In this blog post, we explore the Suryoday Small Finance Bank share price targets for 2024, 2025 to 2030. To know how the stock will perform in the upcoming years, read the complete technical and fundamental analysis report.

Before going on it’s Analysis, We first understand that what he do and his history?

What is Suryoday Small Finance Bank Ltd.?

Suryoday Small Finance Bank Ltd. is an Indian bank that started as a non-banking finance company (NBFC). They provide various types of loans including for vehicles, homes, businesses, and individuals, along with savings and current accounts. Their deposit options range from fixed deposits to recurring deposits, catering to different needs.

Additionally, they offer life and general insurance, as well as investment options like the national pension scheme. Suryoday also extends social security schemes like the Atal Pension Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana. Established in 2008, the bank is led by Mr. Baskar Ramachandran.

Suryoday Small Finance Bank Ltd. Fundamental Analysis

| Market Cap | ₹ 1,757.62 Cr. |

| CASA (%) | 17.11 |

| No. of Shares (Cr.) | 10.62 |

| P/E | 9.06 |

| P/B | 1.01 |

| Face Value (₹) | 10 |

| Div. Yield (%) | 0 |

| Book Value (TTM) (₹) | 164.13 |

| Net Interest Income (Cr.) | 746.57 Cr. |

| Cost to Income (%) | 60.02 |

| Promoter Holding (%) | 22.4 |

| EPS (TTM) (₹) | 18.27 |

| CAR (%) | 33.72 |

| ROE (%) | 5.06 |

| ROCE (%) | 6.26 |

| Profit Growth (%) | 183.51 |

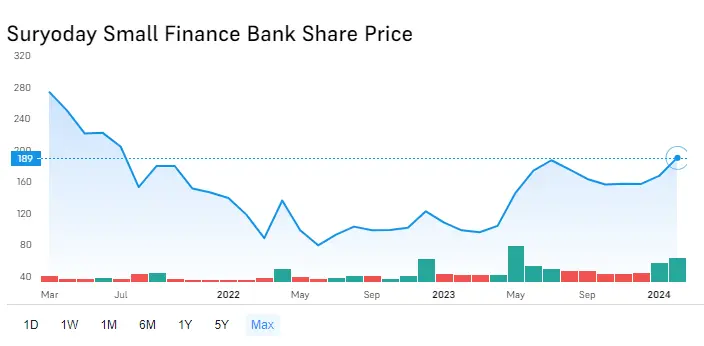

Suryoday Small Finance Bank Ltd. Share Price Growth

Suryoday Small Finance Bank Ltd. Profit & Loss Report

| Particulars | Mar 2020 (Cr) | Mar 2021 (Cr) | Mar 2022 (Cr) | Mar 2023 (Cr) |

|---|---|---|---|---|

| Interest Earned | 766.68 | 776.15 | 941.82 | 1,183.68 |

| Other Income | 87.45 | 76.40 | 93.56 | 97.42 |

| Interest Expended | 276.18 | 365.65 | 357.37 | 437.11 |

| Operating Expenses | 272.12 | 328.64 | 413.10 | 506.54 |

| Total Provisions | 151.86 | 146.16 | 391.98 | 236.60 |

| Profit Before Tax | 153.98 | 12.10 | -127.07 | 100.86 |

| Taxes | 43.04 | 0.24 | -34.04 | 23.17 |

| Net Profit | 110.94 | 11.86 | -93.03 | 77.69 |

| Adjusted EPS (Rs) | 12.81 | 1.12 | -8.76 | 7.32 |

Suryoday Small Finance Bank Ltd. Balance Sheet Report

| Equity and Liabilities | MAR 2018 | MAR 2020 | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|---|---|

| Share Capital | 67.50 Cr | 86.59 Cr | 106.13 Cr | 106.16 Cr | 106.16 Cr |

| Total Reserves | 468.86 Cr | 972.53 Cr | 1,480.66 Cr | 1,389.75 Cr | 1,469.79 Cr |

| Deposits | 749.52 Cr | 2,848.71 Cr | 3,255.68 Cr | 3,853.88 Cr | 5,166.72 Cr |

| Borrowings | 717.83 Cr | 1,264.62 Cr | 1,666.62 Cr | 2,551.34 Cr | 2,765.41 Cr |

| Other Liabilities | 156.39 Cr | 184.96 Cr | 192.79 Cr | 269.85 Cr | 344.36 Cr |

| Total Liabilities | 2,163.50 Cr | 5,364.52 Cr | 6,711.99 Cr | 8,180.18 Cr | 9,861.22 Cr |

Equity and Liabilities:

- Share Capital: The bank’s share capital has remained relatively stable over the period, with a slight increase from ₹67.50 crore in March 2018 to ₹106.16 crore in March 2023.

- Total Reserves: Total reserves have shown a significant increase, growing from ₹468.86 crore in March 2018 to ₹1,469.79 crore in March 2023. This indicates that the bank has retained a larger portion of its earnings over time.

- Deposits: Deposits have grown steadily, reflecting an increase in customer confidence in the bank. Deposits grew from ₹749.52 crore in March 2018 to ₹5,166.72 crore in March 2023.

- Borrowings: Borrowings have also increased significantly, from ₹717.83 crore in March 2018 to ₹2,765.41 crore in March 2023. This suggests that the bank is relying more on borrowed funds to finance its operations.

- Other Liabilities: Other liabilities have also shown an increase, from ₹156.39 crore in March 2018 to ₹344.36 crore in March 2023.

| Assets | MAR 2018 | MAR 2020 | MAR 2021 | MAR 2022 | MAR 2023 |

|---|---|---|---|---|---|

| Balance with RBI | 30.82 Cr | 60.53 Cr | 102.80 Cr | 607.45 Cr | 784.23 Cr |

| Balance with Banks | 176.34 Cr | 777.07 Cr | 493.84 Cr | 370.24 Cr | 48.87 Cr |

| Investments | 311.34 Cr | 808.20 Cr | 1,873.70 Cr | 2,057.68 Cr | 2,570.19 Cr |

| Advances | 1,574.95 Cr | 3,531.94 Cr | 3,982.77 Cr | 4,750.88 Cr | 6,015.05 Cr |

| Net Block | 12.71 Cr | 30.49 Cr | 34.95 Cr | 66.03 Cr | 163.15 Cr |

| Other Assets | 56.51 Cr | 148.05 Cr | 215.66 Cr | 278.68 Cr | 278.40 Cr |

| Total Assets | 2,163.50 Cr | 5,364.52 Cr | 6,711.99 Cr | 8,180.18 Cr | 9,861.22 Cr |

Assets:

- Balance with RBI and Banks: The bank’s balances with RBI and Banks have fluctuated over the period. However, there is a significant increase in balance with RBI in March 2023 (₹784.23 crore) compared to March 2018 (₹30.82 crore).

- Investments: Investments have grown steadily, from ₹311.34 crore in March 2018 to ₹2,570.19 crore in March 2023. This indicates that the bank is investing a larger portion of its funds in securities.

- Advances: Advances, which represent loans given to customers, have increased significantly from ₹1,574.95 crore in March 2018 to ₹6,015.05 crore in March 2023. This reflects the bank’s growth in its loan portfolio.

- Net Block: Net block, which represents the bank’s fixed assets, has also increased over the period, from ₹12.71 crore in March 2018 to ₹163.15 crore in March 2023.

- Other Assets: Other assets have shown a slight increase, from ₹56.51 crore in March 2018 to ₹278.40 crore in March 2023.

Suryoday Small Finance Bank Share Price Target 2024, 2025 to 2030

Suryoday Small Finance Bank Share Price Target 2024

| Year | SURYODAY Share Price Target 2024 |

|---|---|

| 2024 | ₹169-₹295 |

- Analyst Estimates: Market analysts seem to have a bullish outlook with an average target price of ₹295 for 2024, which translates to a potential upside of around 45.2% from the current price of ₹169.90.

- Technical Analysis: Some sources suggest a target range based on technical indicators, with the minimum target being ₹169.90 and the maximum target being ₹280.09 for 2024.

Also Read: Welspun Living Share Price target 2024, 2025 to 2030

Suryoday Small Finance Bank Share Price Target 2025

| Year | SURYODAY Share Price Target 2025 |

|---|---|

| 2025 | ₹294-₹525 |

Our Experts suggest an initial target price of ₹294.32 for January 2025, potentially reaching ₹375.38 by mid-year, with a bullish estimate of ₹525.39 by the end of 2 025

Also Read: TSMC Share Price Target 2024, 2025 to 2030

Suryoday Small Finance Bank Share Price Target 2030

| Year | SURYODAY Share Price Target 2030 |

|---|---|

| 2030 | ₹950-₹1400 |

Our Experts, project an initial target price for Suryoday in the range of ₹950 – ₹1400 for 2030, potentially reaching higher figures by 2030 if the bank demonstrates strong performance.

Also Read: CG Power Share Price Target 2024, 2025 to 2030

Suryoday Small Finance Bank Ltd. Share Quick Analysis: Buy Or Sell?

The Indian banking sector is experiencing significant growth propelled by infrastructure investments, favorable government policies, rising disposable incomes, increasing consumerism, and improved access to credit.

Given this boom in the banking industry, investors are contemplating whether it’s the right time to invest in banking stocks. To make an informed decision, let’s delve into a detailed analysis of Suryoday Small Finance’s performance.

Suryoday Small Finance primarily derives its income from interest earned on loans extended to individuals and corporations. In the latest financial year, it generated revenue of Rs 1,183.68 Cr., marking an impressive growth rate of 15.58% over the past three years.

Regarding advances, Suryoday Small Finance witnessed a notable year-on-year increase of 26.61%. Over the last three years, its advance growth averaged at 19.42%.

- Currently, Suryoday Small Finance maintains a CASA ratio of 17.11% and an overall cost of liability of 5.51%. Its total deposits from these accounts amount to Rs 5,166.72 Cr.

- However, Suryoday Small Finance exhibits a poor track record in terms of Return on Assets (ROA), standing at 0.86%.

- The bank appears inefficient in managing its overall asset portfolio, with Gross NPA and Net NPA rates at 3.13% and 1.55%, respectively, as of the latest financial year.

- Moreover, the YoY change in provision and contingencies is negative at -39.64%, indicating a decrease from the previous year.

- Non-interest income, or other incomes, play a crucial role for banks as they provide a regular income stream with minimal additional risk. Suryoday Small Finance saw a surge in other income, which currently stands at Rs 97.42 Cr.

- On the positive side, Suryoday Small Finance boasts a robust Capital Adequacy Ratio of 33.72%.

- Assessing the bank’s valuation, the Price-to-Book (P/B) ratio is a key metric. Currently, Suryoday Small Finance is trading at a P/B ratio of 1.03. Comparatively, its historical average P/B ratio was 0.62.

- Regarding share price, Suryoday Small Finance is currently valued at Rs 169.90 per share. Utilizing valuation calculators for further analysis can help investors determine whether Suryoday Small Finance’s share price is undervalued or overvalued.

👍 Strengths

- Consistently high Net Interest Margin (NIM): A NIM of 7.26% maintained over the last 3 years indicates the bank is efficient at generating profits from its core lending business.

- Good Capital Adequacy Ratio (CAR): A CAR of 33.72% suggests the bank has a sufficient capital buffer to absorb potential losses. This is important for maintaining financial stability.

👎 Weakness

- Very low Return on Assets (ROA): An average ROA of -0.06% over 3 years is a significant concern. It means the bank is struggling to generate profits on its assets.

- Low CASA ratio and negative CASA growth: A CASA ratio of 17.11% and negative CASA growth indicate the bank relies heavily on expensive sources of funding. This can squeeze profit margins.

- Low Return on Equity (ROE): A negative ROE of -0.03% over 3 years implies the bank is not generating a good return on shareholders’ investment.

- High Non-performing Assets (NPA): An average NPA of 4.08% over 3 years suggests a significant portion of the bank’s loans are not being repaid. This can eat into profits and increase risk.

- Low other income: Low income from sources other than interest on loans can limit the bank’s ability to diversify its revenue streams.

- High cost to income ratio: A cost to income ratio of 60.02% indicates the bank’s expenses are a large portion of its income. This can further strain profitability.

- Poor profit growth: A negative profit growth of -11.20% over 3 years is a worrying sign.

FAQs

Disclaimer: Dear Readers, Please note, These stock price projections are based on factors like past performance and market trends. These projections are for informational purposes only and aren’t financial advice or guarantees.