IIFL Quick Pay 2024: Looking for a safe and reliable online payment platform? Look no further than IIFL Quick Pay! With IIFL Quick Pay, you can make payments to anyone, anywhere, at any time, with just a few clicks. But is IIFL Quick Pay really safe?

In this blog post, we’ll take a closer look at IIFL Quick Pay security features and see why it’s one of the safest online payment platforms available. We’ll also share some tips on how to keep your IIFL Quick Pay account safe and secure.

So if you’re looking for a safe and convenient way to make online payments, be sure to check out IIFL Quick Pay!

What is IIFL Quick Pay?

IIFL Quick Pay is a online payment feature that helps borrowers to pay their loans easily. It is a secure online payment platform that allows users to make payments to IIFL Finance for a variety of products and services, including loans, insurance premiums, and utility bills. Users can’t use IIFL Quick Pay to send money to friends and family.

To use IIFL Quick Pay, users doesn’t need to create an account on the website.

IIFL Quick Pay App | IIFL Quick Pay Mobile App

“IIFL Quick Pay” is an online payment feature, not a mobile app. In reality, IIFL Finance offers a mobile app called “IIFL Loans – Online Loan App” that allows users to apply for loans conveniently through their mobile phones.

IIFL Loans is an online loan app from IIFL Finance. It offers a variety of loans, including gold loans, personal loans, business loans, and home loans. The app is available on both Android and iOS devices.

features of the IIFL Loans app:

- Apply for new loans online

- Check your credit score

- Learn more about various IIFL products

- Apply for mutual funds, trading accounts, and insurance

- Locate nearest IIFL Finance branches

- Resolve queries through customer care

Types of Loans provided by IIFL Finance | IIFL Loans

According to the IIFL website, IIFL Finance provides a variety of loans, including:

- Home Loans: These loans are for individuals looking to purchase or construct a home. Home loans often have extended repayment periods and competitive interest rates.

- Loans Against Property (LAP): LAP allows individuals to use their residential or commercial property as collateral to secure a loan. These loans are versatile and can be used for various purposes.

- Gold Loans: Gold loans are secured loans where borrowers pledge their gold jewelry or ornaments to obtain funds. They are typically quick to process and may have lower interest rates due to the collateral.

- SME Loans: Small and Medium-sized Enterprises (SMEs) can access financing for their business needs, including working capital, expansion, and equipment purchase, through SME loans.

- Personal Loans: Personal loans are unsecured loans that can be used for various personal financial needs, such as medical expenses, travel, debt consolidation, or any other purpose.

- Merchant Finance: This type of financing is typically designed for businesses and merchants to meet their specific financial requirements. It can include working capital loans and other financial solutions tailored to merchants’ needs.

- Digital Finance: Digital finance may refer to the use of technology to facilitate financial transactions and services. It could encompass digital lending and other digital financial solutions.

IIFL Quick Pay Online Payment

IIFL Loan repayment through IIFL Quick Pay Feature:

Step-1. Go to the IIFL Quick Pay website.

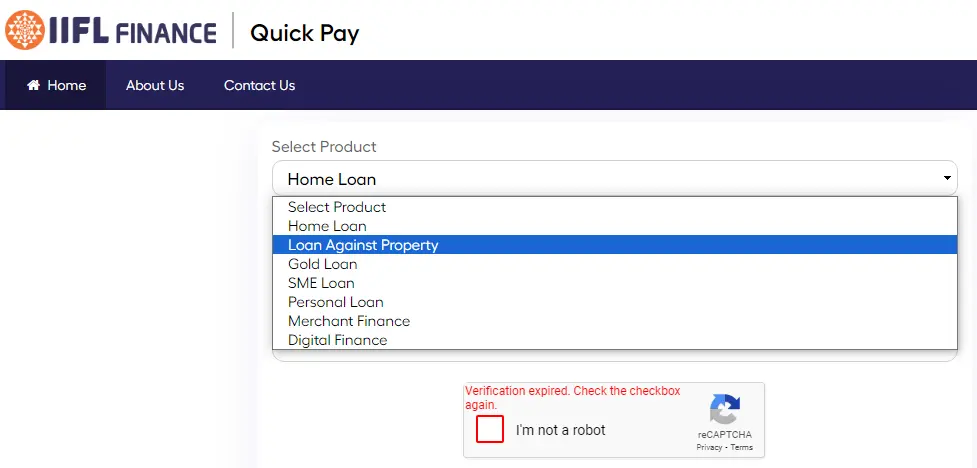

Step-2. Choose the “Product”. For which types of loan’s EMIs you want to pay. as you shown below:

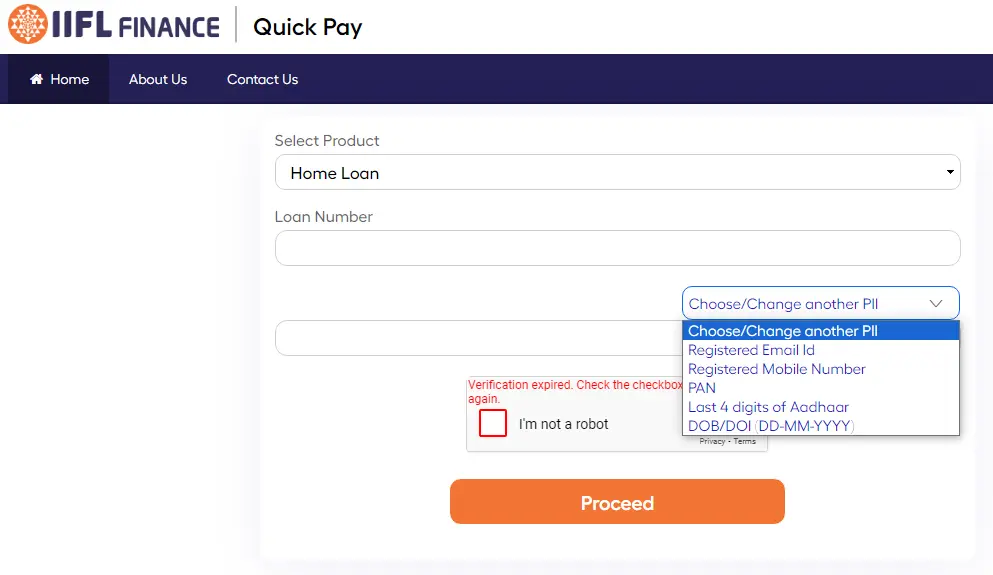

Step-3. Enter your loan number.

Step-4. Now, Select anyone option from “Choose/Change Another PII”. As you seen below:

Step-5. Check the option “I’m not a robot” and click on “Proceed” button.

Step-6. Choose your preferred payment mode and complete the payment.

Step-7. After complete the payment don’t forgot to download receipt for future use.

Loans that pay by direct IIFL Quick Pay website

IIFL Quick Pay is a convenient online payment feature offered by IIFL Finance, providing borrowers with the flexibility to make timely loan repayments from anywhere through their dedicated Quick Pay website.

Here’s a list of the various loan services for which borrowers can use the IIFL Quick Pay feature:

- Home Loan: With IIFL Quick Pay, borrowers can easily and securely make their home loan repayments online, ensuring they stay on top of their mortgage obligations conveniently.

- Loan Against Property: Borrowers who have availed loans against their properties can use IIFL Quick Pay to make timely repayments, leveraging the flexibility of online payments.

- Digital Loan: IIFL Finance’s digital loan customers can take advantage of the Quick Pay feature to conveniently service their digital loan repayments through the online platform.

- Gold Loan: For borrowers who have obtained gold loans from IIFL Finance, the Quick Pay feature streamlines the process of making repayments by offering a user-friendly online payment option.

- SME Loan: Small and Medium-sized Enterprises (SMEs) can efficiently manage their loan repayments through IIFL Quick Pay, ensuring their business finances remain in good standing.

- Merchant Loan: Merchants who have availed loans from IIFL Finance can use Quick Pay to make prompt repayments, supporting their business growth without the hassle of physical transactions.

- Personal Loan: IIFL Quick Pay extends its convenience to borrowers with personal loans, allowing them to make hassle-free repayments to meet their individual financial needs.

In summary, IIFL Quick Pay’s online payment feature caters to borrowers across a spectrum of loan services, including home loans, loans against property, digital loans, gold loans, SME loans, merchant loans, and personal loans.

About IIFL Finance: You Must Know!

IIFL Finance, founded on October 18, 1995, by Nirmal Jain, a graduate of the University of Mumbai and an alumnus of the Indian Institute of Management, Ahmedabad, emerged as a successful entrepreneurial venture in the post-economic liberalization era in India initiated by PV Narasimha Rao. Prior to this, Nirmal Jain had worked with Hindustan Unilever Limited.

Originally established as Probity Research and Services Private Limited, the company initially focused on providing research services related to the Indian economy, businesses, and corporations.

Later, it underwent a name change to become India Infoline Limited. Over time, it expanded its clientele to include research organizations, banks, and corporates and began offering research products to enhance its market presence. In 1999, the company launched its website.

In 2000, the company further diversified by introducing a trading portal called 5paisa, entering the full-service broking agency business and expanding its distribution network.

The year 2001 brought challenges to the Indian dotcom industry, prompting IIFL to explore new avenues. It formed a strategic partnership with ICICI Prudential, a leading life insurance company, utilizing its extensive distribution network and becoming India’s first corporate agent for insurance.

Today, IIFL Holdings Limited (Bloomberg Code: IIFL IN, NSE: IIFL, BSE: 532636) stands as India’s foremost integrated financial services group, with a broad range of operating businesses including Non-Banking and Housing Finance, Wealth and Asset Management, Broking, Financial Product Distribution, Investment Banking, Institutional Equities, Realty, and Property Advisory Services.

IIFL Holdings boasts a consolidated net worth exceeding Rs 45 billion, a global presence spanning Canada, the United States, UK, Singapore, Hong Kong, Switzerland, Mauritius, and the UAE. It maintains a workforce of over 10,500 employees and a robust network of more than 2,250 service locations across India.

The company manages loan assets worth over ₹233 billion and provides advice, management, and distribution services for wealth assets totaling over ₹1,250 billion. Additionally, it conducts research on over 500 stocks and serves as a trusted resource for more than 300 of the world’s leading institutional investors.

FAQs

What is the full form of IIFL?

The full form of IIFL is India Infoline Finance Limited. It is a leading diversified financial services company in India, based in Mumbai. It was founded in 1995 by Nirmal Jain.

Recommended Articles: