DWAC Stock Price Prediction 2025, 2030, 2040, 2050

DWAC Stock Price Predictions for 2025, 2030, 2040, 2050: Digital World Acquisition Corp. (DWAC) is a special-purpose acquisition company (SPAC) established in 2021.

In October of the same year, the company unveiled plans for a proposed merger agreement with Trump Media & Technology Group (TMTG), the entity behind Truth Social. Fast forward to March 2024, DWAC has greenlit a merger deal with TMTG.

On September 3, 2021, DWAC commenced trading on the Nasdaq, following the sale of 25 million shares in its IPO.

On October 20, 2021, DWAC and Trump Media & Technology Group (TMTG) announced a definitive merger agreement, paving the way for TMTG to become a publicly traded company. DWAC’s formation involved ARC Capital, a Shanghai-based firm specializing in listing Chinese companies on American stock markets.

ARC Capital had been under scrutiny by the U.S. Securities and Exchange Commission (SEC) for alleged misrepresentation of shell corporations. Some investors expressed surprise upon discovering that their funds were supporting a Trump-affiliated venture.

In 2021, the DWAC-Trump collaboration was associated with China Yunhong Holdings, based in Wuhan, Hubei, until the lead banker overseeing the merger pledged to sever ties with China in December 2021.

This move involved Yunhong’s dissolution and liquidation. In February 2022, Reuters revealed that the connection between Shanghai-based ARC Capital and Digital World was more extensive than initially understood, with ARC allegedly providing financial support to launch the SPAC.

In August 2022, DWAC obtained shareholder approval for four three-month extensions to finalize the deal, postponing shareholder meetings until September 8, 2023. The company must close the deal by that date or obtain 65% shareholder approval for another extension, or else face liquidation. Shareholders granted a one-year extension on September 5.

In March 2023, Digital World Acquisition ousted its CEO, Patrick Orlando.

DWAC disclosed in an October 2023 regulatory filing that, following the cancellation of $467 million in investor commitments, it would refund the remaining $533 million of the $1 billion raised.

On March 22, 2024, DWAC shareholders sanctioned a merger deal with TMTG. Following the vote, the share price concluded the day at $36.94, starting from an opening value of $43.92 and reaching a peak of $46.70 just before the vote.

Company Profile

| Company Name | Digital World Acquisition Corp. (DWAC) |

| Traded as | Nasdaq: DWAC |

| Industry | Special-purpose acquisition company (SPAC) |

| Founded | December 11, 2020 |

| Website | www.dwacspac.com |

Digital World Acquisition Corp. Fundamental Analysis

| Market Cap | $1.86B |

| Revenue (ttm) | Not available |

| Net Income (ttm) | -$15.22M |

| Shares Out | 37.18M |

| EPS (ttm) | -$0.41 |

| PE Ratio | Not available |

| Forward PE | Not available |

| Dividend | Not available |

| Ex-Dividend Date | Not available |

| Volume | 20,926,588 |

| Open | $40.60 |

| Previous Close | $36.94 |

| Day’s Range | $38.55 – $52.80 |

| 52-Week Range | $12.40 – $58.72 |

| Beta | 6.33 |

| Analysts | Not available |

| Price Target | Not available |

| Earnings Date | Not available |

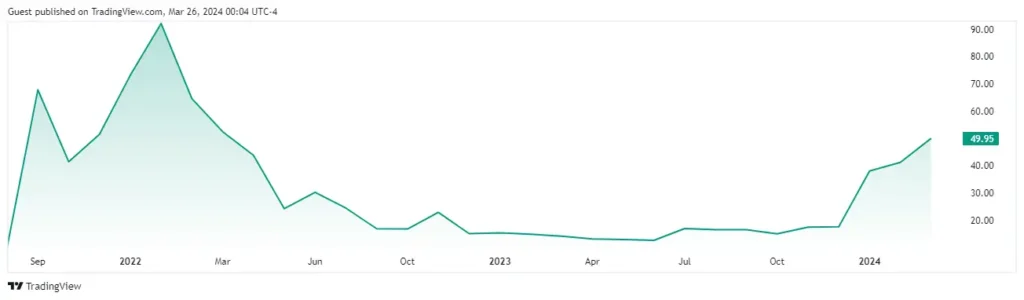

Digital World Acquisition Corp. Stock Price Growth Chart

DWAC Stock Price Prediction 2025, 2026, 2030

Utilizing the average yearly growth rate observed in the past decade, the forecast for Digital World Acquisition Corp. (DWAC) stock at the onset of the upcoming year stands at $177.75.

Employing this methodology, the projected DWAC stock values for subsequent years until 2030 are outlined as follows:

| Year | Prediction |

|---|---|

| 2025 | $79.80 |

| 2026 | $177.75 |

| 2030 | $510.96 |

| 2040 | $1500-$2000 |

| 2050 | $5000-$5500 |

DWAC Stock Price Prediction 2025

| Year | DWAC Stock Price Prediction 2025 |

|---|---|

| 2025 | $79.80 |

Also Read: JNJ Stock Price Prediction 2025, 2030, 2040, 2050

DWAC Stock Price Prediction 2026

| Year | DWAC Stock Price Prediction 2026 |

|---|---|

| 2026 | $177.75-192.05 |

The forecast for Digital World Acquisition Corp. stock in 2026 stands at $177.75-192.05, with the assumption that the shares of Digital World Acquisition Corp. will appreciate. This projection indicates a 45.63% rise from the current DWAC stock price.

Also Read: Amazon stock forecast 2025, 2030, 2040, 2050

DWAC Stock Price Prediction 2030

| Year | DWAC Stock Price Prediction 2030 |

|---|---|

| 2030 | $510.96-$602.10 |

By maintaining its current 10-year average growth rate, Digital World Acquisition Corp. stock is anticipated to reach $510.96-$602.10 by 2030. Should this projection for DWAC stock in 2030 come to fruition, it would signify a growth of 522.53% from its present value.

Also Read: Boeing Share Price Prediction 2025 to 2030

DWAC Stock Price Prediction 2040

| Year | DWAC Stock Price Prediction 2040 |

|---|---|

| 2040 | $1500-$2000 |

According to our analysis, Dwac share price expected to stands between $1500-$2000 in 2040.

Also Read: Nvidia Share Price Target 2025 to 2030

DWAC Stock Price Prediction 2050

| Year | DWAC Stock Price Prediction 2050 |

|---|---|

| 2050 | $5000-$5500 |

Also Read: Rivian Stock Price Prediction 2025, 2030, 2040, 2050

Dwac stock price projections for 2050 stands between $5000 to $5500, If the market conditions are met.

DWAC Stock Quick Analysis

DWAC Balance Sheet Analysis

- Cash on Hand: They have a relatively low amount of cash readily available, only $989.

- Debt: They have a significant amount of debt, a whopping $3.50 million.

- Net Cash Position: This negative number, -$3.50 million, shows that their debt outweighs their cash by a large margin. You can also see this reflected in the negative net cash per share of -$0.09.

- Equity/Book Value: This number, $30.99 million, represents the shareholders’ ownership stake in the company.

- Book Value Per Share: This figure, -$0.83 per share, is negative, indicating that the company’s liabilities are higher than its assets. Not a good sign.

- Working Capital: This positive number, $22.30 million, suggests they have enough current assets (like inventory) to cover their current liabilities (like short-term bills). However, this needs to be evaluated in context of their overall debt situation.

DWAC Stock Cash Flow Analysis

- Operating Cash Flow: This negative number, -$1.38 million, means the company’s day-to-day business activities are not generating enough cash to cover their expenses. In simpler terms, they’re spending more money than they’re bringing in.

- Capital Expenditures (n/a): This information is missing from the report, but it would typically show how much money the company is investing in equipment, buildings, or other long-term assets.

- Free Cash Flow: This negative number, -$1.38 million, is derived by subtracting capital expenditures from operating cash flow. It reflects the amount of cash available for things like debt payments, stock buybacks, or dividends after accounting for operational needs and any investments in fixed assets. A negative free cash flow suggests the company isn’t generating enough cash to sustain itself in the long run without additional funding.

- MFCF Per Share: This negative number, -$0.04 per share, indicates the negative free cash flow on a per-share basis.

Digital World Acquisition Market Analysis

- Digital World Acquisition boasts a market cap of $1.86 billion. This hefty market cap indicates a high valuation assigned to the company by investors.

Enterprise Value

- The enterprise value of $1.86 billion aligns with the market cap, which is typical for SPACs (Special Purpose Acquisition Companies). Enterprise value considers all the company’s debt and cash holdings to arrive at a more comprehensive valuation.

Small-Cap Company with Big Potential (or Hype)?

- Digital World Acquisition falls under the small-cap category. Smaller companies can offer higher growth potential, but also carry greater risk.

Stock Price on the Rise

- The current stock price of $49.95 reflects investor optimism about the company’s future.

FAQs

Does Digital World Pay Dividends?

No, Digital World Acquisition Corp. currently doesn’t pay dividends.

What will be the DWAC Stock Price Prediction for 2025?

According to Our Analysis, DWAC Stock Price expected to hit $79.8.

What will be the DWAC Stock Price Prediction for 2026?

According to Our Analysis, DWAC Stock Price expected to hit $177.75-192.05.