Today, we’ll be providing Fyers Review for the year 2025. Fyers is a new-age stockbroker that has quickly become one of the most popular choices for traders and investors alike.

With its innovative trading platforms, competitive pricing, and wide range of features, Fyers is the perfect choice for anyone who wants to get the most out of their trading experience.

In this blog post, we’ll take a comprehensive look at Fyers, including its brokerage charges, features, and customer service. We’ll also share our thoughts on whether or not Fyers is the right stockbroker for you.

So, if you’re looking for a stockbroker that will help you take your trading to the next level, be sure to read this Fyers review.

What is Fyers?

Fyers is a discount stockbroker in India that offers trading and investment services in the stock market. It is a member of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Fyers is known for its low brokerage charges, advanced trading features, and reliable customer service.

Fyers offers a variety of trading platforms, including a web platform, mobile app, and desktop platform. All of Fyers’ trading platforms are user-friendly and offer a wide range of features, such as advanced charting tools, technical indicators, and real-time market data.

Fyers Key Features

Fyers Markets is a mobile app for both Android and Apple smartphones, and it’s packed with many useful features:

- It’s a single app that covers all trading segments at NSE and MCX.

- You can use advanced charts with over 65 technical indicators and access historical data for over 20 years for end-of-day and over 9 months for intraday charts.

- There’s a data analytics tool to provide you with important market insights.

- You can use the stock screener to find trading opportunities in various sectors and indices.

- The app allows you to simulate 43 different options trading strategies.

- You can create and manage multiple watchlists.

- There’s also an options calculator for your convenience.

- You can quickly transfer funds through the app.

- And the best part, equity delivery trades are free, while all other segments have a flat fee of Rs 20 per trade.

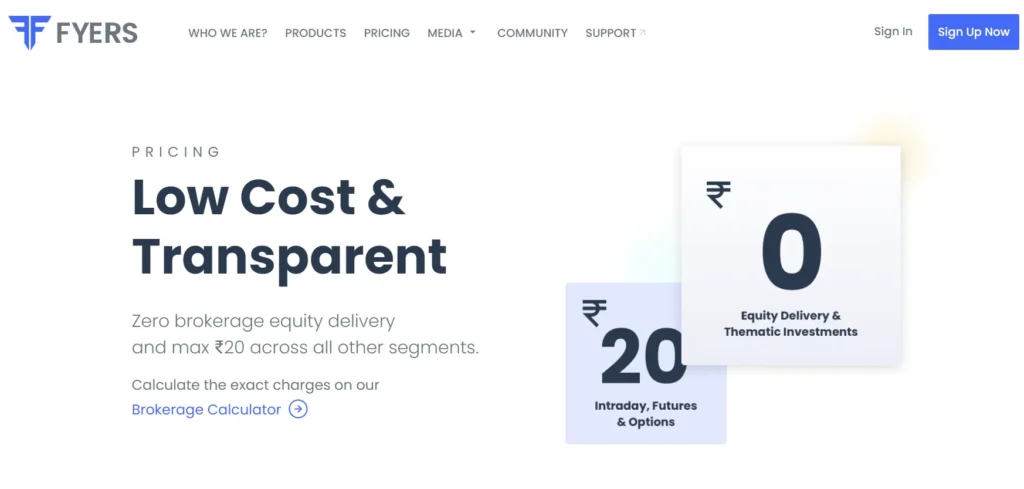

Fyers Charges

When you want to open an account with Fyers for stock trading, you’ll need to pay some fees. This includes charges to open the account and annual maintenance fees (AMC).

Additionally, while trading with Fyers, customers are responsible for covering fees, commissions, and taxes.

Also Read: Angel One App Review: Is Angel One Safe?

Fyers Brokerage Charges

| Segment | Brokerage Fee |

|---|---|

| Equity Delivery | Free (No Brokerage Fee) |

| Equity Intraday | Rs 20 per executed order or 0.03% (whichever is lower) |

| Equity Futures | Rs 20 per executed order or 0.03% (whichever is lower) |

| Equity Options | Rs 20 per executed order |

| Currency Futures | Rs 20 per executed order or 0.03% (whichever is lower) |

| Currency Options | Rs 20 per executed order |

| Commodity Futures | Rs 20 per executed order or 0.03% (whichever is lower) |

| Commodity Options | Rs 20 per executed order |

Fyers Trading Taxes/Charges

| Tax | Rates |

|---|---|

| Securities Transaction Tax (STT) | |

| Equity Delivery | 0.1% on both Buy and Sell |

| Equity Intraday | 0.025% on the Sell Side |

| Equity Futures | 0.01% on the Sell Side |

| Equity Options | 0.05% on the Sell Side (on Premium) |

| Commodity Futures | 0.01% on the Sell Side (Non-Agri) |

| Commodity Options | 0.05% on the Sell Side |

| Currency F&O | No STT |

| On Exercise transaction | 0.125% |

| Right to entitlement | 0.05% on the Sell Side |

| Exchange Transaction Charges | Refer to the table above |

| GST (Goods and Services Tax) | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| SEBI Charges | 0.0001% (₹10/Crore) of the turnover (except for Agri futures where it is Rs 1 per crore) |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.003%, Equity Futures: 0.002%, Equity Options: 0.003%, and Currency F&O: 0.0001%. Commodity Futures: 0.002%, Commodity Options: 0.003% (MCX) |

Fyers AMC Charges | Fyers Account Opening Charges

| Transaction | Fee |

|---|---|

| Trading Account Opening Charges (One Time) | Rs 0 (Free) |

| Trading Annual Maintenance Charges (AMC) (Yearly Fee) | Rs 0 (Free) |

| Demat Account Opening Charges (One Time) | Rs 0 (Free) |

| Demat Account Annual Maintenance Charges (AMC) (Yearly Fee) | Rs 0 (Free) |

Fyers Transaction Charges

| Segment | Transaction Fee |

|---|---|

| Equity Delivery | Rs 325 per Cr (0.00325%) |

| Equity Intraday | Rs 325 per Cr (0.00325%) |

| Equity Futures | Rs 240 per Cr (0.0024%) |

| Equity Options | Rs 5900 per Cr (on premium) (0.059%) |

| Currency Futures | Rs 240 per Cr (0.0024%) |

| Currency Options | Rs 5900 per Cr (on premium) (0.059%) |

| Commodity | NA |

Fyers Demat Account Charges

When you’re considering opening a Demat account with Fyers for your stock and investment needs, it’s important to understand the associated charges.

| Transaction | Charges |

|---|---|

| Demat Account Opening Charges | Rs 0 (Free) |

| Transaction Charges (Buy) | Varies |

| Transaction Charges (Sell) | ₹7 + ₹5.50 flat for every debit transaction |

| Annual Maintenance Charges (AMC) | ₹300 Per Year |

| Demat + Courier Charges | ₹0 |

| Remat | ₹0 |

| Pledge Creation | ₹0 |

| Pledge Creation Confirmation | ₹0 |

| Pledge Invocation | ₹0 |

| Failed Transactions | ₹0 |

| Other Charges | Adhoc / Non Periodic Statement Requests: ₹0 + courier charges at actuals, Conversion of MF Units / Destatementisation: ₹100 per certificate, Modification in Client Master List (CML): ₹50, Modification in KRA: ₹50, Stamp Charges: ₹50 |

Also Read: Upstox App Review: Is Upstox SEBI Registered?

Fyers Demat Account Opening Process

To open an account with Fyers, you have a couple of options:

By Online:

- Request Application Form: You can ask for an application form from Fyers.

- Visit Fyers Website: Go to the Fyers website and click on the “Open an Account” button.

- Provide Your Information: Enter your name, email address, and phone number.

- Talk to Fyers Team: Fyers’ sales team will get in touch with you to guide you through the process.

By Offline:

- Visit Fyers Bangalore Office: If you’re in Bangalore, you can go to the Fyers office and fill out the application form there.

These simple steps make it easy to get started with Fyers and open an account.

Fyers Demat Account Documents Required

- PAN Card

- For Address Proof: Passport / Voter ID / Ration Card / Driving License / Lease Agreement / Driving License

- Cancelled cheque self-named.

- Income Proof (for F&O trading only): Last 6 Months of Bank Statement

Also Read: Zerodha Kite Review: Is Zerodha Kite Free?

Is Fyers App Safe?

Yes, the Fyers app is safe. Fyers is a regulated stockbroker in India, and its app is subject to the same security and compliance requirements as its other trading platforms.

Fyers uses a variety of security measures to protect its users’ data and funds, including:

- Two-factor authentication

- Data encryption

- Regular security audits

Fyers is also a member of the Investor Protection Fund, which provides insurance to investors in case of a brokerage failure.

Overall, the Fyers app is a safe and reliable platform for trading and investing in the Indian stock market.

Fyers Customer Care Number

- Email ID: support@fyers.in

- Address: Brigade Magnum, 9th Floor, Wing A, International Airport Road, Kodigehalli Gate, Hebbal, Byatarayanapura, Amruthahalli, Bengaluru – 560092.

- Contact No: 080-60001111

- Working Hours (Mon-Fri): 08:30 AM to 05:30 PM

Also Read: Zerodha Coin Review: Is Zerodha Coin good for Mutual Funds?

FAQs

Is Fyers brokerage free?

Fyers offers free equity delivery trading. You do not have to pay any brokerage charges when you buy or sell stocks for delivery. But, Fyers does charge brokerage for intraday and F&O trading.

Is Fyers good for trading?

Yes, Fyers is a good stockbroker for trading. It offers a variety of features and benefits that make it a good choice for traders of all experience levels.

Is Fyers SEBI approved?

Yes, Fyers is SEBI approved. Fyers is a registered stockbroker with SEBI and a member of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

What is Fyers used for?

Fyers is a stockbroker that offers a variety of trading and investment services in the Indian stock market. It is used by traders and investors of all experience levels to buy and sell stocks, currency, and mutual funds.

Also Read: IND Money Review: Is IND money safe?

Conclusion: Fyers Review

In conclusion, Fyers is a stock trading platform in India known for its cost-effective and transparent approach to trading.

It offers several advantages, such as free online account opening, no brokerage charges for equity delivery trading, and a flat Rs 20 per trade brokerage fee across various trading segments.

Fyers also provides access to in-house trading platforms, offers thematic investments, and allows demat accounts without the need for a Power of Attorney (POA).

Fyers Pros and Cons

Fyers Pros | Fyers Advantages

- Free online account opening.

- No brokerage charges for equity delivery trading (cash & carry trades).

- Low flat brokerage fee of Rs 20 per trade across all trading segments, regardless of the trade size.

- Transparent fees and charges with no hidden costs.

- Free access to in-house trading platforms with the flexibility to add new features.

- All trading software is available for free.

- Single margin account simplifies your trading experience.

- Opportunity to earn 20% of the revenues generated by referred friends, for life.

- Unique thematic investment option allows investing in groups of stocks based on specific criteria.

- Demat account without the need for a Power of Attorney (POA).

Fyers Cons | Fyers Disadvantages

- Exchange transaction charges are higher compared to other discount brokers.

Also Read: