generators, and more than 3,300 industrial electricity consumers, IEX has established itself as a prominent player in the power trading landscape.

IEX Company Profile

| Company | Indian Energy Exchange Ltd. |

|---|---|

| Founded In | 2008 (16 yrs old) |

| Ownership | Public |

| India Employee Count | 51-200 |

| Global Employee Count | 51-200 |

| Headquarters | New York City, New York, United States |

| Office Locations | New Delhi, Noida |

| CEO | Jayant Deo |

| Type of Company | Indian MNC |

| Nature of Business | B2B |

| Website | iexindia.com |

IEX Ltd. Share Price

IEX Share Price Target 2024, 2025, 2030, 2040, 2050

Predicting the future of any stock price is a hazardous game, and IEX, while boasting strong fundamentals and playing a crucial role in India’s energy landscape, is no exception. However, we can explore potential future scenarios based on the current situation, fundamentals, and technical analysis, offering a roadmap for informed decision-making.

The Current Landscape:

- Market leader: IEX holds a dominant position in India’s power exchange market, accounting for over 50% of the traded volume.

- Strong financials: Despite a slight dip in profits in 2023, IEX maintains a healthy balance sheet, debt-free with significant cash reserves.

- Solid fundamentals: ROE and ROCE remain impressive, highlighting efficient capital utilization and profitability.

- Technical indicators: While the short-term trend appears slightly bearish, long-term indicators suggest potential for upward movement.

Also Read: RVNL Share Price Target 2024, 2025, 2030, 2040, 2050: A Strategic Analysis

IEX Share Price Target 2024

- Base Case: Steady growth (10-15%) driven by market dominance and stable financials. Look for a price range of ₹280-310.

- Bullish Case: Increased electricity demand due to economic growth and policy reforms could propel the price to ₹330-350.

- Bearish Case: Macroeconomic challenges or disruptions in the power sector could lead to a dip to ₹250-260.

IEX Share Price Target 2025

- Base Case: Continued market leadership and healthy financials maintain a price range of ₹520-550.

- Bullish Case: Further market expansion and potential renewable energy adoption could push the price to ₹680-700.

- Bearish Case: Competition from other exchanges or technological advancements could cause a slight dip to ₹800-820.

Also Read: Wipro Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analysis

IEX Share Price Target 2030

- Base Case: Assuming steady market growth, the price could double, reaching ₹1,500-1,550.

- Bullish Case: Aggressive renewable energy adoption and significant market expansion could see a price surge to ₹1,600-1,620.

- Bearish Case: Technological disruptions or limited market growth could limit the price to ₹1,800-1,850.

IEX Share Price Target 2040

- Base Case: Continued market relevance and economic growth could push the price to ₹3,500-3,580.

- Bullish Case: Exponential growth driven by energy goals and market dominance could see a price above ₹4,000.

- Bearish Case: Technological advancements in distributed energy solutions or competition could limit the price to ₹4,050-4,100.

Also Read: Bajaj Auto Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analyst Report

IEX Share Price Target 2050

- Base Case: Continued market leadership and economic growth could see the price cross ₹8,000.

- Bullish Case: Aggressive renewable energy adoption and significant market expansion could propel the price beyond ₹10,000.

- Bearish Case: Technological disruptions or unforeseen events could limit the price to ₹12,000-14,000.

IEX Ltd. Fundamental Analysis

| Company | Indian Energy Exchange Ltd. |

|---|---|

| Market Cap | ₹ 13,130.18 Cr. |

| Enterprise Value | ₹ 13,065.69 Cr. |

| No. of Shares | 89.17 Cr. |

| P/E | 42.21 |

| P/B | 15.4 |

| Face Value | ₹ 1 |

| Div. Yield | 0.73% |

| Book Value (TTM) | ₹ 9.56 |

| Cash | ₹ 64.49 Cr. |

| Debt | ₹ 0 Cr. |

| Promoter Holding | 0% |

| EPS (TTM) | ₹ 3.49 |

| Sales Growth | -5.80% |

| ROE | 40.21% |

| ROCE | 52.62% |

| Profit Growth | -3.24% |

IEX Ltd. Price Chart – Last 5 Years

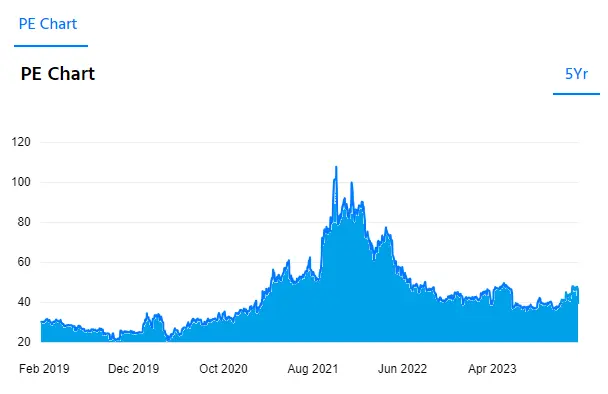

IEX Ltd. P/E Chart – Past 5 Years

IEX Ltd. Profit & Loss

| IEX Ltd. | MAR 2021 (In Cr.) | MAR 2022 (In Cr.) | MAR 2023 (In Cr.) |

|---|---|---|---|

| Net Sales (Cr.) | 317.11 | 425.55 | 400.85 |

| Total Expenditure (Cr.) | 57.68 | 59.97 | 64.36 |

| Operating Profit (Cr.) | 259.43 | 365.58 | 336.50 |

| Other Income (Cr.) | 40.27 | 52.33 | 73.21 |

| Interest (Cr.) | 2.05 | 1.97 | 2.46 |

| Depreciation (Cr.) | 15.86 | 16.32 | 18.59 |

| Exceptional Items (Cr.) | 0 | 0 | 0 |

| Profit Before Tax (Cr.) | 281.80 | 399.61 | 388.66 |

| Provision for Tax (Cr.) | 68.31 | 97.09 | 95.96 |

| Net Profit (Cr.) | 213.49 | 302.51 | 292.70 |

| Adjusted EPS (Rs.) | 2.38 | 3.37 | 3.29 |

IEX Ltd. Balance Sheet

| IEX Ltd. Balance Sheet | MAR 2021 (In Cr.) | MAR 2022 (In Cr.) | MAR 2023 (In Cr.) |

|---|---|---|---|

| Equity and Liabilities | |||

| Share Capital | 29.85 | 89.78 | 89.09 |

| Total Reserves | 501.55 | 612.19 | 695.38 |

| Borrowings | 0 | 0 | 0 |

| Other N/C liabilities | 45.23 | 39.08 | 43.87 |

| Current liabilities | 350.56 | 953.70 | 610.42 |

| Total Liabilities | 927.20 | 1,694.75 | 1,438.75 |

| Assets | |||

| Net Block | 114.92 | 109.87 | 110.20 |

| Capital WIP | 0 | 0 | 2.47 |

| Intangible WIP | 6.48 | 4.88 | 1.32 |

| Investments | 151.32 | 104.65 | 519.66 |

| Loans & Advances | 2.23 | 1.86 | 3.66 |

| Other N/C Assets | 2.30 | 0.25 | 34.71 |

| Current Assets | 649.96 | 1,473.24 | 766.73 |

| Total Assets | 927.20 | 1,694.75 | 1,438.75 |

IEX Ltd. Cash Flows

| Cash Flows | MAR 2021 (In Cr.) | MAR 2022 (In Cr.) | MAR 2023 (In Cr.) |

|---|---|---|---|

| Profit from operations (Cr.) | 281.80 | 399.61 | 388.66 |

| Adjustment (Cr.) | -17.97 | -30.41 | -49.14 |

| Changes in Assets & Liabilities (Cr.) | 105.29 | 521.03 | -269.02 |

| Tax Paid (Cr.) | -64.75 | -102.51 | -92.99 |

| Operating Cash Flow (Cr.) | 304.36 | 787.72 | -22.49 |

| Investing Cash Flow (Cr.) | -194.49 | -473 | 70.01 |

| Financing Cash Flow (Cr.) | -77.12 | -135.77 | -214.79 |

| Net Cash Flow (Cr.) | 32.75 | 178.95 | -167.27 |

IEX Ltd. Share Analysis

Investors often engage in a thorough analysis of a company’s financial statements, including the profit and loss account, balance sheet, and cash flow statement, to determine its true value. However, this process can be time-consuming. A more straightforward approach is to assess key financial ratios, which offer insights into a company’s performance.

Here are essential key insights for investors:

- PE Ratio (Price to Earnings): The PE ratio, indicating how much an investor is willing to pay for a share relative to earnings, is crucial. Indian Energy Exchange’s PE ratio is 39.34, suggesting a comparatively overvalued status.

- Share Price: The current share price of Indian Energy Exchange is Rs 137.25. Valuation calculators can help investors assess whether the stock is undervalued or overvalued.

- Return on Assets (ROA): ROA measures a company’s efficiency in generating profits from its investment in assets. Indian Energy Exchange’s ROA of 18.68% indicates favorable future performance.

- Current Ratio: This ratio assesses a company’s ability to meet short-term liabilities with short-term assets. Indian Energy Exchange’s current ratio is 1.26, signaling stability in handling unexpected challenges.

- Return on Equity (ROE): ROE gauges a firm’s ability to generate profits from shareholders’ investments. Indian Energy Exchange boasts a strong ROE of 40.21%.

- Debt to Equity Ratio: Assessing capital structure and performance, Indian Energy Exchange’s D/E ratio is 0, indicating a low proportion of debt in its capital.

- Inventory Turnover Ratio: Reflecting inventory and working capital management efficiency, Indian Energy Exchange’s Inventory Turnover ratio is 0, suggesting room for improvement in managing inventory.

- Sales Growth: The reported revenue growth for Indian Energy Exchange is -5.80%, indicating a subpar performance in terms of growth.

- Operating Margin: Illustrating operational efficiency, Indian Energy Exchange’s operating margin for the current financial year is 83.95%.

- Dividend Yield: Representing dividend in relation to stock price, Indian Energy Exchange’s current year dividend is Rs 1, with a yield of 0.73%.

IEX Ltd. Share Strengths & Weakness

Strengths:

- Robust profit growth averaging 18.05% over the past three years.

- Strong revenue increase of 15.97% in the last three years.

- Consistent maintenance of a healthy Return on Equity (ROE) at 45.90%.

- Robust Return on Capital Employed (ROCE) at 59.78% over the past three years.

- Virtually debt-free status.

- Commendable Interest Coverage Ratio of 159.22.

- Sustained effective average operating margins of 82.21% over the last five years.

Weakness:

- Negative cash flow from operations at -22.49.

Does IEX Ltd. Pays Dividend?

Yes, IEX Ltd. does pay dividends to its shareholders. In fact, it has a history of paying regular dividends, with the latest being declared in May 2023 for the financial year 2022-2023.

IEX Ltd.’s dividend history:

- Dividend declared in May 2023: ₹1 per share

- Dividend yield as of October 27, 2023: 0.73%

- Dividend payment history: IEX has declared dividends in most years since its listing in 2016.

Why IEX Share Price Falling?

Recommended Articles:

- IRCON Share Price Target 2024, 2025, 2030, 2040, 2050: A Complete Analysis

- Adani Power Share Price Target 2024, 2025, 2030, 2040, 2050: A Strategic Guide

- Polycab Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analysis

FAQs

Q. When will IEX Ltd. share price reach ₹1000?

According to the analysts, The Indian Energy Exchange Ltd. share would be reach ₹1000 in 2025-2026 (expected).

Q. What is the share price target of IEX in 2025?

The IEX Ltd. share price target for 2025 is ₹500 to ₹800 (Approx).

Q. What is the share price target of IEX in 2030?

In 2030, the IEX Ltd. share price target is expected to reach ₹1,800-1,850.

Q. What is the share price target of IEX in 2040?

Predicting 2040 targets is highly speculative. Based on optimistic growth scenarios, IEX could reach ₹4,050-4,100.

Disclaimer: Dear Reader, Please don't consider these projections as a advice. This is based on my fundamental and technical analysis, but the actual growth of any company and stock contain many factors. So, Do your own research before taking any investment decision.