Explore the future trajectory of Adani Power share prices with our comprehensive guide. In “Adani Power Share Price Target 2024, 2025, 2030, 2040, 2050: A Strategic Guide,” we analyze key factors influencing the stock’s growth. Navigate the evolving investment landscape and make informed decisions as we delve into strategic insights and potential milestones. Stay ahead with our expert analysis on Adani Power’s share price targets for the next decades.

About Adani Power Ltd.

Adani Power Ltd. is an Indian multinational power and energy company, subsidiary of the diversified Adani Group. It’s the largest private thermal power producer in India, boasting a capacity of roughly 15,250 MW, spread across nine power plants in various states.

Key Features:

- Largest private thermal power producer in India: Boasts a massive installed capacity of over 15,250 MW, spread across 9 coal-fired power plants and 1 solar plant.

- Market leader: Commands a significant share of India’s power generation market, catering to various states with long-term power purchase agreements.

- Diversifying portfolio: Stepping into renewable energy with its 40 MW solar plant and potential for future expansion in this sector.

Adani Power Ltd. Company Profile

| Company | Adani Power Limited |

|---|---|

| Founded | 2006 (18 years old) |

| Ownership | Public |

| Employee Count | 1,000 – 5,000 (India) |

| Parent Company | Adani Group |

| Headquarters | Ahmedabad, Gujarat, India |

| Office Locations | Ahmedabad |

| CEO | Vneet S. Jaain |

| Type of Company | Corporate |

| Nature of Business | Service |

| Website | adanipower.com |

| Today’s Share Price | View on NSE |

Adani Power Share Fundamental Analysis

| Adani Power Ltd. Company Details | Values |

|---|---|

| Market Cap (Cr) | 208,718.25 |

| Enterprise Value (Cr) | 239,832.26 |

| No. of Shares (Cr) | 385.69 |

| P/E | 10.7 |

| P/B | 5.45 |

| Face Value | 10 |

| Div. Yield | 0 % |

| Book Value (TTM) | 99.28 |

| Cash (Cr) | 1,692.34 |

| Debt (Cr) | 32,806.35 |

| Promoter Holding | 70.02 % |

| EPS (TTM) | 50.56 |

| Sales Growth | 32.37% |

| ROE | 43.89% |

| ROCE | 17.84% |

| Profit Growth | 103.44% |

Adani Power Share Profit & Loss – Past 3 Years

| Particulars | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|

| Net Sales | 447.17 | 27,711.18 | 36,681.21 |

| Total Expenditure | 408.07 | 17,874.49 | 27,362.22 |

| Operating Profit | 39.10 | 9,836.69 | 9,318.99 |

| Other Income | 134.37 | 4,068.32 | 4,519.98 |

| Interest | 644.02 | 4,086.92 | 3,306.80 |

| Depreciation | 32.46 | 3,116.21 | 3,142.79 |

| Exceptional Items | 0.00 | 0.00 | 0.00 |

| Profit Before Tax | -503.01 | 6,701.88 | 7,389.38 |

| Provision for Tax | -4.27 | 1,665.54 | -2,856.77 |

| Net Profit | -498.74 | 5,036.34 | 10,246.15 |

| Adjusted EPS (Rs.) | -1.29 | 13.06 | 26.57 |

Adani Power Share Balance Sheet – Last 3 Years

| Particulars | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|

| Equity and Liabilities | |||

| Share Capital | 3,856.94 | 3,856.94 | 3,856.94 |

| Total Reserves | 13,228.41 | 14,606.95 | 24,366.93 |

| Borrowings | 930.56 | 30,462.45 | 24,978.63 |

| Other N/C liabilities | 228.11 | 7,222.64 | 4,705.44 |

| Current liabilities | 6,164.41 | 15,617.20 | 14,924.01 |

| Total Liabilities | 24,408.43 | 71,766.18 | 72,831.95 |

| Assets | |||

| Net Block | 540.99 | 49,342.28 | 46,582.79 |

| Capital WIP | 0.67 | 184.30 | 188.33 |

| Intangible WIP | 0.00 | 0.00 | 0.00 |

| Investments | 19,358.65 | 4,658.49 | 6,373.48 |

| Loans & Advances | 3,594.11 | 1,138.33 | 2,001.10 |

| Other N/C Assets | 801.84 | 892.87 | 488.12 |

| Current Assets | 112.17 | 15,549.91 | 17,198.13 |

| Total Assets | 24,408.43 | 71,766.18 | 72,831.95 |

Adani Power Shaare CashFlow – Last 3 Years

| Particulars | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|

| Operating Cash Flow | |||

| Profit from operations | -503.01 | 6,701.88 | 7,389.38 |

| Adjustment | 513.92 | 3,448.25 | 1,592.58 |

| Changes in A&L | -311.75 | 338.27 | -973.83 |

| Operating Cash Flow | -288.17 | 10,263.68 | 7,933.07 |

| Investing Cash Flow | |||

| Cash from Investing Activities | 390.10 | 1,386.09 | 2,823.99 |

| Financing Cash Flow | |||

| Cash from Financing Activities | -105.39 | -11,182.27 | -11,137.82 |

| Net Cash Flow | -3.46 | 467.50 | -380.76 |

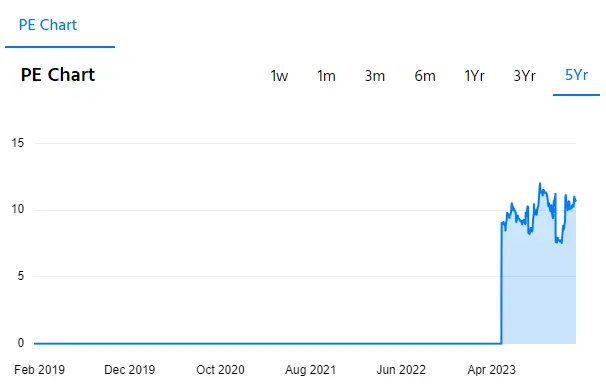

Adani Power Share P/E Chart – Last 5 Years

Adani Power Share Price Chart – Last 5 Years

Adani Power Share Price Target 2024, 2025, 2030, 2040, 2050

Predicting long-term share prices, especially 30 years into the future, is inherently challenging and riddled with uncertainties. However, based on current market trends and analyst estimates, I can provide a tentative table with potential price targets for Adani Power:

| Year | Minimum Price Target (INR) | Maximum Price Target (INR) |

|---|---|---|

| 2024 | 595 | 765 |

| 2025 | 770 | 940 |

| 2030 | 1,644 | 2,549 |

| 2040 | 2,800 | 4,000 |

| 2050 | 4,000 | 8,000 |

Also Read: SBI Share Price Target 2024 to 2050

Adani Power Share Price Target 2024

| Year | Adani Power share Price Target |

| 2024 | ₹595 to ₹765 |

- Technical Analysis: Based on recent trends and momentum, analysts suggest a target range of ₹595 to ₹765 for 2024.

- Fundamental Analysis: Considering factors like financial performance, growth prospects, and market conditions, an estimate of ₹670 to ₹740 seems reasonable.

Also Read: Infosys Share Price Target 2023, 2024, 2025, 2030, 2040, 2050

Adani Power Share Price Target 2025

| Year | Adani Power share Price Target |

| 2025 | ₹770 to ₹940 |

- Technical Analysis: The target range could broaden to ₹770 to ₹940, assuming positive market sentiment and continued growth.

- Fundamental Analysis: Factors like successful debt management and potential diversification into renewables could push the target towards the upper end of the range, up to ₹900.

Also Read: Amazon stock forecast 2023, 2024, 2025, 2030, 2040, 2050

Adani Power Share Price Target 2030

| Year | Adani Power share Price Target |

| 2030 | ₹1,644 to ₹2,549 |

- Long-term projections become more speculative, but expert estimations range from ₹1,644 to ₹2,549 per share. This significant variation depends heavily on factors like:

- Government policies on renewable energy adoption and fossil fuel regulations.

- Adani Power’s ability to adapt and diversify its portfolio.

- Global energy market dynamics and economic stability.

Also Read: Polycab Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analysis

Adani Power Share Price Target 2040

| Year | Adani Power share Price Target |

| 2040 | ₹2,800 to ₹4,000 |

Predicting Adani Power’s 2040 price is like gazing into a crystal ball. While India’s energy demand may boom, Adani’s success hinges on its ability to balance coal with renewables, navigate shifting policies, and outsmart competition. Optimists see a price near ₹2,800 to ₹4,000 per share (estimated), but remember, it’s a long game with plenty of twists to come. Invest cautiously and diversify!

Also Read: Praveg Share Price Target 2024, 2025, 2030, 2040, 2050: A Complete Stock Price Guide

Adani Power Share Price Target 2050

| Year | Adani Power share Price Target |

| 2050 | ₹4,000 to ₹8,000 |

Forecasting Adani Power in 2050’s like peering into a kaleidoscope! Some analysts see dizzying heights, potentially up to ₹4,000 to ₹8,000 per share, fueled by India’s energy boom and Adani’s renewable leap. But hold on, competition and environmental shifts could turn the picture blurry. Ultimately, it’s a long-term gamble, so invest with caution and keep your eyes peeled!

Also Read: MULN Stock Forecast 2024, 2025, 2030: Is Muln Dead?

Does Adani Power Ltd. Pays Dividend?

Yes, Adani Power Ltd. pays dividends to its shareholders. However, it’s important to note that the dividend payout ratio can vary from year to year depending on the company’s financial performance and investment plans.

Adani Power’s dividend history:

- 2023: Paid a final dividend of ₹1.20 per share for the financial year ending March 2023. This translates to a dividend yield of around 0.54% based on the current share price (as of Friday, 12 January 2024).

- 2022: Did not declare any dividends.

- 2021: Paid a final dividend of ₹2 per share for the financial year ending March 2022.

- 2020: Paid a final dividend of ₹1.50 per share for the financial year ending March 2021.

As you can see, there is no guarantee that Adani Power will continue to pay dividends in the future. The decision to declare a dividend rests with the company’s board of directors, and they will consider various factors before making a decision.

Adani Power Ltd. Company History

Adani Power Limited, part of the Adani Group, was incorporated on August 22, 1996, and went public in 2009 with its first IPO offering 301,652,031 shares at a par value of INR 10. The company is listed on both the Bombay Stock Exchange (BSE) under code 533096 and the National Stock Exchange (NSE) under the symbol ADANI POWER.

As of December 31, 2021, the company has 385.69 crore issued shares and operates in the energy sector. Adani Power is the largest private thermal power producer in India with an installed capacity of 12,450 MW, including thermal power plants in Gujarat, Maharashtra, Karnataka, Rajasthan, and Chhattisgarh, as well as a 40 MW solar power project in Gujarat.

Key Details:

- Adani Power is included in BSE 200 and BSE 500 but not in BSE 100, SENSEX, CNX MIDCAP 200, or NIFTY 50.

- The Mundra power plant, the largest single-site coal-fired power plant in India and the third-largest globally, is a flagship project of Adani Power.

- The company is currently adding 7,000 MW of capacity across its established projects.

- In 2017, a wholly-owned subsidiary signed a 25-year power purchase agreement to export electricity to the Bangladesh Electricity Development Commission.

- Subsidiaries include Adani Shipping PTE Ltd, Rahi Shipping PTE Ltd, and Vanshi Shipping PTE Ltd in Singapore.

- For the year ending March 31, 2021, consolidated sales for the quarter ended December 31, 2021, were INR 5,361 crores.

- Annual net sales for March 2021 were INR 26,221 crores, showing a 1% decrease from March 2020. However, the net profit increased significantly by 156% from the loss of INR 2,274 crores in March 2020, reaching INR 1,269 crores.

Conclusion: Adani Power Share Price Analysis

- PE Ratio (Price to Earnings): Adani Power has a PE ratio of 10.70, indicating that the stock is relatively undervalued.

- Share Price: The current share price is Rs 541.15. Valuation calculators can be used to determine if Adani Power’s share price is undervalued or overvalued.

- Return on Assets (ROA): Adani Power has an ROA of 14.17%, which is a less favorable sign for future performance. Higher values are generally more desirable.

- Current Ratio: Adani Power’s current ratio is 1.15, reflecting its ability to pay short-term liabilities with short-term assets. A higher current ratio is generally desirable for stability during unexpected business and economic challenges.

- Return on Equity (ROE): Adani Power has a ROE of 43.89%, indicating a strong ability to generate profits from shareholders’ investments. Higher ROE is generally considered better.

- Debt to Equity Ratio (D/E): Adani Power has a D/E ratio of 1.16, suggesting a low proportion of debt in its capital structure.

- Inventory Turnover Ratio: Adani Power has an Inventory turnover ratio of 16.19, indicating efficient management in terms of inventory and working capital.

- Sales Growth: Adani Power has reported revenue growth of 32.37%, which is considered fair in relation to its overall growth and performance.

- Operating Margin: The operating margin for Adani Power in the current financial year is 25.41%, providing insights into the company’s operational efficiency.

- Dividend Yield: The current year’s dividend for Adani Power is Rs 0, resulting in a dividend yield of 0%.

In summary, Adani Power exhibits some positive indicators such as a low PE ratio, strong ROE, and efficient inventory management. However, the lower ROA and absence of dividends may be concerns for certain investors. As with any investment decision, it’s crucial to conduct further research and consider broader market trends before making a decision.

Disclaimer: This post is for educational purposes only, not financial advice. Remember to do your own research. Past performance doesn't guarantee future results. Investing always involves risk, so it's wise to consult a financial advisor for personalized guidance...read more

FAQs

Q. When will adani power share price reach 1000?

Analysts believe Adani Power could potentially reach ₹1,000 by 2024 or 2025 under favorable conditions, fueled by strong market sentiment and successful execution of its expansion plans.

Q. What will be the adani power share price in 2025?

Analysts predict a possible range of ₹770 to ₹940 per share for 2025, influenced by market sentiment and Adani’s performance.

Q. What will be the adani power share price in 2030?

2030 estimates range from ₹1,644 to ₹2,549, driven by potential continued growth and favorable market conditions.

Q. What will be the adani power share price in 2040?

Predicting 2040 is challenging, but possible scenarios include a range of ₹2,800 to ₹4,000 depending on various factors like India’s energy demand, Adani’s performance, and unforeseen events.