Today, In this article we will share the HDFC AMC Share Price Target 2024, 2025 to 2030. To know how the nestle stock will perform in the upcoming decads, read this complete analysis.

What is HDFC Asset Management Company Ltd.?

HDFC Asset Management Company Limited serves as a leading mutual fund manager, specializing in providing comprehensive asset management solutions to HDFC Mutual Fund as well as alternative investment fund management and portfolio advisory services to a wide array of clients.

Offering an extensive range of savings and investment products, encompassing actively managed and passive mutual funds, alongside portfolio management services and alternative investment opportunities, the company caters to the diverse needs of its clientele.

With a robust presence comprising 228 investor service centers (ISCs) spread across over 200 cities, HDFC AMC delivers financial management, advisory, brokerage, and consulting services.

Moreover, it extends portfolio management and separately managed account (SMA) services, addressing the investment requirements of various segments, including high net worth individuals (HNIs), family offices, domestic corporates, trusts, provident funds, and both domestic and global institutions.

| Sector | Finance |

|---|---|

| Industry | Investment Managers |

| CEO | Navneet Munot |

| Website | hdfcfund.com |

| Headquarters | Mumbai |

| Founded | 1999 |

| ISIN | INE127D01025 |

| FIGI | BBG00JDHF4L8 |

HDFC Asset Management Company Ltd. Fundamentals

| Company Essentials | Amount (in ₹) |

|---|---|

| Market Cap | ₹ 79,570.82 Cr. |

| Advances | ₹ 0 Cr. |

| No. of Shares | 21.35 Cr. |

| P/E | 40.89 |

| P/B | 11.24 |

| Face Value | ₹ 5 |

| Div. Yield | 1.86% |

| Book Value (TTM) | ₹ 331.60 |

| Operating Revenue | ₹ 2,166.81 Cr. |

| Net Profit | ₹ 1,423.92 Cr. |

| Promoter Holding | 52.55% |

| EPS (TTM) | ₹ 91.15 |

| Sales Growth | 2.43% |

| ROE | 24.86% |

| ROCE | 32.31% |

| Profit Growth | 2.21% |

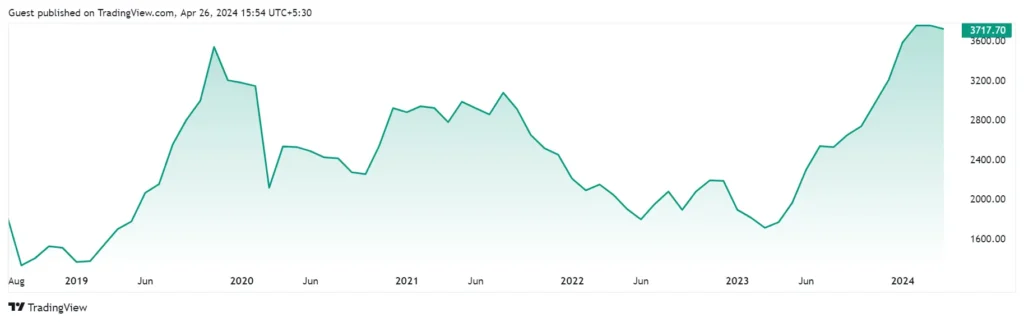

HDFC AMC Share Price Historical Chart

HDFC AMC Share Price Target 2024, 2025 to 2030

HDFC AMC Share Price Target 2024

| Year | HDFC AMC Share Price Target 2024 |

|---|---|

| 2024 | ₹3,700 to ₹4,200 |

The current price target for HDFC ASSET MANAGEMENT is INR 3717.50, showing a gain of +167.80 (+4.51%). Over the past year, 21 analysts have provided forecasts for the stock, with estimates ranging from a low of INR 3,700 to a high of INR 4,200.

Also Read: Nestle India Share Price Target 2024, 2025, 2030, 2040, 2050

HDFC AMC Share Price Target 2025

| Year | HDFC AMC Share Price Target 2025 |

|---|---|

| 2025 | ₹4,100 to ₹4,700 |

According to Analysts, If HDFC AMC maintains its projected core income CAGR (Compound Annual Growth Rate) of 17.0%, the target price in 2025 could be higher than ₹4,200 based on the 2024 estimate.

Also Read: [JIOFIN] Jio Finance Share Price Target 2024, 2025, 2030, 2040 & 2050

HDFC AMC Share Price Target 2026

| Year | HDFC AMC Share Price Target 2026 |

|---|---|

| 2026 | ₹4,500 to ₹5,200 |

Also Read: DMART Share Price Target 2024, 2025, 2030, 2040 to 2050

HDFC AMC Share Price Target 2027

| Year | HDFC AMC Share Price Target 2027 |

|---|---|

| 2027 | ₹5,150 to ₹5,900 |

Also Read: Astra Micro Share Price Target 2024, 2025 to 2030

HDFC AMC Share Price Target 2028

| Year | HDFC AMC Share Price Target 2028 |

|---|---|

| 2028 | ₹5,700 to ₹6,500 |

Also Read: Zomato Share Price Target 2024, 2025, 2030, 2040, 2050

HDFC AMC Share Price Target 2029

| Year | HDFC AMC Share Price Target 2029 |

|---|---|

| 2029 | ₹6,400 to ₹7,200 |

Also Read: TATA Tech Share Price Target 2024, 2025 to 2030

HDFC AMC Share Price Target 2030

| Year | HDFC AMC Share Price Target 2030 |

|---|---|

| 2030 | ₹7,000 to ₹8,050 |

According to Walletinvestor.com, He indicate a projected stock price of ₹7,000 to ₹8,050 INR. A substantial long-term increase, with an estimated revenue growth of approximately +196.18% over the 2030.

Therefore, considering these projections, investing in HDFC Asset Management Co. Ltd. stock could be a lucrative opportunity for long-term investors.

Also Read: Vedanta Share Price Target 2024, 2025 to 2030

HDFC Asset Management Company Ltd. Profit & Loss Analysis

Revenue

The company’s operating income (revenue) has grown steadily from ₹ 1,915.18 Crore in March 2019 to ₹ 2,166.81 Crore in March 2023.

Expenses

The company’s operating expenses have also increased over the same period, from ₹ 642.85 Crore to ₹ 548.25 Crore. However, the rate of expense growth (around 13%) is slower than the rate of revenue growth (around 13.7%).

Profit

The company’s profit after tax (PAT) has also increased steadily over the past five years, from ₹ 930.60 Crore to ₹ 1,423.92 Crore.

How Healthy HDFC Asset Management Company Ltd. Balance Sheet?

| Equity and Liabilities (in Crores) | MAR 2019 | MAR 2020 | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|---|---|

| Share Capital | 106.29 | 106.40 | 106.48 | 106.64 | 106.71 |

| Total Reserves | 2,964.43 | 3,922.86 | 4,669.70 | 5,423.40 | 6,001.70 |

| Borrowings | 0 | 0 | 0 | 0 | 0 |

| Other Non-Current Liabilities | 3.85 | -14.42 | 127.54 | 172.56 | 209.01 |

| Current Liabilities | 149.18 | 272.09 | 190.98 | 177.77 | 219.11 |

| Total Liabilities | 3,223.75 | 4,286.93 | 5,094.70 | 5,880.37 | 6,536.53 |

Equity

The company’s total equity has increased from ₹ 3,070.72 Crore in March 2019 to ₹ 6,108.01 Crore in March 2023.

Liabilities

The company’s other liabilities, such as current liabilities, have increased from ₹ 149.18 Crore in March 2019 to ₹ 219.11 Crore in March 2023.

| Assets (in Crores) | MAR 2019 | MAR 2020 | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|---|---|

| Loans | 0 | 0 | 0 | 0 | 0 |

| Net Block | 39.70 | 156.71 | 153.22 | 135.10 | 150.47 |

| Capital Work in Progress | 0 | 0 | 0 | 0 | 0 |

| Intangible Work in Progress | 3.17 | 4.60 | 1.18 | 0.46 | 2.14 |

| Investments | 584.10 | 610.02 | 594.84 | 631.57 | 602.30 |

| Other Loans | 50.72 | 46.98 | 45.23 | 44.99 | 44.95 |

| Other Non-Current Assets | 0 | 0 | 0 | 0 | 0 |

| Current Assets | 2,546.06 | 3,468.62 | 4,300.23 | 5,068.25 | 5,736.67 |

| Total Assets | 3,223.75 | 4,286.93 | 5,094.70 | 5,880.37 | 6,536.53 |

Assets

The company’s total assets have increased from ₹ 3,223.75 Crore in March 2019 to ₹ 6,536.53 Crore in March 2023.

HDFC AMC Quarterly Results

Revenue

The company’s operating revenue has increased steadily throughout the fiscal year 2024, from ₹ 540.95 Crore in March 2023 to ₹ 695.43 Crore in March 2024.

Profit

Profit Before Tax (PBT) has also shown an increasing trend, from ₹ 491.78 Crore in March 2023 to ₹ 679.09 Crore in March 2024.

HDFC AMC Strengths & Weakness

👍Strengths

- Consistent ROA of 25.53% over the last 3 years.

- Healthy track record of ROE at 27.43%.

- Sustained healthy ROCE of 36.14% over the past 3 years.

- Strong promoter shareholding of 52.55

👎Weakness

- Poor profit growth of 2.65% over the past 3 years.

- Limited Operating Income growth of 2.65% over the past 3 years

Is HDFC AMC a good stock to buy?

According to Livemint, HDFC Asset Management Company currently boasts a trailing twelve months (TTM) price-to-earnings (P/E) ratio of 41.25, surpassing the sector’s P/E ratio of 24.73.

Among the 19 analysts covering HDFC Asset Management Company, 5 have assigned it a “Strong buy” rating, while 4 have given it a “Buy” rating.

FAQs

Does HDFC AMC Pay Dividends?

Yes, HDFC AMC does pay dividends to its shareholders. The company typically pays dividends annually. The last dividend paid out was ₹48.00 per share on July 26, 2023. This translates to a current dividend yield (TTM) of around 1.31%.

What is the HDFC AMC Share Price Target for 2025?

According to analysts, Expected targeted share price for HDFC AMC stands at ₹4,100 to ₹4,700 in 2025.

What is the HDFC AMC Share Price Target for 2030?

Expected HDFC AMC share price target stands at ₹7,000 to ₹8,050 in 2030.

Disclaimer: Dear Readers, These projections are for informational purposes only and aren’t financial advice or guarantees.

Recommended Articles: