Cryptocurrency 2025: Is Crypto Legal in india?

Cryptocurrencies have taken the world by storm in recent years, with Bitcoin and Ethereum leading the way. But what exactly is cryptocurrency? And how does it work?

In this blog post, we’ll take a deep dive into the world of cryptocurrency. We’ll explain what it is, how it works, and why it’s so popular. We’ll also discuss the potential benefits and risks of investing in cryptocurrency.

So whether you’re a complete beginner or a seasoned investor, stay tuned for a comprehensive guide to cryptocurrency!

What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security.

It is a decentralized currency, which means it is not controlled by any government or institution.

Some examples of cryptocurrencies include Bitcoin, Ethereum, and Litecoin.

How does cryptocurrency work?

Transactions with cryptocurrencies are recorded on a public digital ledger called the blockchain.

This ledger is maintained by a network of computers around the world and each new transaction is verified and added to the blockchain by these computers.

This decentralization and use of cryptography makes it difficult for anyone to manipulate the currency or transactions recorded on the blockchain.

To use cryptocurrencies, individuals or businesses must first obtain a digital wallet, which is a software program that stores the user’s public and private keys (cases).

These keys are used to send and receive cryptocurrencies as well as verify transactions on the blockchain.

Users can obtain cryptocurrencies through a process called “mining” which involves using computers’ ability to solve complex mathematical equations to validate and execute transactions on the blockchain in exchange for a fixed amount of cryptocurrencies. Records.

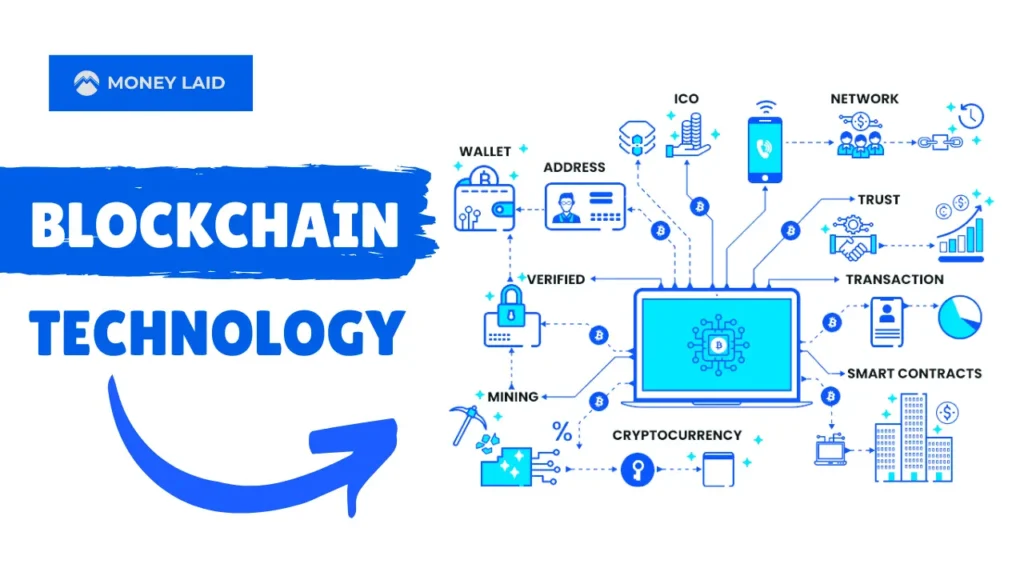

What is blockchain technology?

Blockchain technology is a decentralized, digital ledger that records transactions across a network of computers.

Each block in the chain consists of a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to each participant’s ledger.

The decentralized nature of the technology ensures that no single entity can alter or delete previous transactions, providing a high level of security and transparency.

Blockchain is the foundation of cryptocurrencies like Bitcoin, but it has many potential uses beyond digital currencies.

Some examples of cryptocurrencies

1. Bitcoin (BTC):

It is the first and most famous crypto currency, which was created in the year 2009.

Bitcoin was invented by an unknown person or group of people using the name Satoshi Nakamoto and was released as open-source software in the year 2009. It is considered to be the first decentralized cryptocurrency.

Bitcoin has no single administrator and the currency can be sent electronically by users on the peer-to-peer Bitcoin network without the need for intermediaries.

Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain.

2. Ethereum (ETH):

Ethereum (ETH) is a decentralized, opensource blockchain platform that enables the creation of smart contracts and decentralized applications (dApps).

It uses its own cryptocurrency, Ether, as a means of payment for transaction fees and services on the Ethereum network.

It also has a built-in programming language that enables developers to create and deploy their own decentralized applications on the Ethereum network.

3. Litecoin (LTC):

Litecoin (LTC) is a peer-to-peer cryptocurrency and open-source software project.

It is inspired by and almost identical to Bitcoin (BTC), but takes less time to confirm transactions and with a different hashing algorithm.

It is designed to process small transactions faster and more efficiently than Bitcoin.

4. Ripple (Ripple:XRP):

Ripple (XRP) is a digital asset and cryptocurrency designed to facilitate fast and cheap international money transfers.

It is built on the Ripple protocol, a decentralized open-source protocol to facilitate cross-border payments.

Ripple can be used to transfer any currency including USD, EUR and Bitcoin and can also be traded on digital currency exchanges.

5. Bitcoin Cash (BCH):

Bitcoin Cash (BCH) is a cryptocurrency that was created as a result of a hard fork from Bitcoin in the year 2017.

It has a larger block size limit (8MB) than Bitcoin (1MB), allowing faster and cheaper transactions.

It is considered by some to be a “pure” version of Bitcoin because it more closely adheres to Bitcoin’s original vision as a peer-to-peer electronic cash system.

What is the legal status of cryptocurrencies in India?

The legal status of cryptocurrencies in India is in a process of constant change.

The Reserve Bank of India (RBI) has issued several warnings against the use of cryptocurrencies, saying they pose risks to investors and are not legal tender.

In the year 2018, the Supreme Court struck down a circular of the Reserve Bank of India, which prohibited financial institutions from transacting in digital or cryptocurrencies.

In the year 2023, the Government of India mentioned in the Union Budget 2023-24 that- Transfer of any virtual currency/cryptocurrency assets will be subject to 30% tax deduction.

The government has also set up a panel to explore the potential use of blockchain technology and the possibility of issuing a Central Bank

Digital Currency (CBDC)

Currently El Salvador and the Central African Republic (CAR) are the only two countries in the world where Bitcoin serves as legal tender.

However many countries have taken steps to recognize and regulate the use of certain cryptocurrencies such as Bitcoin.

Some countries, such as Japan and South Korea, have issued regulations for cryptocurrency exchanges.

Countries like Germany and Switzerland have recognized Bitcoin as a “legal means of payment.”

Other countries like China and Russia have taken a more cautious stance and banned the use of cryptocurrencies.

What is India’s Central Bank Digital Currency?

The Central Bank Digital Currency (CBDC) pilot launched by the RBI in the retail segment has components based on blockchain technology.

CBDCs are a digital form of paper currency and unlike cryptocurrencies which operate in a regulatory vacuum, they are legal tenders issued and backed by a central bank.

It is similar to fiat currency and is one-to-one interchangeable with fiat currency.

Digital currency refers to the digital version of the Indian rupee, also known as digital rupee or e-rupee.

Challenges

- Volatility: Cryptocurrency prices are highly volatile making it difficult for businesses to accept it as payment.

- Regulation: There is a lack of clear regulation of cryptocurrencies making it difficult for businesses and individuals to know how to use them legally.

- Security: Cryptocurrency exchanges and wallets are susceptible to hacking attacks, which can result in loss of funds.

- Adoption: Despite its growing popularity, cryptocurrency still has a low adoption rate making it difficult for individuals to use it as a form of payment in everyday life.

- Scalability: The scalability of cryptocurrencies is limited, making it difficult for this technology to handle large numbers of transactions.

- Energy Consumption: The process of verifying transactions in cryptocurrency networks, known as mining , is energy-intensive, and contributes to climate change.

What is the best crypto to invest in?

The best cryptocurrency to invest in depends on your individual investment goals and risk tolerance.

However, some of the most popular and established cryptocurrencies include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Cardano (ADA)

- Solana (SOL)

- Binance Coin (BNB)

- Avalanche (AVAX)

- Polkadot (DOT)

- Tether (USDT)

- USD Coin (USDC)

- Terra (LUNA)

- Polygon (MATIC)

Quotes about Cryptocurrencies by Experts

“Bitcoin is the most important invention in the history of the world since the internet.”

Peter Thiel, co-founder of PayPal

“Bitcoin is a revolutionary breakthrough in monetary technology. It is the first truly peer-to-peer payment system that enables anyone to send and receive payments anywhere in the world without the need for a trusted third party.”

Satoshi Nakamoto, creator of Bitcoin

“Cryptocurrency is the future of money. It is a more efficient, secure, and transparent way to pay for goods and services.”

Mark Cuban, owner of the Dallas Mavericks

“Cryptocurrencies have the potential to revolutionize the global financial system. They can make payments faster and cheaper, and they can give people more control over their own money.”

Christine Lagarde, president of the European Central Bank

“Cryptocurrency is a new asset class with the potential to disrupt the traditional financial system. It is important to understand the risks involved before investing in cryptocurrency, but it is also important to be aware of the potential rewards.”

Warren Buffett, CEO of Berkshire Hathaway

Some people believe that cryptocurrencies are the future of money, while others believe that they are a scam. Only time will tell what the future holds for cryptocurrencies.

However, one thing is for sure: cryptocurrencies are here to stay. They are a new and innovative way to pay for goods and services, and they have the potential to revolutionize the global financial system.

Bottom Line

Clarity on the legal status of cryptocurrencies is vital for their widespread adoption and use. When governments provide a clear framework for cryptocurrencies, it creates a more stable environment for businesses and individuals to invest and use them. It can also encourage innovation and growth in the industry.

The examples of countries like El Salvador and the Central African Republic show that governments can embrace this new technology and create an enabling environment for it to flourish.

RBI has launched a blockchain-based Central Bank Digital Currency (CBDC) pilot programme. The government should keep this in mind as cryptocurrency is also based on blockchain technology.

Launching cryptocurrencies with a strong regulatory framework can ensure its fair use, prevent fraudulent and illegal activities, and enhance consumer protection.

On the other hand, a complete ban of cryptocurrencies could stifle innovation and limit its potential benefits to society.

The classification of cryptocurrencies as commodities or asset classes is still vague and subject to change in many countries, including India.

Currently, software is considered a good and can be taxed under Indian law. Profits and earnings from the sale of cryptocurrencies are considered taxable income, but only after the legalization of cryptocurrencies.

Recommended Articles:

- Top 10 books for stock market beginners in india

- Best Trading Apps in India

- Top 10 Best Mutual Fund Investment Apps in India

- Top 10 Payment Getways in India

FAQs

Is Crypto legal in India?

Cryptocurrencies are not illegal in India, but they are also not regulated. This means that there are no specific laws or regulations governing the use, trading, or mining of cryptocurrencies.

Is cryptocurrency a safe?

Cryptocurrency is a relatively new asset class, and its safety is still a matter of debate. Some people believe that cryptocurrency is a very safe investment, while others believe that it is very risky.

Can I buy crypto for 100 rupees?

Yes, you can buy crypto for 100 rupees. Most cryptocurrency exchanges in India allow you to buy crypto for as little as 1 rupee. However, there may be a minimum transaction fee, so it is important to check the exchange’s fees before you trade.