CDNS Stock Forecast 2025, 2030, 2040, 2050

Today, We’ll be analyzing the CDNS Stock Forecast for 2025, 2030, 2040, 2050. To know how the CDNS stock will expected to perform in the upcoming decades, read the complete post.

What is Cadence Design Systems, Inc.?

Cadence Design Systems, Inc., spelled cādence, is a leading American tech company based in sunny San Jose, California. Born in 1988 from the fusion of SDA Systems and ECAD, Cadence has been a powerhouse in the world of technology and computational software.

While initially focusing on electronic design automation (EDA) software for semiconductors, Cadence has evolved to provide a diverse array of solutions.

Today, they develop software and hardware for crafting cutting-edge products like integrated circuits, systems on chips (SoCs), and printed circuit boards.

They also offer intellectual property licensing for industries spanning electronics, aerospace, defense, and automotive sectors, to name just a few.

Top Cadence Design Systems, Inc. Products

Electronic Design Automation (EDA) Software

- Integrated Circuit Design

- Virtuoso Platform

- Spectre X simulator

- AWR (radio frequency to millimeter wave design environment)

- Digital Implementation and Signoff

- Genus

- Innovus

- Tempus & Voltus

- Stratus (high-level synthesis tool)

- Formal verification and signoff tools (Conformal Equivalence Checker, Joules RTL Power Solution, Quantus Extraction Solution, Modus DFT Software Solution)

- System Verification

- JasperGold (formal verification tool)

- vManager (verification management tool)

- Perspec System Verifier

- Xcelium (parallel simulator)

- Hardware Emulation

- Palladium Z1/Z2 hardware emulation platform

- FPGA Prototyping

- Protium S1/X1 and Protium X2 FPGA prototyping platforms

Intellectual Property (IP)

- Interface design (USB, MIPI, ethernet)

- Memory, analog, SoC peripherals, data plane processing units

- Tensilica DSP processors (audio, vision, wireless modems, convolutional neural nets)

PCB and Packaging Technologies

- Allegro Platform (co-design of ICs, packages, and PCBs)

- OrCAD/PSpice (for smaller design teams and individual PCB designers)

- OrbitIO Interconnect Designer (die/package planning & route optimization)

- InspectAR (uses augmented reality for PCB schematics)

Systems Design and Analysis

- Sigrity (signal, power integrity, and thermal integrity analysis)

- Clarity 3D field solver (electromagnetic analysis)

- Celsius (parallel architecture thermal solver)

- Cascade Technologies (hi-fidelity CFD solvers for multiphysics analysis)

- Fidelity Pointwise (CFD mesh generation)

Company Profile

| Company Type | Public |

| Traded As | Nasdaq: CDNS |

| Industry | Software |

| Predecessors | Solomon Design Automation, ECAD |

| Founded | 1983 (41 years ago) |

| Founders | James Solomon, Richard Newton, Alberto Sangiovanni-Vincentelli |

| Headquarters | San Jose, California, U.S. |

| President, CEO | Anirudh Devgan |

| Executive Chairman | Lip-Bu Tan |

| Revenue (2023) | US$4.09 billion |

| Number of Employees (2023) | 11,200 |

| Website | www.cadence.com |

Cadence Design Systems, Inc. Fundamentals

| Financial Ratios | Value |

|---|---|

| ROE | 74.5 |

| Div. Yield | 0.00% |

| EPS (TTM) | $0.94 |

| P/E Ratio | 22.8 |

| Market Cap | $77.59B |

| Enterprise Value | $77.23B |

| P/B Ratio | NA |

| Book Value | $3.40 billion |

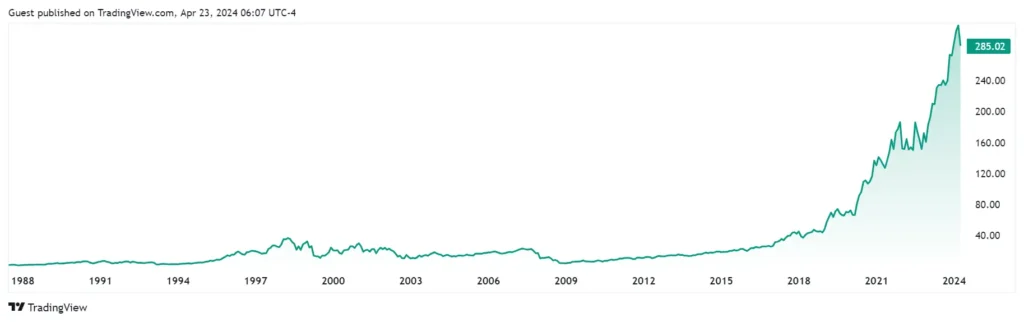

CDNS Stock Price Historical Chart

CDNS Stock Forecast 2025, 2030, 2040, 2050

CDNS Stock Forecast 2025

| Year | CDNS Stock Forecast 2025 |

|---|---|

| 2025 | $365 |

Analysts are feeling bullish on CDNS, with an average price target of $365, marking a solid 15.34% increase from its current price.

The consensus among experts?

A resounding “Strong Buy.” With 10 analysts weighing in, there’s a strong outlook for this stock.

Looking ahead, revenue growth is forecasted at a promising 12.64% over the next five years, with earnings per share (EPS) expected to climb by 26.10%. It’s shaping up to be an exciting ride for CDNS investors!

Also Read: Amazon stock forecast 2025, 2030, 2035, 2040, 2050

CDNS Stock Forecast 2026

| Year | CDNS Stock Forecast 2026 |

|---|---|

| 2026 | $415-$435 |

Analysts have issued price targets for CDNS in the next year, with an average target around $425, representing a 19.65% increase from the current price.

Looking at historical data, CDNS has experienced consistent growth. Coincodex predicts a price of $405.65 for 2026, which is a 37.40% increase based on the average yearly growth rate.

The EDA software and IP market is expected to continue growing in the coming years, driven by factors like increasing demand for advanced chips and the rise of AI and 5G technologies. This could positively impact CDNS’s performance.

Cadence Design Systems itself hasn’t issued any official forecasts for 2026. However, their focus on innovation in areas like AI-powered chip design and investment in R&D could contribute to future growth.

Also Read: JNJ Stock Price Prediction 2025, 2030, 2040, 2050

CDNS Stock Forecast 2030

| Year | CDNS Stock Forecast 2030 |

|---|---|

| 2030 | $855-$905 |

Analysts predict that by 2030, its stock could soar to $855-$905. This projection suggests a whopping 289.34% increase from its current price.

Also Read: DWAC Stock Price Prediction 2025, 2030, 2040, 2050

CDNS Stock Forecast 2040

| Year | CDNS Stock Forecast 2040 |

|---|---|

| 2040 | $3900-$4400 |

In 2040, the Cadence Design Systems stock will reach $3900-$4400 if it maintains its current 10-year average growth rate.

If this Cadence Design Systems stock prediction for 2040 materializes, CDNS stock will grow 3189.34% from its current price.

Also Read: NEM Stock Price Prediction 2025, 2030, 2040, 2050

CDNS Stock Forecast 2050

| Year | CDNS Stock Forecast 2050 |

|---|---|

| 2050 | $9500-$10100 |

According to our Cadence Design Systems stock forecast for 2050, CDNS stock will be priced at $9500-$10100 in 2050.

Also Read: [NFLX] Netflix Stock Price Prediction 2025, 2030, 2040, 2050

How Healthy CDNS Stock Balance Sheet?

Analysis based on fiscal year 2024 of CDNS Stock:

Liquidity:

- Cadence maintains a healthy level of cash and cash equivalents (C&CE) at $1.01 billion. While C&CE growth slowed in 2024 (14.26%), it still indicates positive cash flow generation.

- The company has minimal short-term investments, suggesting they prioritize readily available cash for operational needs.

- Working capital (current assets minus current liabilities) remains positive at $385.35 million, ensuring sufficient resources to cover short-term obligations.

Debt:

- Total debt sits at $649.06 million, with long-term debt accounting for the majority.

- Debt has decreased by 13.24% year-over-year, indicating a focus on debt reduction.

- The Net Cash / Debt ratio of 0.36 is positive but low, suggesting the company relies more on equity financing than debt.

Equity:

- Shareholders’ equity is strong at $3.40 billion, highlighting a solid financial foundation.

- Retained earnings have grown steadily, reflecting consistent profitability.

- Book value per share stands at $12.64, indicating potential undervaluation if the stock price is significantly higher.

Profitability (indirect measure):

- While the balance sheet doesn’t directly show profitability, positive cash flow generation and retained earnings growth suggest consistent profitability.

Cadence Design Systems exhibits a financially healthy position with ample liquidity, decreasing debt, and strong equity.

The company seems to be generating positive cash flow and reinvesting profits back into the business.

While the Net Cash / Debt ratio is low, the overall financial health is positive.

Cadence Design Systems Revenue Analysis

Cadence Design Systems’ revenue performance in 2024 indicates positive growth. The company generated $4.09 billion in total revenue, reflecting a year-over-year increase of 14.83%.

This growth trajectory seems to be continuing into 2025, with the revenue for the quarter ending December 31, 2024, reaching $1.07 billion. This represents an 18.75% growth compared to the same period in the previous year.

Looking at the financial ratios, the P/S Ratio of 19.00 suggests that the company’s stock price is relatively high compared to its revenue.

It’s also interesting to note the company’s revenue per employee. In 2024, each employee generated an average of $365,177 in revenue.

Is CDNS a good stock to buy?

According to Yahoo Finance, Cadence Design Systems (CDNS) could make a strong addition to your investment portfolio, especially now that it’s been upgraded to a Zacks Rank #1 (Strong Buy).

This boost largely stems from a positive shift in earnings estimates, a key factor that can significantly impact stock prices.

The Zacks rating system focuses squarely on changes in a company’s earnings outlook. It evaluates EPS estimates for both the current year and the next from analysts covering the stock, creating a consensus measure known as the Zacks Consensus Estimate.

Because shifts in earnings projections wield considerable influence over short-term stock movements, the Zacks rating system serves as a valuable tool for individual investors.

It provides a clear, data-driven perspective that can be hard to come by amidst the more subjective factors driving Wall Street analyst upgrades.

In essence, Cadence’s Zacks rating upgrade reflects growing optimism about its earnings potential. This could spur increased buying interest and, ultimately, drive its stock price higher. It’s a positive signal worth considering for investors looking to navigate the market landscape.

CDNS Q1 Results

FAQs

Does CDNS Pay Dividends?

No, Cadence Design Systems (CDNS) does not currently pay a dividend.

What is the stock forecast for Cadence in 2025?

According to analysts, Cadence stock price stands between $415-$435 for 2025.

What is the stock forecast for Cadence in 2030?

CDNS stock price expected to hit $855-$905 in 2030.

What is Stock Volatility for CDNS?

According to Market Chameleon, CDNS’s current implied volatility (IV) is 32.6, which is in the 96th percentile rank. But, CDNS’s historical volatility has been relatively low recently, with a monthly average change of around 6.66%.

Recommended Articles: