Bajaj Auto Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analyst Report

Explore the future of Bajaj Auto’s share price with our in-depth analyst report! Unlocking the Bajaj Auto Share Price Target 2024, 2025, 2030, 2040, and 2050 in this comprehensive analysis.

Join us on a journey as we dissect the driving forces influencing the outlook of Bajaj Auto’s stock in the years to come.

About Bajaj Auto Limited

Bajaj Auto Limited, based in India, is a manufacturer of two-wheelers, three-wheelers, and quadricycles. The company is involved in developing, manufacturing, and distributing various automobiles, including motorcycles, commercial vehicles, electric two-wheelers, and parts.

Bajaj Auto’s motorcycle lineup comprises models such as Boxer, CT, Platina, Discover, Pulsar, Avenger, KTM, Dominar, Husqvarna, and Chetak. Commercial vehicles include Passenger Carriers, Good Carriers, and Quadricycles. Geographically, the company operates in India and the Rest of the World.

Bajaj Auto has manufacturing plants like Waluj, Chakan, and Pantnagar, along with several subsidiaries both in India and overseas, including PT Bajaj Auto Indonesia, Bajaj Auto International Holdings BV, Bajaj Auto (Thailand) Ltd., Bajaj Auto Spain S.L.U., Bajaj Do Brasil Comercio De Motocicletas Ltda, Chetak Technology Ltd., and Bajaj Auto Consumer Finance Ltd.

Bajaj Auto Ltd. – Vision

The integrity, dedication, resourcefulness and determination to succeed which are characteristic of the group today, are often traced back to its birth during those days of relentless devotion to a common cause.

Bajaj Auto Ltd.

Bajaj Auto Ltd. Company Profile

| Company | Bajaj Auto Ltd. |

|---|---|

| Founded | 1945 (79 years old) |

| Ownership | Public |

| India Employee count | 5k-10k |

| Global Employee count | 10k-50k |

| Headquarters | Pune, Maharashtra, India |

| Office Locations | New Delhi, Nagpur, Mumbai |

| Type of Company | Indian MNC |

| Nature of Business | Product |

| Target Market | B2C |

| Website | bajajauto.com |

Bajaj Auto Ltd. Fundamentals

| Company | Bajaj Auto Ltd. |

|---|---|

| Market Cap | ₹ 2,06,776.44 Cr. |

| Enterprise Value | ₹ 2,06,614.92 Cr. |

| No. of Shares | 28.32 Cr. |

| P/E | 32.18 |

| P/B | 8.15 |

| Face Value | ₹ 10 |

| Div. Yield | 1.92 % |

| Book Value (TTM) | ₹ 896.29 |

| Cash | ₹ 285.75 Cr. |

| Debt | ₹ 124.23 Cr. |

| Promoter Holding | 54.94 % |

| EPS (TTM) | ₹ 226.90 |

| Sales Growth | 9.90% |

| ROE | 21.64 % |

| ROCE | 28.46% |

| Profit Growth | 12.13 % |

Bajaj Auto Ltd. Profit & Loss – Last 3 Years

| Particulars | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|

| Net Sales | 27,741.08 | 33,144.71 | 36,427.60 |

| Total Expenditure | 22,818.17 | 27,908.18 | 29,880.46 |

| Operating Profit | 4,922.91 | 5,236.53 | 6,547.14 |

| Other Income | 1,282.03 | 1,231.35 | 1,183.42 |

| Interest | 6.66 | 8.66 | 39.48 |

| Depreciation | 259.28 | 269.17 | 282.44 |

| Exceptional Items | 15.28 | 0 | 0 |

| Profit Before Tax | 5,939.00 | 6,505.33 | 7,408.64 |

| Tax | 1,384.41 | 1,486.46 | 1,781.04 |

| Net Profit | 4,554.59 | 5,018.87 | 5,627.60 |

| Adjusted EPS (Rs.) | 157.40 | 173.44 | 198.88 |

Bajaj Auto Ltd. Balance Sheet – Past 3 Years

| Details | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|

| Share Capital | 289.37 | 289.37 | 282.96 |

| Total Reserves | 24,912.89 | 26,379.43 | 25,142.90 |

| Borrowings | 121.46 | 122.77 | 124.23 |

| Other N/C liabilities | 563.27 | 440.93 | 379.56 |

| Current liabilities | 5,643.21 | 4,689.44 | 5,198.04 |

| Total Liabilities | 31,530.20 | 31,921.94 | 31,127.69 |

| Net Block | 1,612.63 | 1,782.89 | 2,665.99 |

| Capital WIP | 15.98 | 76.82 | 81.92 |

| Intangible WIP | 0.00 | 0.00 | 0.00 |

| Investments | 14,602.84 | 18,849.63 | 18,503.96 |

| Loans & Advances | 1,054.77 | 1,119.52 | 954.35 |

| Other N/C Assets | 68.85 | 98.61 | 51.06 |

| Current Assets | 14,175.13 | 9,994.47 | 8,870.41 |

| Total Assets | 31,530.20 | 31,921.94 | 31,127.69 |

Bajaj Auto Ltd. Cash Flow – Last 3 Years

| Particulars | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|

| Profit from operations | 5,939.00 | 6,505.33 | 7,408.64 |

| Adjustment | -974.64 | -1,196.79 | -701.37 |

| Changes in Assets & Liabilities | -510.81 | 600.57 | 723.03 |

| Tax Paid | -1,339.69 | -1,701.54 | -1,918.41 |

| Operating Cash Flow | 3,113.86 | 4,207.57 | 5,511.89 |

| Investing Cash Flow | -2,866.54 | -92.40 | 1,322.42 |

| Financing Cash Flow | -19.52 | -4,056.33 | -7,178.86 |

| Net Cash Flow | 227.80 | 58.84 | -344.55 |

Bajaj Auto Ltd. Price Chart – Last 5 Years

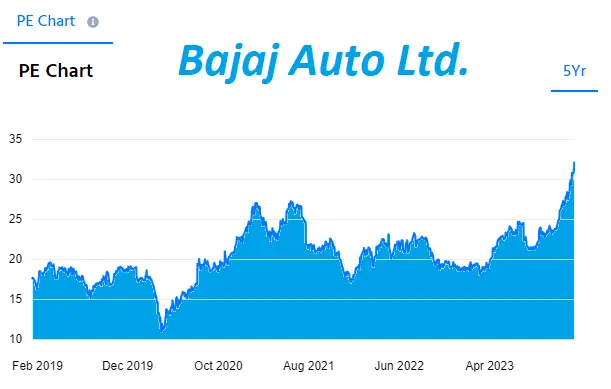

Bajaj Auto Ltd. P/E Chart – Past 5 Years

Bajaj Auto Share Price Target 2024, 2025, 2030, 2040, 2050

| Year | Minimum Target (INR) | Maximum Target (INR) |

|---|---|---|

| 2024 | 7,300 | 8,500 |

| 2025 | 8,269 | 10,200 |

| 2030 | 14,000 | 16,356 |

| 2040 | 25,004 | 27,300 |

| 2050 | 36,700 | 38,400 |

Bajaj Auto Share Price Target 2024

| Year | Bajaj Auto Share Price Target |

|---|---|

| 2024 | INR 7,300 to INR 8,500 |

- Technical Analysis:

- Minimum target: INR 7,300

- Maximum target: INR 8,500

- Fundamental Analysis:

- Economic recovery

- Rising demand for two-wheelers

- Focus on electric vehicles

- Potential challenges:

- Rising fuel costs

- Competition

Also Read: Amazon stock forecast 2023, 2024, 2025, 2030, 2040, 2050

Bajaj Auto Share Price Target 2025

| Year | Bajaj Auto Share Price Target |

|---|---|

| 2025 | INR 8,269 to INR 10,200 |

- Technical Analysis:

- Minimum target: INR 8,269

- Maximum target: INR 10,200

- Fundamental Analysis:

- Continued economic recovery

- Sustained demand for two-wheelers

- Increased market share for electric vehicles

- Potential challenges:

- Rising interest rates

- Global economic slowdown

Bajaj Auto Share Price Target 2030

| Year | Bajaj Auto Share Price Target |

|---|---|

| 2030 | INR 14,000 to INR 16,356 |

- Technical Analysis:

- Minimum target: INR 14,000

- Maximum target: INR 16,356

- Fundamental Analysis:

- Robust economic growth

- Two-wheelers becoming the primary mode of transportation in many developing countries

- Bajaj Auto becoming a major player in the global EV market

- Potential challenges:

- Government regulations on emissions and fuel efficiency

- Disruption from new technologies such as autonomous vehicles

Also Read: SBI Share Price Target 2024 to 2050

Bajaj Auto Share Price Target 2040

| Year | Bajaj Auto Share Price Target |

|---|---|

| 2040 | INR 25,004 to INR 27,300 |

- Technical Analysis:

- Minimum target: INR 25,004

- Maximum target: INR 27,300

- Fundamental Analysis:

- Widespread adoption of electric vehicles

- Bajaj Auto expanding into new markets and segments

- Strong brand recognition and customer loyalty

- Potential challenges:

- Competition from established automakers and new entrants in the EV market

- Increasing cost of raw materials

Bajaj Auto Share Price Target 2050

| Year | Bajaj Auto Share Price Target |

|---|---|

| 2050 | INR 36,700 to INR 38,400 |

- Technical Analysis:

- Minimum target: INR 36,700

- Maximum target: INR 38,400

- Fundamental Analysis:

- Electric vehicles becoming the dominant mode of transportation globally

- Bajaj Auto becoming a leader in sustainable mobility solutions

- Strong financial performance and shareholder returns

- Potential challenges:

- Geopolitical instability and economic disruptions

- Rapid technological advancements

Does Bajaj Auto Ltd. Pays Dividend?

Yes, Bajaj Auto Ltd. does pay dividends to its shareholders. They have a consistent track record of dividend payments, having declared dividends for the past five years.

Bajaj Auto Ltd. dividend history:

- March 2023: ₹140 per share

- March 2022: ₹11 per share

- March 2021: ₹16 per share

- March 2020: ₹8 per share

- March 2019: ₹4 per share

Bajaj Auto Share Analysts Report – Should I Invest or Not?

Analyzing Bajaj Auto’s stock and conducting a comprehensive research review, the Indian auto industry stands among the world’s top 5, with significant export growth prospects. Government support is currently fostering development, prompting a closer examination of Bajaj Auto’s stock performance to determine its investment appeal.

- The primary revenue driver for the auto sector is sales, and Bajaj Auto has recently experienced a moderate sales growth of 9.90%, with the latest quarter’s sales reaching Rs 10,777.27 Cr. Evaluating the efficiency of inventory management, the inventory turnover ratio for Bajaj Auto stands at a commendable 27.95 times.

- Bajaj Auto has reported a 12.13% growth in profit, reaching Rs 5,627.60 Cr in the latest year. Anticipated increases in demand, coupled with new government permits, are expected to contribute to further profit growth in the upcoming year.

- In the latest quarter, Bajaj Auto’s operating profit is Rs 2,132.85 Cr, providing insights into the company’s operational efficiency and aiding in financial decision-making.

- With a healthy Return on Equity (ROE) of 21.64%, Bajaj Auto demonstrates strong financial performance, crucial for auto companies with substantial equity investments. Additionally, the low Debt to Equity ratio of 0.00 reflects prudent financial management.

- Despite paying a dividend of Rs 140 per share, indicating a willingness to share profits with shareholders, the dividend yield is relatively low at 1.91%.

- Bajaj Auto’s promoter share stands at a significant 54.94%, with minimal pledging at 0.01%.

- The Price to Earnings (PE) multiple, a key indicator of market sentiment, is currently at 32.18, compared to the 5-year average PE of 18.69. This suggests that the market is willing to pay a premium for Bajaj Auto’s earnings.

- As of now, the share price of Bajaj Auto is Rs 7,301.95, and investors may consider using valuation calculators to determine whether the stock is undervalued or overvalued.

Recommended Articles:

- Praveg Share Price Target 2024, 2025, 2030, 2040, 2050: A Complete Stock Price Guide

- Adani Power Share Price Target 2024, 2025, 2030, 2040, 2050: A Strategic Guide

- Polycab Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analysis

FAQs

Q. When will Bajaj Auto Share reach 10000?

Some analysts see it by late 2024 if markets cooperate, but it’s dependent on many factors, making an exact timeline unreliable.

Q. What will be the Bajaj Auto Share Price in 2025?

Analysts project Bajaj Auto’s share price in 2025 to range between ₹8,269 and ₹10,200. This optimistic outlook factors in continued economic recovery, sustained demand for two-wheelers, and rising EV market share.

Q. What will be Bajaj Auto Share Price in 2030?

Analysts predict Bajaj Auto’s 2030 share price could potentially reach ₹14,000-₹16,356, fueled by robust economic growth, EV dominance in developing countries, and Bajaj Auto’s potential EV leadership.

Q. What will be the Bajaj Auto Share Price Target in 2040?

Bajaj Auto’s 2040 target holds wide range: ₹25,004-₹27,300. Potential drivers include EV boom, market expansion, and strong brand. But beware, competition, economic swings, and tech disruptions could swing things off course.