Today, We will explore SMCI Stock Price Predictions for 2024, 2025, 2030, 2040, 2050. To know how the SMCI stock will expected to perform in the upcoming decades, read the complete article.

Let’s first understand “What is SMCI and his company profile & fundamentals?“

What is Super Micro Computer, Inc.?

Super Micro Computer, Inc., known as Supermicro, is an American tech company headquartered in sunny San Jose, California. Since its founding on November 1, 1993, it’s become a major player in the world of high-performance servers.

With manufacturing hubs in Silicon Valley, the Netherlands, and Taiwan’s Science and Technology Park, Supermicro serves diverse markets, from enterprise data centers to cutting-edge fields like cloud computing, AI, 5G, and edge computing.

You’ll find its stock trading under the ticker symbol SMCI on the Nasdaq exchange.

In fiscal year 2023, Supermicro boasted revenues of $7.1 billion and a global workforce of over 5,000.

Company Profile

| Trade name | Supermicro |

| Company type | Public |

| Ticker Symbol | SMCI |

| Industry | Information technology |

| Founded | 1993 (31 years ago) |

| Founders | Charles Liang, Sara Liu |

| Headquarters | San Jose, California, U.S. |

| Number of locations | 11 |

| CEO | Charles Liang |

| CFO | David Weigand |

| Products | BigTwin, Ultra, SuperBlade, Rack servers, GPU servers, 5G/Telco |

| Revenue (USD) | 7.12 Billion (2023) |

| Number of employees | 5126 |

| Websites | supermicro.com |

Super Micro Computer, Inc. Fundamentals

| Market Cap | $42.61B |

| P/B Ratio | 58.2 |

| P/E Ratio | 13.8 |

| Enterprise Value | $42.26B |

| Div. Yield | 40.78 |

| Book Value | $2.96 |

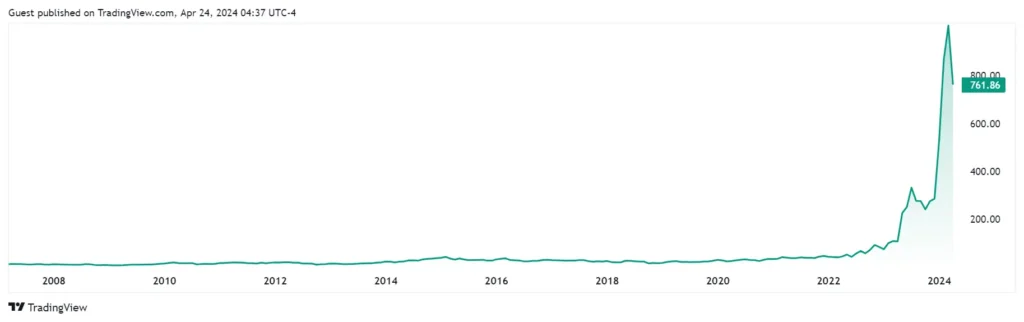

SMCI Stock Price Historical Chart

SMCI Stock Price Prediction 2024, 2025, 2030, 2040, 2050

SMCI Stock Price Prediction 2024

| Year | SMCI Stock Price Prediction 2024 |

|---|---|

| 2024 | $850.8 to $875.7 |

Super Micro Computer (SMCI) has been on fire lately, with its stock price skyrocketing over 800% in the past year and a staggering 5,000% over the past five years!

Wall Street analysts are bullish on SMCI stock, giving it an average Buy rating. They’re forecasting a 12-month price target of $850.8 to $875.7, which could be a potential increase of 30.55% from the current price.

Also Read: Amazon stock forecast 2024, 2025, 2030, 2040, 2050

SMCI Stock Price Prediction 2025

| Year | SMCI Stock Price Prediction 2025 |

|---|---|

| 2025 | $1001.2 to $1035.7 |

The forecast for Super Micro Computer’s stock in 2025 stands at $1001.2 to $1035.7, based on the assumption that the shares will maintain the average yearly growth rate observed over the past decade.

If this prediction holds true, it would signify a remarkable 45.62% increase in the SMCI stock price.

Also Read: Nvidia Share Price Target 2024, 2025 to 2030

SMCI Stock Price Prediction 2030

| Year | SMCI Stock Price Prediction 2030 |

|---|---|

| 2030 | $2,500 to $2,800 |

By 2030, Super Micro Computer’s stock is expected to hit $2,500 to $2,800 if it keeps up its current 10-year average growth rate.

Should this prediction for Super Micro Computer stock in 2030 come to fruition, it would mean an impressive 853.39% surge from its current price.

Also Read: NEM Stock Price Prediction 2024, 2025, 2030

SMCI Stock Price Prediction 2040

| Year | SMCI Stock Price Prediction 2040 |

|---|---|

| 2040 | $5,700 to $6,800 |

Experts are predicting a bright future for Super Micro Computer, Inc. (SMCI) stock. By the year 2040, they say it could be trading anywhere between $5,700 and $6,800 a share! That’s some serious upside potential.

And you know what’s gonna help drive that price?

You guessed it, the artificial intelligence (AI) boom!

With AI taking over the world (in a good way, of course), SMCI is perfectly positioned to benefit.

Also Read: CDNS Stock Forecast 2024, 2025, 2030, 2040, 2050

SMCI Stock Price Prediction 2050

| Year | SMCI Stock Price Prediction 2050 |

|---|---|

| 2050 | $10,500 to $11,200 |

Analysts are predicting big things for Super Micro Computer, Inc. (NASDAQ: SMCI). They say the stock could skyrocket to a range of $10,500 to $11,200 by 2050.

This potential surge is fueled by the expected boom in the artificial intelligence (AI) market, which is a sweet spot for Supermicro.

They make high-performance servers that are in high demand for AI applications. So, if the AI market takes off, Supermicro’s revenue is expected to follow suit.

And here’s the kicker: if this growth continues and investors become even more bullish on Supermicro, the company could hit a whopping trillion-dollar valuation by 2050. That’s a huge leap from its current market cap of around $44 billion.

Also Read: [NFLX] Netflix Stock Price Prediction 2024, 2025, 2030, 2040, 2050

How Healthy Super Micro Computer Stock Balance Sheet?

Super Micro Computer’s (SMCI) financial health based on their latest 12-month trailing data (TTM):

Liquidity:

- SMCI has a healthy level of cash and equivalents ($440.46 million), indicating good short-term liquidity.

- Cash & equivalents have grown significantly (64.72%) year-over-year, suggesting strong cash flow generation.

- Working capital (current assets minus current liabilities) is also positive at $1.8 billion, providing a buffer for operational needs.

Debt:

- SMCI’s total debt is moderate at $290.35 million.

- Debt has actually decreased significantly (-51.35%) compared to the previous year, which is a positive sign.

- The net cash to debt ratio is positive at 1.5, indicating the company has more cash than debt, further strengthening their financial position.

Profitability (Limited Data):

- While the balance sheet doesn’t directly show profitability, retained earnings of $1.43 billion suggest historical profitability.

Equity:

- Shareholders’ equity sits at a healthy $1.97 billion, demonstrating a strong financial foundation.

Where Will Super Micro Computer Stock Be in 1 Year?

What will SMCI stock be worth in 5 years?

After its rocketing rise, Super Micro Computer now boasts a price-to-earnings (P/E) ratio of around 62, marking a significant premium compared to both the S&P 500’s average of 27 and Nvidia, which sits at just 34 times its forward earnings. These figures strongly hint that Super Micro might be overvalued.

Nvidia’s robust economic standing and higher margins indicate that its bottom line is likely to grow much faster than that of the smaller competitor.

In the next five years, Super Micro could still outpace the market, riding on the momentum of the rapidly expanding AI industry.

However, at present, the stock appears to be priced to perfection. It must substantiate its valuation or risk facing a correction. Investors might consider taking profits or holding off on purchasing shares until more clarity emerges.

Is SMCI a good long term investment?

SMCI seems to be on a path towards sustained success. However, success can be measured in different ways. If a company consistently boosts its earnings, sales, and cash flow, it typically drives up the stock’s value over time.

Yet, in the case of SMCI, it’s highly probable that much of its future potential has already been factored into its current stock price.

With a price tag of 92 times trailing 12-month earnings and 7 times trailing 12-month sales, the valuation appears astronomical, even for a high-growth company positioned in the midst of a potential tech revolution.

It’s feasible that the rapid surge in enthusiasm for this stock has propelled it to a price level that its fundamentals won’t catch up to for many years, if ever.

So, while SMCI is a solid company, I hesitate to label it as a good stock at its current price level.

The historic surge in its price, partly fueled by expectations of inclusion in the S&P 500, brings its own set of risks. Additionally, there are fundamental risks associated with any stock that suddenly gains such high esteem.

These risks include declining adjusted gross margins over recent quarters and the possibility of further pressure from increased competition and the urgent need to roll out new products.

FAQs

Does SMCI Pay Dividends?

No, Super Micro Computer (SMCI) does not pay dividends. There is no record of them ever having paid a dividend.

What is the price target for SMCI stock in 2025?

According to analysts, SMCI stock price stand at $1020.2 in 2025.

What is the price target for SMCI stock in 2030?

Expected Super Micro Computer, Inc. stock price in 2030 stands at $2,700.

Disclaimer: Dear Readers, These projections are for informational purposes only and aren’t financial advice or guarantees.

Recommended Articles: