Today, we explore the Rivian Stock Price Predictions for 2024, 2025, 2030 and so on. To know how the stock will perform in the upcoming years, read the complete technical and fundamental analysis report.

What is Rivian Automotive, Inc.?

Rivian Automotive, Inc., an American electric vehicle manufacturer and automotive technology firm, was established in 2009. Rivian specializes in producing electric SUVs, pickup trucks, and delivery vans, utilizing a versatile “skateboard” platform that can accommodate future vehicle models or be utilized by other companies.

The company initiated deliveries of its R1T pickup truck in late 2021 and aimed to establish an exclusive charging network across the United States and Canada by the close of 2023. Headquartered in Irvine, California, Rivian operates a manufacturing plant in Normal, Illinois, alongside facilities in Palo Alto and Carson, California; Plymouth, Michigan; Vancouver, British Columbia; Wittmann, Arizona; Woking, England; and Belgrade, Serbia.

Additionally, Rivian has plans to construct a new $5 billion factory in Georgia. Since its IPO in November 2021, Rivian has secured over $13.5 billion in financing.

Company Profile

| Company Name | Rivian Automotive, Inc. |

| Formerly Known As | Mainstream Motors, Avera Automotive |

| Company Type | Public |

| Traded As | Nasdaq: RIVN (Class A) |

| Industry | Automotive, Energy storage |

| Founded | June 2009 (14 years ago) in Rockledge, Florida |

| Founder | R. J. Scaringe |

| Headquarters | Irvine, California, U.S. |

| Number of Locations | 42 service centers (2023) |

| Area Served | North America |

| Key People | R. J. Scaringe (CEO) |

| Products | Electric vehicles, Batteries |

| Production Output | 57,232 vehicles (2023) |

| Services | Electric vehicle charging, Vehicle insurance |

| Revenue | US$4.43 billion (2023) |

| Operating Income | US$-5.7 billion (2023) |

| Net Income | US$-5.4 billion (2023) |

| Total Assets | US$16.8 billion (2023) |

| Total Equity | US$9.14 billion (2023) |

| Major Owners | Amazon (18.1%), Abdul Latif Jameel (12.7%) |

| Number of Employees | 16,790 (December 2023) |

| Website | rivian.com |

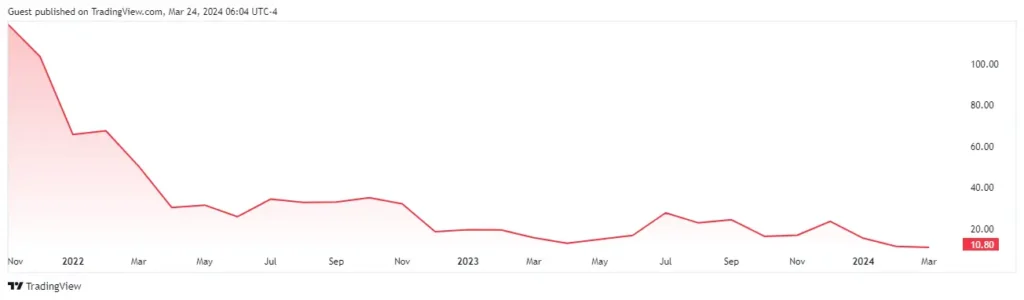

Rivian Automotive, Inc. Stock Price Growth

Rivian Automotive Inc. Balance Sheet Analysis

Strong Cash Position:

- Rivian boasts a healthy cash position of $9.37 billion, significantly exceeding its total debt of $5.12 billion.

- This translates to a net cash position of $4.25 billion, which provides a financial cushion and flexibility for future investments and operations.

- On a per-share basis, the net cash position translates to $4.43, indicating a strong balance sheet relative to the share price.

High Equity:

- Rivian has a total equity of $9.14 billion, highlighting a significant investment from shareholders.

- This translates to a book value per share of $9.52, suggesting the company’s net assets are valuable compared to the current stock price.

Solid Working Capital:

- The company’s working capital, which is the difference between current assets and current liabilities, sits at $9.83 billion.

- This indicates Rivian has sufficient resources to cover its short-term obligations and maintain day-to-day operations.

Considerations:

- While the cash position and equity are positive signs, Rivian is a young company with significant losses in 2023. Investors should monitor future financial performance to gauge profitability and long-term sustainability.

- The debt level, although manageable with the strong cash position, could become a concern if the company continues to operate at a loss.

Rivian Automotive Inc. Cash Flow Analysis

Burning Cash to Fund Growth:

- Rivian’s cash flow statement indicates a negative free cash flow of -$5.89 billion over the last 12 months.

- This signifies that the company’s current operations and investments are consuming more cash than they generate. In simpler terms, Rivian is “burning cash” to fund its growth.

Breakdown of Cash Burn:

- The negative operating cash flow of -$4.87 billion highlights Rivian’s inability to generate sufficient cash from its core business activities to cover its operating expenses.

- Capital expenditures of -$1.03 billion represent investments in property, plant, and equipment, which are essential for future production capacity but further strain near-term cash flow.

Impact on Investors:

- A negative free cash flow is a common concern for young, high-growth companies like Rivian. Investors should closely monitor future cash flow trends to assess the company’s path to achieving profitability and financial sustainability in the long run.

Rivian Automotive Inc. Financial Efficiency Analysis

Low Profitability:

- Rivian’s negative return on equity (ROE) of -49.20% and return on invested capital (ROIC) of -40.25% indicate significant losses. This means the company is not generating a return on shareholder investments or its overall capital.

- The negative return on assets (ROA) of -31.60% further emphasizes the company’s inability to generate profits from its assets.

High Revenue per Employee:

- Despite the negative profitability metrics, Rivian boasts a high revenue per employee of $264,086. This suggests the company has a productive workforce, but its expenses are likely exceeding its revenue generation.

Significant Losses per Employee:

- Unfortunately, the high revenue per employee is overshadowed by the negative profits per employee of -$323,526. This highlights the substantial losses Rivian is incurring for each employee.

Low Asset Turnover:

- The asset turnover ratio of 0.26 indicates Rivian is not efficiently utilizing its assets to generate sales. This could be due to factors like excess inventory or underutilized production capacity.

Moderate Inventory Turnover:

- An inventory turnover ratio of 3.26 suggests Rivian manages its inventory somewhat effectively. This means the company sells its inventory relatively quickly, avoiding excessive storage costs and potential obsolescence.

Rivian Stock Price Prediction 2024, 2025, 2030, 2040, 2050

Rivian Stock Price Prediction 2024

| Year | RIVN Stock Price Prediction 2024 |

|---|---|

| 2024 | $26 |

While some analysts rate Rivian a “hold” or even a “sell,” many remain bullish. On average, analysts have a price target of around $26, which is a significant increase from the current price.

Also Read: JNJ Stock Price Prediction 2024, 2025, 2030, 2040, 2050

Rivian Stock Price Prediction 2025

| Year | RIVN Stock Price Prediction 2025 |

|---|---|

| 2025 | $8.95-$83 |

According to Motley Fool, Yahoo Finance, WSJ and Money Laid, Rivian’s 2025 stock price vary widely, ranging from a low of $8.95 to a high of $83, with a median target around $53.20.

Also Read: Amazon stock forecast 2024, 2025, 2030, 2040, 2050

Rivian Stock Price Prediction 2030

| Year | RIVN Stock Price Prediction 2030 |

|---|---|

| 2030 | $180-$250 |

Predictions are even more uncertain, ranging from a few dollars to over $1 trillion!

Rivian’s success, electric vehicle market growth, and technological advancements will play a big role.

Also Read: MULN Stock Forecast 2024, 2025, 2030: Is Muln Dead?

Where will Rivian Stock be in 1 Year?

Fool.com contributor Parkev Tatevosian assesses Rivian’s (RIVN -3.31%) prospects for 2024, using stock prices from March 19, 2024, to formulate a price prediction on the company’s stock in a video published on March 21, 2024.

Before considering an investment in Rivian Automotive, it’s worth noting that The Motley Fool Stock Advisor analyst team recently unveiled their selection of what they believe are the top 10 stocks for investors to consider right now – and Rivian Automotive did not make the cut. The 10 chosen stocks have the potential to generate significant returns over the coming years.

It’s reminiscent of the situation with Nvidia, which found its place on a similar list back on April 15, 2005. Had you invested $1,000 at the time of the recommendation, your investment would have grown to $577,714!

The Stock Advisor service offers investors a comprehensive framework for achieving success in the market, featuring guidance on portfolio construction, regular analyst updates, and two fresh stock picks each month. Notably, the Stock Advisor service has outperformed the S&P 500 by more than fourfold since its inception in 2002.

FAQs

Disclaimer: Dear Readers, Please note, These stock price projections are based on various factors like past performance, fundamentals, technical signals and market trends. These projections are for informational purposes only and aren’t financial advice or guarantees.