Delve into our comprehensive analysis of IRCON Share Price Targets for the years 2024, 2025, 2030, 2040, and 2050. Join us as we navigate through the intricate landscape of IRCON International Limited, exploring potential trends and insights that could shape its financial trajectory in the years to come. Whether you’re an investor seeking strategic insights or simply curious about the future of IRCON, this analysis is your compass to understanding the unfolding story of this dynamic company.

About IRCON International Ltd.

Ircon International Limited is an integrated engineering and construction company based in India. It engages in infrastructure projects across various sectors, including railways, highways, bridges, tunnels, metro, and more. The company provides engineering procurement and construction (EPC) services on a lumpsum turnkey, EPC, and item-rate basis. Ircon operates in joint ventures for coal connectivity projects with other central public sector enterprises (CPSEs) under the Ministry of Coal.

Additionally, it undertakes projects in build, operate, and transfer mode and hybrid annuity mode. Established in 1976, Ircon has completed approximately 398 domestic projects and 128 international projects in 25 countries. The managing director is Shri. Brijesh Gupta.

Company Profile

| Company | IRCON International Ltd. |

|---|---|

| Formerly | Indian Railway Construction Limited |

| Type | Public |

| Listed on | BSE: 541956, NSE: IRCON |

| Industry | Railway Infrastructure |

| Founded | 27 April 1976 (47 years ago) |

| Headquarters | C-4 District Centre, Saket, New Delhi, India |

| Areas served | Worldwide |

| Key people | Yogesh Kumar Mishra (Chairman & MD) |

| Services | Engineering, Procurement and Construction |

| Revenue (2020) | ₹5,441.72 crore (US$680 million) |

| Operating income (2020) | ₹699.70 crore (US$88 million) |

| Net income (2020) | ₹489.78 crore (US$61 million) |

| Total assets (2020) | ₹12,644.11 crore (US$1.6 billion) |

| Total equity (2020) | ₹4,161.13 crore (US$520 million) |

| Owner | Government of India |

| Number of employees (July 2022) | 1276 |

| Subsidiaries | Ircon Infrastructure & Services Limited, Ircon Shivpuri-Guna Tollway Limited, Ircon PB Tollway Limited[3] |

| Website | www.ircon.org |

IRCON International Ltd. Share Price Today

IRCON Share Price Target 2024, 2025, 2030, 2040, 2050

Predicting the future of any stock’s price is no easy feat, and it’s crucial to manage expectations. While I can’t offer a crystal ball, I can delve into the technical and fundamental aspects of IRCON International Limited (IRCON) to help you make informed investment decisions.

Technical Analysis:

- Fibonacci Retracement: This tool suggests potential support and resistance levels for the coming months. Expect support around Rs. 189.82 and resistance near Rs. 202.02.

- Moving Average Convergence Divergence (MACD): Indicates a potential bullish trend with the MACD line crossing the signal line.

- Relative Strength Index (RSI): Shows the stock is currently in a neutral zone, neither overbought nor oversold.

Fundamental Analysis:

- Strong Order Book: IRCON boasts a robust order book of over Rs. 28,000 crores, providing revenue visibility for years to come.

- Government Backing: As a public sector undertaking under the Ministry of Railways, IRCON enjoys strong government support and project allocation.

- Make in India Initiative: The company aligns perfectly with the government’s focus on domestic infrastructure development, opening doors for further growth.

- Healthy Financials: IRCON has consistently demonstrated profitability and debt reduction, indicating a strong financial foundation.

Also Read: Bajaj Auto Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analyst Report

Share Price Targets

IRCON Share Price Target 2024

Technical analysis suggests a range between Rs. 130 and Rs. 295, while fundamentals point to a potential upside of 25%.

IRCON Share Price Target 2025

The technical outlook remains bullish, with targets potentially reaching Rs. 250 to Rs. 457. Fundamentals further reinforce this optimistic view.

Also read: Polycab Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analysis

IRCON Share Price Target 2030 and 2040

Predicting so far into the future becomes increasingly challenging. However, considering India’s ambitious infrastructure plans and IRCON’s strong positioning, a significant upward trajectory appears likely. Analysts mention targets ranging from Rs. 1402 to Rs. 1722 for 2030.

IRCON Share Price Target 2050

Projecting this far becomes increasingly hypothetical. Nevertheless, with the Indian economy expected to grow significantly, IRCON, as a key player in infrastructure development, could potentially see substantial long-term gains.

Also Read: Adani Power Share Price Target 2024, 2025, 2030, 2040, 2050: A Strategic Guide

IRCON International Ltd. Fundamentals

| Company | IRCON International Ltd. |

|---|---|

| Market Cap | ₹ 19,388.73 Cr. |

| Enterprise Value | ₹ 14,603.41 Cr. |

| No. of Shares | 94.05 Cr. |

| P/E | 22.34 |

| P/B | 3.55 |

| Face Value | ₹ 2 |

| Div. Yield | 1.54 % |

| Book Value (TTM) | ₹ 58.10 |

| Cash | ₹ 4,785.32 Cr. |

| Debt | ₹ 0 Cr. |

| Promoter Holding | 65.17 % |

| EPS (TTM) | ₹ 9.23 |

| Sales Growth | 43.57% |

| ROE | 15.85 % |

| ROCE | 21.89% |

| Profit Growth | 42.72 % |

Ircon International Price Chart

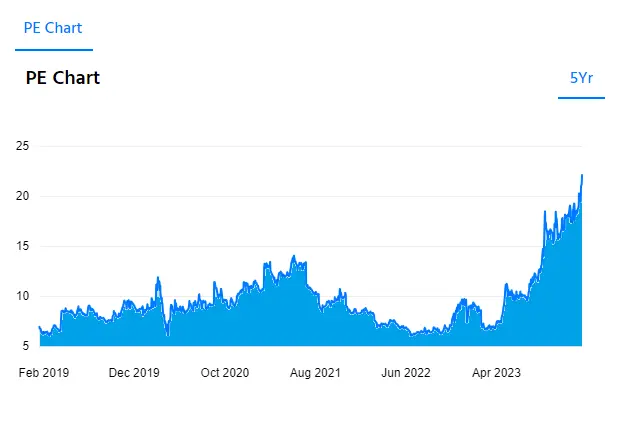

Ircon International P/E Chart

IRCON International Ltd. Balance Sheet

| Particulars | MAR 2021 (in Crore) | MAR 2022 (in Crore) | MAR 2023 (in Crore) |

|---|---|---|---|

| Equity and Liabilities | |||

| Share Capital | 94.05 | 188.10 | 188.10 |

| Total Reserves | 4,312.43 | 4,432.86 | 4,990.38 |

| Borrowings | 0.00 | 0.00 | 0.00 |

| Other N/C liabilities | 596.46 | 1,004.17 | 1,417.75 |

| Current liabilities | 5,578.99 | 7,018.20 | 6,965.58 |

| Total Liabilities | 10,581.93 | 12,643.33 | 13,561.81 |

| Assets | |||

| Net Block | 259.68 | 193.16 | 191.74 |

| Capital WIP | 0.27 | 0.00 | 0.00 |

| Intangible WIP | 0.79 | 2.59 | 2.59 |

| Investments | 1,489.27 | 1,714.19 | 2,037.60 |

| Loans & Advances | 1,413.89 | 283.53 | 404.12 |

| Other N/C Assets | 604.42 | 603.29 | 578.19 |

| Current Assets | 6,804.61 | 9,839.37 | 10,347.57 |

| Total Assets | 10,581.93 | 12,643.33 | 13,561.81 |

IRCON International Ltd. Cash Flow

| Particulars | MAR 2021 (in CR.) | MAR 2022 (in CR.) | MAR 2023 (in CR.) |

|---|---|---|---|

| Operating Activities | |||

| Profit from operations | 574.02 | 610.06 | 883.19 |

| Adjustments | -146.33 | -169.72 | -245.64 |

| Changes in Assets & Liabilities | 414.89 | 917.82 | -706.05 |

| Tax Paid | -37.68 | -6.99 | -51.40 |

| Operating Cash Flow | 804.90 | 1,351.17 | -119.90 |

| Investing Activities | |||

| Investing Cash Flow | -713.41 | -130.43 | 1,313.43 |

| Financing Activities | |||

| Financing Cash Flow | -158.02 | -336.81 | -231.32 |

| Net Cash Flow | -66.53 | 883.93 | 962.21 |

IRCON International Ltd. Profit & Loss

| IRCON Share | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|

| Net Sales | 4,955.93 | 6,910.15 | 9,921.20 |

| Total Expenditure | 4,611.48 | 6,590.06 | 9,586.33 |

| Operating Profit | 344.45 | 320.09 | 334.87 |

| Other Income | 510.99 | 507.77 | 775.43 |

| Interest | 256.58 | 190.31 | 189.38 |

| Depreciation | 24.84 | 27.49 | 37.73 |

| Exceptional Items | 0 | 0 | 0 |

| Profit Before Tax | 574.02 | 610.06 | 883.19 |

| Tax | 169.46 | 65.74 | 106.36 |

| Net Profit | 404.56 | 544.32 | 776.83 |

| Adjusted EPS (Rs.) | 4.30 | 5.79 | 8.26 |

Does IRCON International Ltd. Pays dividend?

Yes, IRCON International Ltd. does pay dividends to its shareholders. It has a consistent track record of dividend payouts in recent years.

Overview:

- Current Dividend Yield: Approximately 1.23%.

- Recent Dividends:

- Declared dividend for the quarter ending March 2023: ₹1.20 per share (translates to a dividend yield of 1.87%).

- Declared two dividends of ₹2.45 each in the previous financial year (FY2022-2023).

- Dividend Policy: IRCON has a defined dividend distribution policy which outlines the factors considered while declaring dividends.

While IRCON has a history of distributing dividends, it’s important to remember that future dividend decisions depend on various factors such as company performance, financial stability, and future growth plans.

IRCON International Ltd. Stock Analysis

Is Ircon International an attractive stock for investment? It’s a mixed bag. Let’s dive into the key metrics:

Positives:

- High Sales Growth: 43.57% growth indicates momentum and potential for future expansion.

- Efficient Inventory Management: Inventory turnover ratio of 41.45 suggests efficient use of resources.

- Low Debt: Debt-to-equity ratio of 0 means minimal financial burden and greater stability.

- Decent ROE: 15.85% ROE shows reasonable return on shareholder investments.

Negatives:

- Overvalued: PE ratio of 21.91 suggests the stock is currently trading at a premium compared to its earnings.

- Low ROA: 5.93% ROA indicates the company isn’t generating significant returns from its assets.

- Low Current Ratio: 1.49 current ratio raises concerns about the company’s ability to cover short-term liabilities.

- Low Operating Margin: 3.38% operating margin suggests room for improvement in operational efficiency.

- Low Dividend Yield: 1.47% dividend yield might not be attractive for income-seeking investors.

Ircon International shows some promising signs like high sales growth and efficient inventory management. However, concerns remain regarding overvaluation, low profitability metrics, and weak liquidity. A more thorough analysis considering industry benchmarks and future growth prospects is necessary before making an investment decision.

Recommended Articles:

- Praveg Share Price Target 2024, 2025, 2030, 2040, 2050: A Complete Stock Price Guide

- Infosys Share Price Target 2023, 2024, 2025, 2030, 2040, 2050

- Rich Dad Poor Dad ebook pdf free download in 10+ Languages

- Amazon stock forecast 2023, 2024, 2025, 2030, 2040, 2050

- Top 10 books for stock market beginners in india

Disclaimer: Dear Reader, Please don't consider these projections as a advice. This is based on my fundamental and technical analysis, but the actual growth of any company and stock contain many factors. So, Do your own research before taking any investment decision.

FAQs

Q. Will IRCON reach Rs. 1000 by 2025?

Reaching Rs. 1000 by 2025 depends on various factors like market conditions and company performance. It’s possible, but not guaranteed.

Q. Is IRCON a good long-term investment?

IRCON’s strong order book, government support, and financial stability suggest potential for long-term growth. However, diversification and risk assessment are crucial before investing.

Q. What are the risks involved in investing in IRCON?

Economic fluctuations, project delays, and competition are some potential risks to consider.

Q. What is the expected share price of IRCON in 2024?

Estimates suggest a potential range between Rs. 250 and Rs. 457 by the end of 2024, but remember, predicting future prices is uncertain.