Discover the future of ITC Share Price Targets for 2024, 2025, and 2030. We’ll break down market trends, assess the company’s strengths and weaknesses, and predict potential ups and downs. Join us as we guide investors through the exciting journey ahead with one of India’s top companies, ITC Limited.

About ITC Ltd.

ITC Limited, an Indian holding company established in 1910, operates through various segments: FMCG, Hotels, Paperboards, Paper and Packaging, and Agri Business. The FMCG segment encompasses products like cigarettes, personal care items, packaged foods, and more. Paperboards, Paper, and Packaging include specialty paper and flexible packaging. Agri Business deals with commodities such as wheat, rice, and coffee. ITC’s hotel segment comprises six brands catering to different market segments.

Company Profile

| Company | ITC Limited |

|---|---|

| Former Names | Formerly Imperial Tobacco Company of India Limited (1910–1970) |

| Former Names | India Tobacco Company Limited (1970–1974) |

| Former Names | I.T.C. Limited (1974–2001) |

| Current Name | ITC Limited (2001–present) |

| Company Type | Public |

| Traded As | BSE: 500875 |

| Traded As | NSE: ITC |

| Industry | Conglomerate |

| Predecessor | W.D. & H.O. Wills |

| Founded | 24 August 1910 (113 years ago) |

| Headquarters | Virginia House, Kolkata, West Bengal, India |

| Area Served | Indian subcontinent, Gulf countries |

| Key People | Sanjiv Puri (Chairman & MD) |

| Products | Consumer goods, Cigarettes, Apparel, Education, Hotels and Resorts, Paperboards & Specialty papers, Packaging, Agribusiness, Information technology, |

| Brands | Gold Flake, Wills Navy Cut, Classic, Aashirvaad, Fiama Di Wills, Classmate, Dark Fantasy |

| Revenue | ₹78,498.70 crore (US$9.8 billion) (2023) |

| Operating Income | ₹25,793.21 crore (US$3.2 billion) (2023) |

| Net Income | ₹19,427.68 crore (US$2.4 billion) (2023) |

| Total Assets | ₹85,882.98 crore (US$11 billion) (2023) |

| Total Equity | ₹69,538.79 crore (US$8.7 billion) (2023) |

| Number of Employees | ~49,824 (2023) |

| Website | www.itcportal.com |

ITC Ltd. Fundamental Analysis

| Market Cap | ₹ 5,14,326.95 Cr. |

| Enterprise Value | ₹ 5,10,500.23 Cr. |

| No. of Shares | 1,248.06 Cr. |

| P/E | 25.1 |

| P/B | 7.06 |

| Face Value | ₹ 1 |

| Div. Yield | 3.79 % |

| Book Value (TTM) | ₹ 58.34 |

| Cash | ₹ 3,831.26 Cr. |

| Debt | ₹ 4.54 Cr. |

| Promoter Holding | 0 % |

| EPS (TTM) | ₹ 16.42 |

| Sales Growth | 17.22% |

| ROE | 29.55 % |

| ROCE | 38.49% |

| Profit Growth | 24.54 % |

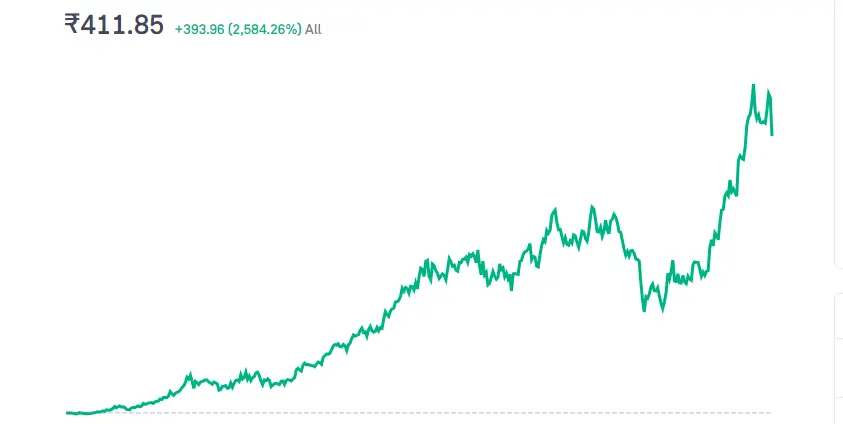

ITC Ltd. Share Price Growth Chart – All Time

ITC Ltd. Profit & Loss – Last 3 Years

| DATA | MAR 2021 (Cr.) | MAR 2022 (Cr.) | MAR 2023 (Cr.) |

|---|---|---|---|

| Net Sales | 45,485.13 | 56,341.27 | 66,043.27 |

| Total Expenditure | 29,952.43 | 37,447.80 | 42,076.46 |

| Operating Profit | 15,532.70 | 18,893.47 | 23,966.81 |

| Other Income | 3,252.26 | 2,648.74 | 2,447.04 |

| Interest | 58.94 | 60.53 | 73.58 |

| Depreciation | 1,561.83 | 1,652.15 | 1,662.73 |

| Exceptional Items | 0 | 0 | 72.87 |

| Profit Before Tax | 17,164.19 | 19,829.53 | 24,750.41 |

| Tax | 4,132.51 | 4,771.70 | 5,997.10 |

| Net Profit | 13,031.68 | 15,057.83 | 18,753.31 |

| Adjusted EPS (Rs.) | 10.59 | 12.22 | 15.09 |

ITC Share Price Target 2024, 2025, 2030

ITC Share Price Target 2024

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2024 | 513 | 980 |

For 2024, analysts predict a minimum target of ₹513 and a maximum target of ₹980. This potential growth reflects ITC’s consistent revenue growth and improved profitability in recent years.

The company’s strong brand portfolio across various segments, including FMCG with popular brands like Aashirvaad and Classmate, is expected to continue driving sales. Additionally, the potential expansion of the hospitality sector post-pandemic could benefit ITC’s hotel business.

Also Read: Tech Mahindra Share Price Target 2024, 2025 and 2030: A Detailed Overview

ITC Share Price Target 2025

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 850 | 1530 |

Looking ahead to 2025, the estimated share price target ranges from ₹850 to ₹1530. This anticipated rise builds upon the projected growth in 2024. Continued economic recovery and potential government initiatives fostering the FMCG sector could further contribute to ITC’s revenue growth.

Additionally, the company’s strategic investments in areas like agribusiness and paperboards might translate into promising returns in the long term.

Also Read: Bajaj Electricals Share Price Target 2024, 2025, 2030: A Fundamental Analysis

ITC Share Price Target 2030, 2040 & 2050

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2030 | 3000 | 3520 |

Forecasting the share price in 2030 involves greater uncertainty due to the extended timeframe. However, analysts have provided a wider range of potential targets, from ₹3000 to ₹3520.

This indicates a cautious optimistic outlook, taking into account potential factors like technological advancements, changing consumer preferences, and regulatory developments in the coming years. ITC’s commitment to innovation and diversification could be crucial in navigating these future challenges and achieving long-term success.

Also Read: Mercury EV-Tech Share Price Target 2024, 2025, 2030, 2040, 2050: A Detailed Analysis

Expert analysis on ITC share price targets

Several market experts have provided their insights on ITC’s share price prospects:

- BOB Capital Markets has set an estimated target of Rs 486 for ITC.

- KRChoksey advises buying ITC at Rs 412, with a share price target of Rs 492.

- Axis Direct has projected an ITC share price target of Rs 480.

- Motilal Oswal recommends purchasing ITC Ltd at Rs 419.70, with share price targets reaching Rs 485.

ITC Ltd. Share Analysis Report – Good to Invest?

Stock analysis demands meticulous scrutiny of financial data, including profit and loss statements, balance sheets, and cash flow statements. However, financial ratios offer a more digestible insight into a company’s performance. Let’s examine ITC through key metrics:

- PE Ratio: ITC’s PE ratio stands at 24.93, indicating it might be overvalued.

- Share Price: Currently at Rs 409.20, the share price warrants further valuation analysis.

- Return on Assets (ROA): At 23.84%, ITC exhibits efficient asset utilization.

- Current Ratio: With a ratio of 2.84, ITC demonstrates robust liquidity.

- Return on Equity (ROE): ITC’s ROE of 29.55% showcases strong profitability.

- Debt to Equity Ratio: At 0.00, ITC maintains a low debt-to-equity ratio, reflecting a favorable capital structure.

- Inventory Turnover Ratio: ITC’s ratio of 6.82 suggests room for improvement in inventory management.

- Sales Growth: With a growth rate of 17.22%, ITC shows steady revenue expansion.

- Operating Margin: Operating margin for ITC stands at 36.29%, indicating operational efficiency.

- Dividend Yield: ITC offers a dividend yield of 3.79%, providing investors with modest returns.

👍 Strengths

- The company has maintained a robust ROE of 25.68% over the past 3 years.

- Consistently strong ROCE of 33.17% over the past 3 years.

- Virtually debt-free.

- Healthy interest coverage ratio of 337.37.

- Maintained effective average operating margins of 34.77% in the last 5 years.

- Efficient Cash Conversion Cycle of 10.41 days.

- Strong liquidity position with a current ratio of 2.84.

- Demonstrates a strong degree of Operating leverage, with an average Operating leverage standing at 12.58.

👎 Weakness

- Poor profit growth of 7.40% over the past 3 years.

- Poor revenue growth of 13.12% over the past 3 years.

Disclaimer: Please note, stock price projections for ITC Ltd. in 2024, 2025, and 2030 are based on factors like past performance and market trends. However, investing involves risks, and past performance doesn’t guarantee future results. These projections are for informational purposes only and aren’t financial advice or guarantees. It’s essential to research and consult with experts before making investment decisions.

FAQs

You can easily acquire shares of ITC through various platforms such as

- Zerodha,

- Upstox,

- ICICI Direct,

- HDFC Securities,

- Kotak Securities,

- Angel Broking,

- Sharekhan,

- and 5paisa.

As per stock market experts, ITC share could possible to reach ₹1000 in 2025 (Approx.)

Experts Predicts, ITC share price hit ₹500 to ₹750 at the end of this year.