mStock Review 2025: Is Mstock really free?

Today, We’ll be providing mStock Review for the year 2025. Is it the best stockbroker for you in 2025?

Are you looking for a stockbroker that offers zero brokerage and a lifetime free demat account? If so, mStock is worth checking out. It is a new-age stockbroker from Mirae Asset, one of the leading financial services companies in India.

mStock has quickly become popular among Indian traders and investors due to its competitive brokerage charges, user-friendly platform, and excellent customer service.

In this review, we will take a closer look at mStock’s features, benefits, and drawbacks to help you decide if it is the right stockbroker for you.

What is mStock?

mStock is a discount stockbroker in India that offers zero brokerage on all trades, including equity, F&O, currency, ETFs, and mutual funds.

It is a subsidiary of Mirae Asset Securities, one of the largest financial services companies in South Korea.

mStock was launched in India in 2019 and has quickly become one of the most popular stockbrokers in the country.

mStock Key Features/Benefits

- Lifetime free demat account

- Margin trading facility

- IPO investing

- Mutual fund investment

- Advanced charting tools

- Real-time market data

mStock Charges

Mutual Fund Charges

| Charge Type | Details |

|---|---|

| Mutual Fund Charges | No fees on Mutual Fund Direct Plans |

DP (Depository Participant) Charges

| Charge Type | Details |

|---|---|

| DP Charges | ₹12 + GST per ISIN per transaction per day for sell transactions charged by CDSL & m.Stock |

Pledge Charges

| Charge Type | Details |

|---|---|

| Pledge Charges | Pledge creation & closure charges will be ₹25 per PSN (Pledge Sequence Number) per day (+GST) for ‘Lifetime free AMC’ plan |

| Pledge creation & closure charges will be ₹32 per PSN (Pledge Sequence Number) per day (+GST) for standard quarterly AMC plan |

Quarterly Operating Charges

| Charge Type | Details |

|---|---|

| Operating Charges | ₹99 + 18% GST per quarter for clients under the standard quarterly AMC plan |

| No operating charge will be applicable for clients under the ‘Lifetime free AMC’ plan |

Upgrade Charges

| Charge Type | Details |

|---|---|

| Upgrade Charges | Brokerage Plan: If you opt for Free Delivery account during account opening and upgrade later, then you will have to pay ₹1,299. |

| AMC Plan: If you opt for the standard AMC plan (₹120 per quarter) during account opening and upgrade later, you will have to pay ₹1,299. |

Off-market Transfer Charges

| Charge Type | Details |

|---|---|

| Transfer Charges | Transfer in FREE – Transfer out ₹20 per transaction or 0.50%, whichever is lower |

Corporate Action Order Charges

| Charge Type | Details |

|---|---|

| Corporate Action Charges | Lifetime Zero brokerage in the Zero Brokerage account at a one-time fee of ₹999. In case of Free Delivery account, a charge of ₹20 per transaction will be levied |

Delayed Payment Charges

| Charge Type | Details |

|---|---|

| Delayed Payment Charges | Interest is levied at 18% a year or 0.05% per day on the debit balance in your trading account |

Physical CMR Request

| Charge Type | Details |

|---|---|

| CMR Request Charges | First CMR request is free. ₹20 + ₹100 (courier charge) + 18% GST for subsequent requests |

Payment Gateway Charges – Margin Fund Transfer

| Charge Type | Details |

|---|---|

| Payment Gateway Charges | UPI Transactions are Free and in case of Net banking, charges will vary between ₹7 – ₹11 + GST depending on the bank selection |

Physical Statement Courier Charges

| Charge Type | Details |

|---|---|

| Courier Charges | ₹100 per request + ₹100 per courier |

Demat per certificate

| Charge Type | Details |

|---|---|

| Demat Charges | A charge of ₹150 per certificate + ₹100 courier charges will be levied |

Remat Charges

| Charge Type | Details |

|---|---|

| Remat Charges | A charge of ₹150 per certificate + ₹100 courier charges + CDSL Charges will be levied |

Failed Instruction Charges

| Charge Type | Details |

|---|---|

| Failed Instruction Charges | A charge of ₹50 per instruction will be applied |

Reactivation Charges

| Charge Type | Details |

|---|---|

| Reactivation Charges | No charge will be applicable for account reactivation |

Modification Charges

| Charge Type | Details |

|---|---|

| Modification Charges | A charge of ₹20 will be applicable per request |

Account Closure Charges

| Charge Type | Details |

|---|---|

| Closure Charges | No charge will be applicable for account closure |

18% GST

| Charge Type | Details |

|---|---|

| GST Charges | Applicable on Brokerage, DP charges, Exchange Transaction charges, SEBI charges, and Auto Square-Off charges |

Physical Delivery of Derivatives

| Charge Type | Details |

|---|---|

| Derivatives Charges | Nominal brokerage of 0.05% of the contract value will be charged when physical delivery happens. |

Transaction/Turnover Charges

| Charge Type | Details |

|---|---|

| Turnover Charges | BSE transaction charges on securities traded in X, XT and Z group is 0.10% per crore & for ‘P’, ‘ZP’, ‘SS’, and ‘ST’ group, it is 1% per crore on the gross turnover value |

Other Charges

| Charge Type | Details |

|---|---|

| Other Charges | – RMS square-off charges for open intraday positions by the system: ₹60 per position |

| – Auction if unable to deliver a stock (not in demat): As per the actual penalty by the exchange |

mStock Brokerage Charges

| Type | Charges | m.Stock | Full Service Broker | Discount Broker |

|---|---|---|---|---|

| Brokerage | Delivery | ₹0 | Upto 0.55% | ₹0 – ₹20 |

| Intraday | ₹0 | Upto 0.19% | ₹10 – ₹20 | |

| Futures | ₹0 | Upto 0.05% | ₹10 – ₹20 | |

| ETF | ₹0 | Upto 0.55% | ₹0 – ₹20 | |

| MTF (eMargin) | ₹0 | Upto 0.55% | ₹0 – ₹20 | |

| Options | ₹0 – ₹100 | Upto ₹25 | ₹0 – ₹20 | |

| Currency | ₹0 | ₹0 | ₹20 | |

| Other Charges | DP Charges During Sell Transactions | ₹12 | ₹6 | ₹24 |

| Payment Gateway Charges | Upto ₹11 | ₹16 | ₹9 | |

| Call & Trade | ₹0 | 18% | 20% | |

| MTF Interest Rate | Upto 9.49% | N/A | N/A |

mStock Trading Taxes/Charges

Trading Charges

| Segment | Equity Delivery | Equity Intraday | Futures | Options |

|---|---|---|---|---|

| Brokerage | Zero | Zero | Zero | Zero |

| Call & Trade Charges | Zero | Zero | Zero | Zero |

| STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | 0.0125% on sell side | • 0.125% of the intrinsic value on options that are bought and exercised<br>• 0.0625% on sell side (on premium) |

| Transaction Charges | NSE: 0.00325%<br> BSE: 0.00375% | NSE: 0.00325%<br> BSE: 0.00375% | NSE: 0.0019% | NSE: 0.050% (on premium) |

| GST | 18% on (brokerage + transaction charges + SEBI charges) | 18% on (brokerage + transaction charges + SEBI charges) | 18% on (brokerage + transaction charges + SEBI charges) | 18% on (brokerage + transaction charges + SEBI charges) |

| SEBI Charges | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

| Stamp Charges | 0.015% or ₹1500 / crore on buy side | 0.003% or ₹300 / crore on buy side | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

What’s that:

- Brokerage: mStock offers zero brokerage for Equity Delivery, Equity Intraday, Futures, and Options trading, making it an attractive option for cost-conscious traders.

- Call & Trade Charges: mStock doesn’t impose any Call & Trade charges, ensuring that traders have access to phone-based trading without additional costs.

- STT/CTT (Securities Transaction Tax/Commodity Transaction Tax): These taxes are levied as a percentage of the trade value, with different rates for buy and sell transactions in various segments.

- Transaction Charges: Transaction charges are levied by the stock exchanges (NSE and BSE) and are a small percentage of the traded value.

- GST (Goods and Services Tax): GST is applicable on the brokerage, transaction charges, and SEBI charges, with a standard rate of 18%.

- SEBI Charges: The Securities and Exchange Board of India (SEBI) charges a nominal fee per crore of turnover.

- Stamp Charges: Stamp charges are applicable on the buy side of transactions and are calculated as a percentage of the traded value or a fixed amount, whichever is lower.

Understanding these charges ensures that traders can make informed decisions and effectively manage their trading costs on mStock.

Always refer to mStock’s official website for the most up-to-date information on taxes and charges.

mStock Demat Account Charges | mStock AMC Charges

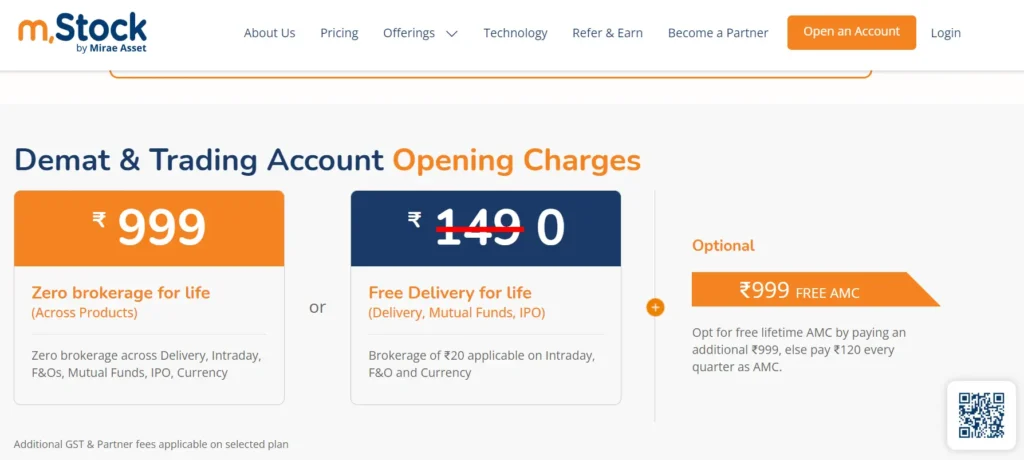

mStock offers a lifetime free demat account for investors who pay a one-time fee of ₹999. This is a very competitive offer, as most stockbrokers charge an annual AMC for demat accounts.

Investors who choose not to pay the one-time fee will be charged a quarterly AMC of ₹120 for their demat account.

mStock Margin Exposure

MTF (eMargin) Charges:

| Charge Type | MTF (eMargin) |

|---|---|

| Interest Rate | 6.99% – 9.49% |

| Brokerage | Zero |

| Subscription Fee | Zero |

| Margin Pledge | ₹25^^ |

| GST | 18% on (brokerage + transaction charges) |

MTF (eMargin) on m.Stock offers a competitive interest rate range of 6.99% to 9.49%. It comes with zero brokerage charges and no subscription fees.

To utilize the margin facility, a margin pledge of ₹25^^ is required.

Additionally, GST at 18% is applicable on brokerage and transaction charges for MTF transactions.

This clear and concise format provides an overview of the charges and terms associated with MTF (eMargin) on m.Stock.

mStock Demat Account Key Features

Zero Brokerage

Enjoy the benefit of zero brokerage for life with m.Stock’s Demat account. Calculate your potential brokerage savings using mstock brokerage calculator.

Best-in-Class Technology

Access cutting-edge technological mStocks’s features, including advanced fundamental and technical charts, live news, market updates, pre-designed index baskets, and flexible watchlists.

Free Access to Margin Trading Facility

Utilize m.Stock’s Margin Trading Facility (eMargin) to access up to 80% funding in more than 700 stocks at the industry’s lowest rate of 6.99%.

Global Investment Powerhouse

Tap into the expertise of a global investment powerhouse, Mirae Asset, with 25 years of global experience and over 16 years of experience in the Indian market.

Quick, Paperless Onboarding

Experience a hassle-free onboarding process with 100% paperless and efficient backend procedures. You can open your m.Stock Demat account in less than 5 minutes, and with Digilocker, document verification becomes even more streamlined.

Fast and Intuitive Platform

Benefit from a fast and intuitive trading platform that has successfully executed more than 15 crore+ trades. mStock stable and superfast trading app and web platform ensure a seamless trading experience.

Choose m.Stock for your Demat account and access a wide range of benefits and cutting-edge features to enhance your trading and investment journey.

mStock Demat Account Opening Process

Follow these steps to Opening a m.Stock Demat & Trading Account:

- Mobile Number Entry: Begin by entering your mobile number and complete the online KYC (Know Your Customer) process.

- Personal Information Verification: Verify your personal information, including address proof, identity proof, PAN number, and date of birth.

- Payment Selection: Choose a suitable payment option for your trading account and make the payment securely online.

- Bank Account Addition: Add your bank account details to complete your profile.

- eSign the Form: Electronically sign the Demat account opening form.

- Verification and Activation: Once your details are successfully verified, your Demat account will be operational within 24 hours. You’ll receive your login credentials via email.

Who behind mStock?

Mirae Asset is a global financial services company headquartered in Seoul, South Korea. It was founded in 1997 and has since grown to become one of the largest asset managers in Asia.

Mirae Asset has a presence in over 14 countries, including India, the United States, and the United Kingdom.

Mirae Asset offers a wide range of financial services, including asset management, investment banking, wealth management, and life insurance. It is also a leading provider of exchange-traded funds (ETFs).

In India, Mirae Asset is one of the largest mutual fund companies. It offers a wide range of mutual fund schemes, including equity funds, debt funds, and hybrid funds. Mirae Asset is also a leading stockbroker in India.

It offers a variety of trading platforms and brokerage plans to suit the needs of different traders and investors.

Mirae Asset is a well-respected financial services company with a strong track record. It is known for its innovative products and services, its strong customer focus, and its commitment to ethical business practices.

Conclusion: mStock Review 2025

mStock is a new-age stockbroker from Mirae Asset that offers zero brokerage on all trades, including equity, F&O, currency, ETFs, and mutual funds. It also offers a lifetime free demat account for investors who pay a one-time fee of ₹999.

mStock Pros and Cons

Pros

Cons

While m.Stock offers several advantages, there are areas where it can further improve its services, such as research and commodity investment options, to cater to a broader range of investor needs.

FAQs

Is Mstock registered with SEBI?

Yes, Mstock is registered with SEBI. Its SEBI registration number is INZ000163138.

Who is owner of Mstock?

Mstock is a subsidiary of Mirae Asset Securities, one of the largest financial services companies in South Korea.

Is Mstock really free?

Mstock offers zero brokerage on all trades and a lifetime free demat account for investors who pay a one-time fee of ₹999. However, there are some other charges associated with trading, such as GST and transaction charges.