In this blog post, we explore the Exicom share price targets for 2024, 2025 to 2030. To know how the stock will perform in the upcoming years, read the complete technical and fundamental analysis report.

Before analysis it’s future targets, We first understand it’s financials, Profile & Profit & Loss, Share price Growth Chart and Company Profile also.

What is Exicom Tele-Systems Ltd.?

Exicom Tele-Systems Limited, established in 1994, is renowned for its expertise in power systems, including critical power solutions.

Company Profile

| Company | Exicom Tele-Systems Ltd. |

|---|---|

| Founded in | 1994 (30 yrs old) |

| Ownership | Public |

| India Employee Count | 1,000 – 5,000 |

| Headquarters | Gurgaon, Haryana, India |

| Office Locations | Gurgaon, Haryana, India |

| Type of Company | Corporate |

| Nature of Business | Product & Services |

| Website | exicom.in |

Exicom Tele-Systems Ltd. Fundamental Analysis

| Market Cap | ₹ 2,746.34 Cr. |

| Enterprise Value | ₹ 2,827.66 Cr. |

| No. of Shares | 12.08 Cr. |

| P/E | 84.51 |

| P/B | 3.53 |

| Face Value | ₹ 10 |

| Div. Yield | 0% |

| Book Value (TTM) | ₹ 64.41 |

| Cash | ₹ 25.20 Cr. |

| Debt | ₹ 106.52 Cr. |

| Promoter Holding | – |

| EPS (TTM) | ₹ 2.69 |

| Sales Growth | 53.73% |

| ROE | 22.14% |

| ROCE | 21.68% |

| Profit Growth | 10.86% |

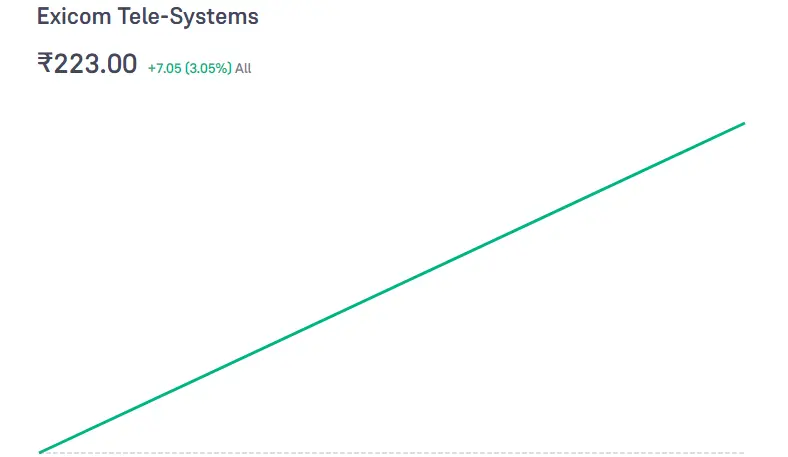

Exicom Tele-Systems Ltd. share price growth chart

Exicom Tele-Systems Ltd. profit & Loss Report

| Particulars | MAR 2019 | MAR 2020 | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|---|---|

| Net Sales (Cr.) | 345.85 | 275.45 | 309.13 | 335.53 | 515.80 |

| Total Expenditure (Cr.) | 324.08 | 319.18 | 315.24 | 306.69 | 464.54 |

| Operating Profit (Cr.) | 21.77 | -43.73 | -6.11 | 28.84 | 51.27 |

| Other Income (Cr.) | 28.66 | 35.66 | 14.35 | 38.16 | 18.25 |

| Interest (Cr.) | 9.30 | 10.98 | 15.62 | 17.65 | 17.39 |

| Depreciation (Cr.) | 8.39 | 16.24 | 15.90 | 14.52 | 15.57 |

| Exceptional Items (Cr.) | 0 | 0 | 0 | 0 | 0 |

| Profit Before Tax (Cr.) | 32.74 | -35.30 | -23.29 | 34.83 | 36.56 |

| Tax (Cr.) | 17.93 | 1.16 | -12.63 | 5.52 | 4.06 |

| Net Profit (Cr.) | 14.81 | -36.46 | -10.66 | 4.05 | 7.84 |

| Adjusted EPS (Rs.) | 1.71 | -4.20 | -1.23 | 3.38 | 3.75 |

Exicom Share Price Target 2024, 2025 to 2030

Exicom Share Price Target 2024

In 2023, Indian stocks like Exicom witnessed a significant Bull run, setting a positive tone for the market. As the first quarter of 2024 unfolds, it is anticipated that the bullish sentiment will persist, albeit with some initial consolidation. Based on technical analysis, the projected share price targets for Exicom in 2024 are as follows:

| Year | Minimum Exicom Share Price Target 2024 (₹) | Maximum Exicom Share Price Target 2024 (₹) |

|---|---|---|

| 2024 | ₹230.50 | ₹325.90 |

Also Read: Mahindra and Mahindra Share Price Target 2024, 2025, 2030: A Detailed Analysis

Exicom Share Price Target 2025

| Year | Minimum Exicom Share Price Target 2025 (₹) | Maximum Exicom Share Price Target 2025 (₹) |

|---|---|---|

| 2025 | ₹326.10 | ₹550.10 |

In January 2025, the expected share price of TATACHEM is forecasted to reach Rs. 425.18. If both macro and microeconomic factors, along with industry trends, remain supportive, there’s a possibility that the target price for Exicom Tele-Systems Ltd. could rise to Rs. 650.10 by December 2025.

Also Read: Tata Motors Share Price Target 2024, 2025, 2030, 2040 & 2050: A Fundamental Analysis

Exicom Share Price Target 2030

| Year | Minimum Exicom Share Price Target 2025 (₹) | Maximum Exicom Share Price Target 2025 (₹) |

|---|---|---|

| 2030 | ₹1060.1 | ₹1220.6 |

According to the Experts,

- The initial price target for Exicom Tele-Systems Ltd. in 2030 is projected to be ₹1060.16.

- With favorable market conditions, the mid-year price target for Exicom Tele-Systems Ltd. could reach ₹1220.6.

- By the end of 2030, the price target for Exicom Tele-Systems Ltd. is expected to potentially reach ₹1220.6, considering bullish market trends.

Also Read: Asian Paints Share Price target 2024, 2025 to 2030

Exicom Tele-Systems Ltd. share quick analysis report: Buy or Sell?

Stock investing necessitates thorough analysis of financial data to gauge a company’s true value. This typically involves examining profit and loss accounts, balance sheets, and cash flow statements. However, financial ratios offer a more accessible means to assess performance. Here are key metrics for evaluating Exicom Tele-Systems:

- PE Ratio: Exicom Tele-Systems exhibits a high PE ratio of 88.56, suggesting it may be overvalued.

- Share Price: The current share price stands at Rs 238.20, requiring further valuation analysis to determine if it’s undervalued or overvalued.

- Return on Assets (ROA): With an ROA of 7.02%, Exicom Tele-Systems shows less efficiency in generating profits from its assets, signaling potential challenges for future performance.

- Current Ratio: Exicom Tele-Systems maintains a current ratio of 1.51, indicating moderate stability in meeting short-term liabilities with assets.

- Return on Equity (ROE): The ROE of 22.14% suggests the company effectively generates profits from shareholders’ investments.

- Debt to Equity Ratio: Exicom Tele-Systems boasts a low D/E ratio of 0.71, indicating a favorable capital structure with minimal reliance on debt.

- Inventory Turnover Ratio: A ratio of 4.26 implies inefficiency in managing inventory and working capital.

- Sales Growth: Exicom Tele-Systems reports a fair revenue growth of 53.73%, reflecting satisfactory performance.

- Operating Margin: With an operating margin of 9.94%, Exicom Tele-Systems demonstrates decent operational efficiency.

- Dividend Yield: The absence of dividends for the current year results in a 0% yield.

👍Strengths

- Over the past three years, the company has demonstrated robust revenue growth of 23.26%.

- With an efficient Cash Conversion Cycle of 18.33 days, the company exhibits strong liquidity management.

- Demonstrating effective cash flow management, the CFO/PAT ratio is solid at 2.17.

- The company leverages its operations effectively, with an average Operating Leverage of 32.51%.

👎Weakness

- Over the past five years, the company has maintained a low EBITDA margin of 1.40%.

- The company is currently trading at a high EV/EBITDA ratio of 42.53.

FAQs

Q. Who is the Owner of Exicom Tele-Systems Ltd. ?

Mr. Anant Nahata is the Owner & MD of Exicom Tele-Systems Ltd.

Q. When does Exicom share price reach INR 500?

As per our analysis, Exicom share price expected to reach INR 500 at the end of 2025.

Q. What is the P/E and P/B ratios of Exicom Tele-Systems Ltd.?

The P/E and P/B ratios of Exicom Tele-systems Ltd. is 448.96 and 4.3 as of 10 Mar 24.

Disclaimer: Dear Readers, Please note, stock price projections for Exicom Tele-Systems Ltd. in 2024, 2025, and 2030 are based on factors like past performance and market trends. These projections are for informational purposes only and aren’t financial advice or guarantees.