In this blog post, we will share our analysis on Persistent Share Price Target for 2024, 2025 to 2030 based on market trends, historical performances, balance sheet analysis, profit & loss report analysis . To know how the stock will perform and how hight it’s share price expected to go in the upcoming years based on our analysis, read this complete analysis.

What is Persistent Systems Ltd.?

Persistent Systems Limited, established in 1990, is an Indian holding company specializing in software products and technology services. The company operates across segments such as Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, as well as Technology Companies and Emerging Verticals.

Its diverse range of services encompasses digital strategy and design, software product engineering, client experiences (CX) transformation, cloud & infrastructure solutions, intelligent automation, enterprise IT security, enterprise integration, application development and management, and data and analytics.

Persistent Systems caters to various industries including banking and financial services, insurance, healthcare life sciences, software and hi-tech, as well as telecom and media. Under its cloud and infrastructure offerings, the company provides services such as Hybrid & Multi-Cloud Transformation, Data Center Modernization, Persistent Intelligent IT Operations (PiOps), and Cloud Advisory Services.

Company Profile

| Company Type | Public |

| Traded As | BSE: 533179, NSE: PERSISTENT |

| Industry | Information Technology |

| Founded | 1990 in Pune |

| Founder | Anand Deshpande |

| Headquarters | Pune, Maharashtra, India |

| Key People | Dr. Anand Deshpande (Founder, Chairman and Managing Director) Sandeep Kalra (CEO and Executive Director) Sunil Sapre (Chief Financial Officer and Executive Director) |

| Revenue | ₹8,350 crore (US$1.0 billion) (FY23) |

| Net Income | ₹921 crore (US$120 million) (FY23) |

| Number of Employees | 23,000+ |

| Website | persistent.com |

Persistent Systems Ltd. Fundamental Analysis

| MARKET CAP | ₹ 61,338.86 Cr. |

| ENTERPRISE VALUE | ₹ 60,798.25 Cr. |

| NO. OF SHARES | 15.41 Cr. |

| P/E | 57.86 |

| P/B | 12.82 |

| FACE VALUE | ₹ 5 |

| DIV. YIELD | 0.63 % |

| BOOK VALUE (TTM) | ₹ 310.51 |

| CASH | ₹ 540.98 Cr. |

| DEBT | ₹ 0.38 Cr. |

| PROMOTER HOLDING | 31.06 % |

| EPS (TTM) | ₹ 68.82 |

| SALES GROWTH | 43.13% |

| ROE | 22.85 % |

| ROCE | 29.29% |

| PROFIT GROWTH | 15.35 % |

| Year | Persistent Share Price Target 2024 |

|---|---|

| 2024 | ₹3250.50 to ₹4585.00 |

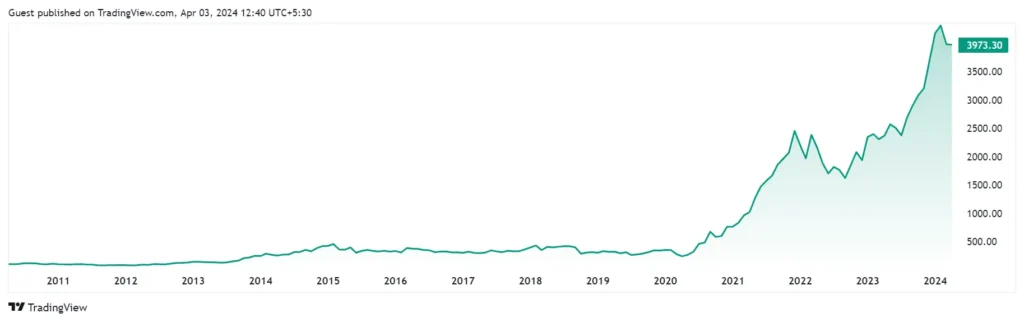

The initial price target for Persistent Systems Ltd in 2024 is projected to be ₹3250.4. With favorable market conditions, the mid-year price target for Persistent Systems Ltd could reach ₹3900.4. By the end of 2024, the price target for Persistent Systems Ltd is expected to potentially reach ₹4585.4, considering bullish market trends.

Also Read: [JIOFIN] Jio Finance Share Price Target 2024, 2025, 2030, 2040 & 2050: A Complete Analysis Report

| Year | Persistent Share Price Target 2025 |

|---|---|

| 2025 | ₹4550.50 to ₹4805.00 |

The analysts’ price forecasts for the next year range from a minimum estimate of 4550.50 INR to a maximum estimate of 4805.00 INR, with a consensus average of 4659.00 INR.

Also Read: Astra Micro Share Price Target 2024, 2025 to 2030

| Year | Persistent Share Price Target 2030 |

|---|---|

| 2030 | ₹5500 to ₹6500 |

As per Techincal & Fundamental analysis, Presistent share price potentially stands between ₹5500 to ₹6500 in 2030.

Also Read: Vedanta Share Price Target 2024, 2025 to 2030

| CATEGORY OF SHAREHOLDER | NUMBER OF SHAREHOLDERS | TOTAL NUMBER OF SHARES | PERCENTAGE (%) |

|---|---|---|---|

| Promoter & Promoter Group | 112 | 3,893,965 | 31.06% |

| Public Shareholding | 67.60% | ||

| – Institutions | 658 | 38,994,614 | 50.69% |

| – Non-Institutions | |||

| – Bodies Corporate | 976 | 439,779 | 0.57% |

| – Individual Shareholders | 175,635 | 10,478,591 | 13.62% |

| – Others | 8,447 | 2,090,230 | 2.72% |

| Employee Trust | 1 | 27,821 | 1.34% |

| Total | 185,728 | 76,925,000 | 100.00% |

Persistent Systems Ltd. Quick Analysis Report

Financial Strength:

- High P/E Ratio (57.69): This suggests the stock might be overvalued compared to its earnings. Further analysis is recommended.

- Good ROA (18.01%): The company efficiently generates profits from its assets, indicating a positive outlook.

- Strong Current Ratio (3.07): Persistent Systems has ample short-term assets to cover short-term liabilities, signifying financial stability.

- High ROE (22.85%): The company effectively utilizes shareholder investments to generate profits.

- Very Low Debt-to-Equity Ratio (0.00): The company has minimal debt, making it financially secure.

Growth and Profitability:

- Decent Sales Growth (43.13%): This indicates moderate company growth.

- Healthy Operating Margin (22.25%): The company efficiently converts revenue into operating profit.

Dividend:

- Low Dividend Yield (0.63%): Investors seeking high dividend income may not find Persistent Systems very attractive.

👍Strengths:

- The company operates with virtually no debt.

- Over the last three years, it has consistently achieved an average profit growth rate of 24.73%.

- In the same period, the company has demonstrated robust income growth of 34.40%.

Conclusion

Persistent Systems shows signs of financial strength with good profitability and low debt. However, the high P/E ratio suggests the stock might be expensive.

FAQs

Disclaimer: Dear Readers, Please note, These stock price projections are based on various factors like past performance, fundamentals, technical signals and market trends. These projections are for informational purposes only and aren’t financial advice or guarantees.