Ever sold stocks on Zerodha and wondered why 20% of the proceeds seem “missing”? Don’t panic! It’s called the delivery margin, and it plays a key role in your trades.

This article demystifies the “What is Delivery Margin in Zerodha,” explaining its purpose, how it works, and when you get those funds back. Buckle up, Zerodha traders, and let’s unlock the secrets of smooth selling!

Zerodha’s delivery margin, typically 20% of the sold stock value, is the amount withheld when selling from your Demat account.

Under SEBI’s new peak margin norms, 80% of the sale is credited on the same day, and the remaining 20% on the next trading day, minimizing risk for new traders. The broker debits shares from your Demat, sending them to the Clearing Corporation (CC) on the trading day.

These stocks serve as margins, meeting upfront and peak margin requirements, with the full settlement occurring on T+2 days.

Also Read: What is BO ID in Zerodha: Where to get?

What is Delivery Margin in Zerodha?

Sold some stocks on Zerodha but can’t access all the cash?

Don’t panic!

That 20% hold is the delivery margin, and here’s why it exists:

- Imagine you sell Rs. 1 lakh worth of stocks.

- Rs. 80,000 is instantly available for you to trade with.

- The remaining Rs. 20,000 is the delivery margin, temporarily held till the next trading day.

Why the hold? It ensures you have enough funds to deliver the sold stocks if needed. This is especially important for short selling or options trading.

The good news: You get that Rs. 20,000 back in your account by the next trading day, ready to fuel your next Zerodha moves!

Remember, delivery margin is just a temporary hold, not a hidden fee. Now you’re in the know, so trade on!

Also Read: Varsity By Zerodha Review: Is Zerodha Varisty Good?

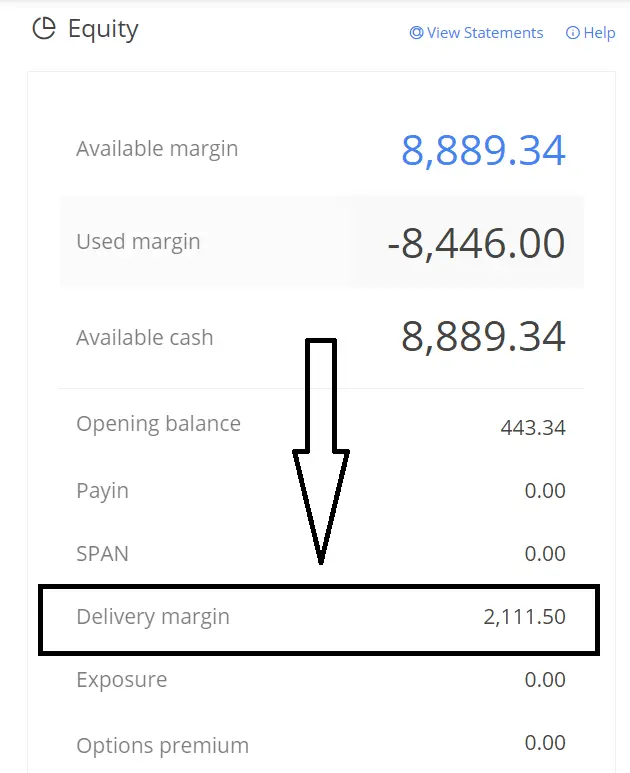

How to check Delivery Margin in Zerodha ?

Want to see exactly how much is on hold? Here’s a simple step-by-step guide:

Step-1. Log in to Zerodha Kite.

Step-2. Navigate to the “Funds” page.

Step-3. Look for the section labeled “Delivery Margin.” as you shown in the image below:

Step-4. There you’ll find the exact amount currently on hold.

Also Read: Zerodha Trading App Review: Is Zerodha SEBI Registered?

Key Terms Everyone Should Know

1. Peak Margin:

- Minimum margin required before placing any trade (intraday or delivery).

- Differs from delivery margin, which is held after selling your holdings.

2. Peak Margin Penalty:

- Zerodha charges this penalty if you:

- Sell holdings.

- Use the credited amount (80%) for new trades.

- Buy back the same shares on the same day.

3. Zerodha Nudge:

- Warning message you receive if you attempt to buy back sold shares with the 80% credit to avoid peak margin penalty.

4. Interest Rate on Zerodha Margin:

- No interest on delivery margin.

- 18% per year/0.05% per day interest on used margin leverage from Zerodha.

5. Negative Balance in Margin:

- Indicates pending credit from selling stocks, already credited but used, or both.

Examples:

- Selling 100 Reliance shares (Rs. 2,000 each) results in Rs. 1,60,000 credit (80%) and Rs. 40,000 delivery margin (20%).

- Negative margin of Rs. -4,078.40 signifies sold stock proceeds of Rs. 5,098, with Rs. 4,078.40 credited and Rs. 1,019.60 held as delivery margin.

Remember: Avoid buying back sold shares on the same day with the 80% credit to avoid peak margin penalty. Keep funds in your account or utilize Zerodha Nudge’s warning to prevent penalties.

Also Read: Zerodha Account Opening Charges: Review, Details, Documentions

FAQs

Will I get the delivery margin money back?

Yes, The 20% held as delivery margin gets released back to your Zerodha account on the next trading day. You’ll have full access to this funds then, just like any other balance in your account.

When can I withdraw my delivery margin in Zerodha?

Once it’s credited back to your account on the next trading day, you’re free to withdraw the delivery margin just like any other funds. You can transfer it to your bank account, use it for other trades, or keep it within Zerodha for future investments.

Can I use the delivery margin?

Unfortunately, no. The delivery margin isn’t available for immediate use. It acts as a temporary hold to ensure sufficient funds for potential stock delivery in case of short selling or options trading. Think of it as temporarily locked funds to safeguard your trading activity.

What happens if I get a margin call from Zerodha?

A margin call occurs when your used margin exceeds your available margin due to falling stock prices or other factors. If this happens, Zerodha will require you to deposit additional funds to bring your margin back within the accepted limits. Failure to do so could lead to forced liquidation of some of your holdings to meet the margin requirements.

Conclusion

Remember, delivery margin is just a temporary hold, not a lost cost. It plays a crucial role in ensuring smooth trading and mitigating potential risks.

So, while you can’t use it immediately, rest assured it will be back in your account soon and you can then utilize it as you wish.

I hope this clarifies your doubts about delivery margin in Zerodha! Feel free to ask us by below comment section if you have any further questions.