Google Pay Loan review 2025: Know how to get loan from Google Pay

Are you looking for a quick and easy way to get a loan? Google Pay Loan may be the answer you’re looking for. In ‘Google Pay Loan review’ blog post, we’ll take a comprehensive look at Google Pay Loan, including how it works, its eligibility criteria, and how to apply.

Now many questions will be raise in your mind about Google pay loan regarding, like: Interest rate, How to get Loan from Googple pay?, Eligibility Criteria, Required Documents and the most popular question is that ” how much loan we will get from Google Pay?”

Don’t worry we will complete information provide in this article, so read ” Google Pay loan Review” article complete to know about Google Pay Loan.

What is Google Pay Loan?

Google Pay Loan is a personal loan product offered by Google Pay in partnership with select financial institutions. It allows eligible Google Pay users to borrow money quickly and easily, without having to visit a bank or fill out lengthy paperwork.

Things to know before taking Google Pay Loan

- Google Pay acts as a middleman between you and lending partners.

- Google Pay itself does not provide loans or review your loan application.

- The option to get a loan and the section in the Google Pay app where you can find loans are only for eligible users.

- You can request a personal loan from participating lenders through the Google Pay app if you meet the eligibility criteria.

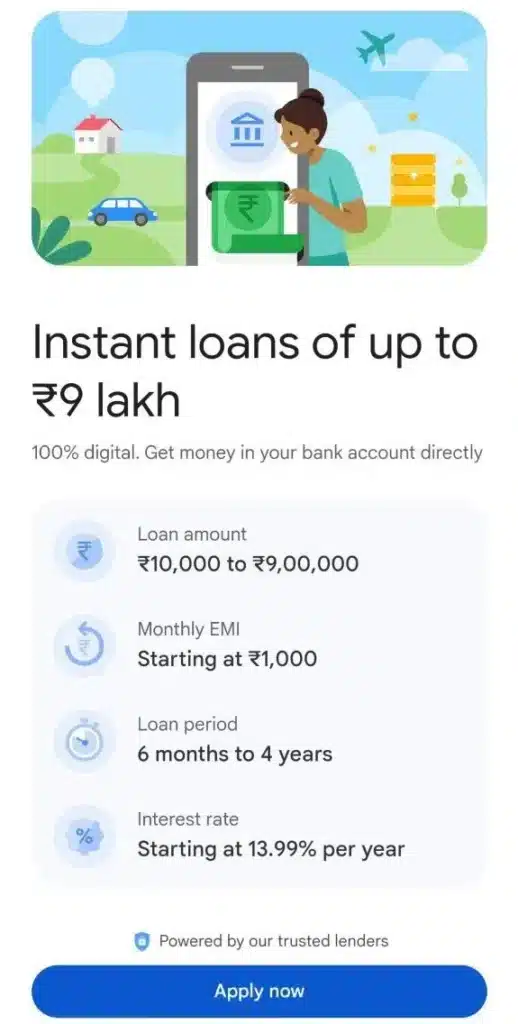

Google Pay Loan Interest Rate

As above you must knows that Google Pay directly doesn’t provide any loans, so Interest rates for these loans will be depend on the Lenders.

Google Pay Loan Key Features/Benefits

Google Pay Loan has several key features and benefits, including:

- Convenience: You can apply for and receive a Google Pay Loan entirely within the Google Pay app, without having to visit a bank or fill out lengthy paperwork.

- Speed: Google Pay Loans are typically processed and approved within minutes.

- Flexibility: You can choose the loan amount and repayment tenure that best suits your needs.

- Affordability: Google Pay Loans are offered at competitive interest rates.

- No collateral required: Google Pay Loans are unsecured loans, which means you do not need to put up any collateral to secure the loan.

- Easy EMI payments: Google Pay Loans offer easy EMI payments, which can be deducted from your bank account automatically.

- Trusted partnerships: Google Pay Loans are offered by trusted financial institutions in India.

- No hidden charges: Google Pay Loans do not have any hidden charges. You will only pay the interest on the loan amount, and no other fees.

- Transparency: Google Pay Loans are transparent, and you will be able to see all the terms and conditions of the loan before you apply.

- Customer support: Google Pay provides excellent customer support for Google Pay Loans. You can contact Google Pay customer support if you have any questions or problems with your loan.

Overall, Google Pay Loan is a convenient, fast, affordable, and transparent way to get a loan. If you are eligible and need money quickly, a Google Pay Loan may be a good option for you.

Google Pay Loan Eligibility Criteria

The Google Pay Loan eligibility criteria vary depending on the lending partner. However, there are some general eligibility criteria that most lenders consider:

- Age: You must be at least 18 years old.

- Citizenship: You must be a resident of India.

- Employment type: You may be required to be employed full-time or to have a regular business income.

- Minimum credit score: You may be required to have a minimum credit score of 650 or 700.

- Google Pay account: You must have a valid Google Pay account.

How can i check my eligibility for google pay loan?

To check your eligibility for a Google Pay Loan, you can simply open the Google Pay app and tap on the “Loan” tab. You will be able to see a list of all the loan offers that are available to you, and you can check the eligibility criteria for each loan offer.

If you are not sure whether you are eligible for a Google Pay Loan, you can contact Google Pay customer support for assistance.

Google Pay Loan apply online process

According to google pay, there are three ways to apply for google pay loans. here’s that:

- Pre-approved loans from Federal Bank

- Pre-qualified loans with DMI Finance

- Avail pre-qualified loans with IDFC

Apply Process For Pre-approved loans from Federal Bank

- Open the Google Pay app.

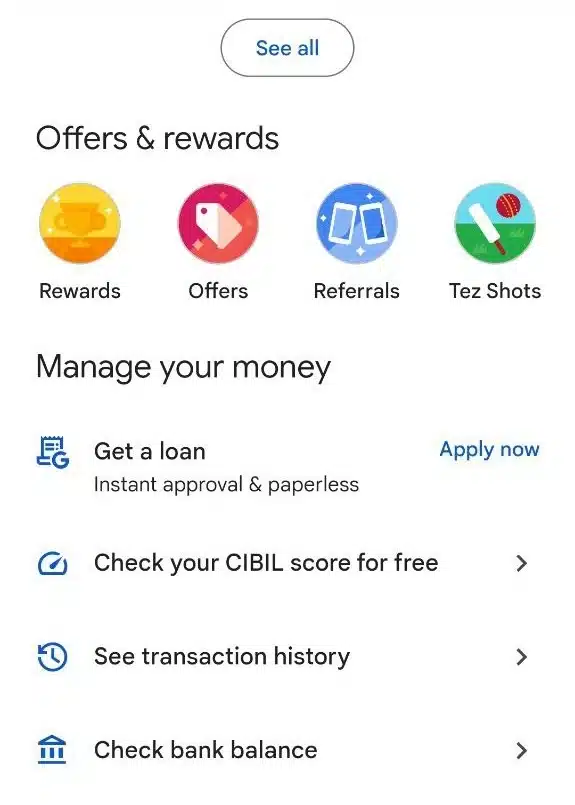

- In the “Money” section, tap on “Loans,” or you can click on a loan offer notification in the app.

- In the “Offers” tab, you’ll see loan offers that you qualify for.

- Choose the loan offer you want.

- Pick how much money you want and how long you want to pay it back. You’ll also see the monthly payment amount and the fees your bank will charge.

- Remember, your bank will take out fees and taxes before they give you the loan. You can ask your bank for more info.

- To double-check the details, tap on “Review.“

- Click “Continue.”

- Read the rules and conditions from the lender.

- Tap “Accept and apply.” You’ll get a one-time password (OTP) through SMS.

- Enter the OTP.

- Tap “Submit.“

- Wait for a message that says your loan is approved, then click “Got it.” You can see more about your loan in the “Your Loans” section.

Some extra tips:

- Your bank will take out fees, taxes, and sometimes a first partial monthly interest (called “Pre-EMI interest“) before giving you the loan. You can ask your bank for more info on this.

Applying Process For Pre-qualified loans with DMI Finance

- Open the Google Pay app.

- In the “Money” section, click on “Loans” Look in the “Offers” section to find loan offers that you’ve been pre-qualified for. Alternatively, you can tap on a Google Pay loan offer notification.

- Choose the pre-qualified loan offer you want. You’ll need to provide some personal details, like your job information.

- Click “Continue” You’ll receive a one-time password (OTP) via SMS.

- Enter the OTP.

- Click “Submit.“

To check the status of your loan application:

- Go to the “Loans” section. You’ll see one of these statuses:

- “In progress“: The lender is still looking at your loan application.

- “Pre-approved“: Your application is approved.

- “Not eligible“: Your loan application was rejected.

- Select the pre-approved loan.

- Choose the loan amount and how long you want to repay it.

- Click “Review details.“

- Fill out the needed KYC information and your bank details, including your repayment plan. This information will usually be updated on the partner bank’s website.

- Read the terms and conditions from the bank.

- Click “Accept and apply.” You’ll receive an OTP via SMS.

- Enter the OTP.

- Click “Submit.”

For more information about your loan’s status, get in touch with the lender.

Applying Process For Avail pre-qualified loans with IDFC

follow these steps to get a pre-qualified loan through the Google Pay app:

- Open the Google Pay app.

- In the “Money” section, click on “Loans.“

- In the “Offers” section, you’ll see loan offers you qualify for.

- If you want to get notifications about offers, you can tap on the Google Pay loan offer notification.

- Choose the pre-qualified loan offer you want. You’ll need to provide some personal details like your job information.

- Click “Continue.” You’ll receive a one-time password (OTP) through SMS.

- Enter the OTP and click “Submit.“

To check the status of your loan application:

- Go to the “Loans” section. You’ll see one of these statuses:

- “In progress“: The lender is still looking at your loan application.

- “Pre-approved“: Your application is approved.

- “Not eligible“: Your loan application was rejected.

- If your application is pre-approved, select that loan.

- Choose how much money you want and for how long you’ll pay it back.

- Click “Review details.“

- Fill out the required KYC (Know Your Customer) information and your bank details, including your repayment plan. This information is usually updated on the partner bank’s website.

- Read the terms and conditions from the bank.

- Click “Accept and apply” You’ll get an OTP through SMS.

- Enter the OTP and click “Submit.”

For more information about your loan status, get in touch with the lender.

Google Pay Personal Loan EMI Calculator

To calculate your EMIs or understand your total payable interest, Use our Personal Loan EMI Calculator.

Also Read: Dhani Personal Loan Review 2025: Is Dhani Loan Safe?

Conclusion: Google Pay Loan Review

Google Pay Loan is a convenient, fast, and affordable way to get a personal loan. It is a good option for people who need money quickly and do not have the time or resources to visit a bank or fill out lengthy paperwork.

key features and benefits of Google Pay Loan:

- Convenience: Apply for and receive a loan entirely within the Google Pay app.

- Speed: Loans are typically processed and approved within minutes.

- Flexibility: Choose the loan amount and repayment tenure that best suits your needs.

- Affordability: Competitive interest rates.

- No collateral required: Unsecured loans.

- Easy EMI payments: Automatic EMI payments from your bank account.

- Trusted partnerships: Loans are offered by trusted financial institutions in India.

Things to keep in mind when considering a Google Pay Loan:

- Eligibility: Not everyone is eligible for a Google Pay Loan. You must meet the eligibility criteria of the lending partner.

- Interest rates: Interest rates vary depending on the lender and your creditworthiness.

- Repayment terms: Repayment terms vary depending on the lender.

- Fees: Some lenders may charge additional fees, such as a processing fee or a late payment fee.

Overall, Google Pay Loan is a good option for people who need money quickly and do not have the time or resources to visit a bank or fill out lengthy paperwork.

However, it is important to compare loan offers from different lenders before applying to ensure that you are getting the best possible deal.

Also Read: Cashe Personal Loan Review 2025: Is Cashe Loan Safe?

FAQs

Can we get loan from Google Pay?

Yes, you can get a loan from Google Pay. Google Pay has partnered with select financial institutions to offer personal loans to eligible users.

What is the interest of Google Pay loan?

The interest rate on Google Pay loans varies depending on the lender and your creditworthiness.

How to get 2000 rs loan instantly?

There are a few ways to get a 2000 rs loan instantly.

One way is to apply for a Google Pay Loan. If your application is approved, you will receive the loan amount in your Google Pay account within a few minutes.

Another way to get a 2000 rs loan instantly is to apply for a loan from a microfinance institution. Microfinance institutions typically offer small loans with short repayment terms.

What is DMI in Google Pay?

DMI stands for Digital Mandate Initiation. It is a feature that allows you to authorize a financial institution to debit your bank account for a specific amount on a specific date. DMI is used to automate EMI payments for Google Pay Loans.

Is Google Pay instant loan safe?

Yes, Google Pay instant loans are safe. Google Pay partners with trusted financial institutions to offer loans to its users. Additionally, all Google Pay loan transactions are protected by Google’s security features.

Is Google Pay a good company?

Yes, Google Pay is a good company. It is a trusted payment platform that is used by millions of people around the world. Google Pay offers a variety of features, including the ability to send and receive money, pay bills, and shop online.

I got the loan by following your guides. Thanks alot.

I need a Loan in Google pay

Please Check Your Eligibility in G-Pay and Follow our step-by-step process.

Need loan

So, Please apply through your google pay account.