Explore JSW Infrastructure share price targets for 2024, 2025 to 2030 in this concise forecast. Discover potential growth trends and market insights for investors seeking valuable projections. Stay informed about JSW Infrastructure’s performance amidst evolving market dynamics.

About JSW Infrastructure

JSW Infrastructure Limited, established in 2006, is an Indian company specializing in the development, operation, and maintenance of port services and related infrastructure. Under the leadership of Managing Director Mr. Arun Maheshwari, it provides a wide range of port services including marine, stevedoring, storage, handling, and evacuation services, catering to various cargo types through diverse transportation modes.

JSW Infrastructure Ltd. Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹ 53,602.54 Cr. |

| Enterprise Value | ₹ 56,452.26 Cr. |

| No. of Shares | 210 Cr. |

| P/E | 799.15 |

| P/B | 7.26 |

| Face Value | ₹ 2 |

| Div. Yield | 0 % |

| Book Value (TTM) | ₹ 35.17 |

| Cash | ₹ 409.91 Cr. |

| Debt | ₹ 3,259.63 Cr. |

| Promoter Holding | 85.61 % |

| EPS (TTM) | ₹ 0.32 |

| Sales Growth | 12.38% |

| ROE | 4.48 % |

| ROCE | 10.91% |

| Profit Growth | -52.28 % |

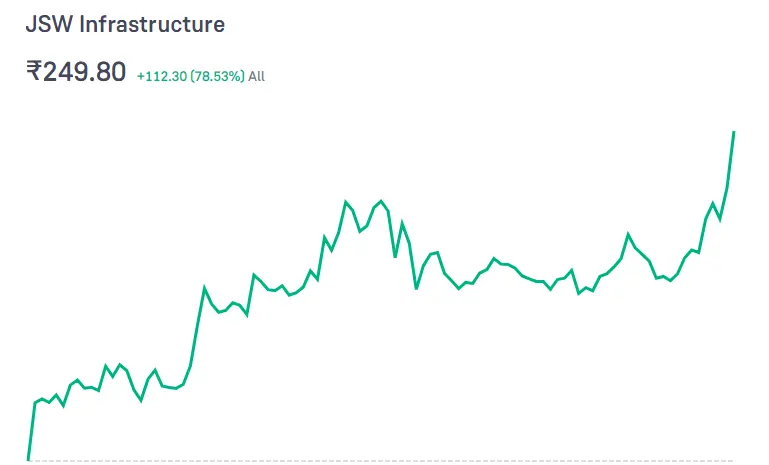

JSW Infrastructure Ltd. Share Price Growth Chart

JSW Infrastructure Ltd. Profit & Loss

| PARTICULARS | MAR 2021 (Cr.) | MAR 2022 (Cr.) | MAR 2023 (Cr.) |

|---|---|---|---|

| Net Sales | 320.26 | 473.03 | 531.58 |

| Total Expenditure | 164.05 | 270.04 | 313.74 |

| Operating Profit | 156.21 | 202.99 | 217.84 |

| Other Income | 49.55 | 117.16 | 296.70 |

| Interest | 69.16 | 145.35 | 460.48 |

| Depreciation | 1.77 | 1.66 | 1.36 |

| Exceptional Items | 0 | 0 | 0 |

| Profit Before Tax | 134.83 | 173.14 | 52.69 |

| Tax | 35.84 | 32.60 | -14.37 |

| Net Profit | 98.97 | 140.88 | 67.07 |

| Adjusted EPS (Rs.) | 0.55 | 0.78 | 0.37 |

JSW Infrastructure Share Price Target 2024, 2025 and 2030

Also Read: ITC Share Price Target 2024, 2025, 2030: A Strategic Analysis

JSW Infrastructure Share Price Target 2024

| Year | JSW INFRA Share Price Target 2024 |

| 2024 | ₹250.36 – ₹350.12 |

In 2023, many Indian stocks, including JSWINFRA, witnessed a remarkable bull run. The first quarter of 2024 is anticipated to maintain a bullish sentiment, albeit with some initial consolidation. Technical data suggests that JSWINFRA’s minimum share price target for 2024 is estimated at ₹250.36, with a maximum target of ₹350.12.

Also Read: Devyani International Share Price Target 2024, 2025, 2030: A Strategic Analysis

JSW Infrastructure Share Price Target 2025

| Year | JSW INFRA Share Price Target 2025 |

| 2025 | ₹360.73 – ₹496.71 |

The anticipated value of JSWINFRA’s share price is expected to reach Rs. 360.73 by January 2025. If supported by macro and microeconomic factors, along with industry trends, there’s a possibility that the target price of JSW Infrastructure Ltd could reach Rs. 496.71 by December 2025.

Also Read: Bajaj Electricals Share Price Target 2024, 2025, 2030: A Fundamental Analysis

JSW Infrastructure Share Price Target 2026

| Year | JSW INFRA Share Price Target 2026 |

| 2026 | ₹490.73 – ₹620.71 |

According to technical data, the projected minimum share price target for JSWINFRA is expected to reach Rs. 490.73, while the maximum value could be Rs. 620.71.

Also Read: Mahindra and Mahindra Share Price Target 2024, 2025, 2030: A Detailed Analysis

JSW Infrastructure Share Price Target 2027

| Year | JSW INFRA Share Price Target 2027 |

| 2027 | ₹600.03 – ₹796.26 |

Utilizing Fibonacci projections, the forecasted price target for JSW Infrastructure Ltd (JSWINFRA) in the first half of 2027 is estimated to range between ₹600.03 – ₹796.26. By the second half of 2027, JSWINFRA’s share price may reach a maximum value of ₹796.26.

Also Read: Mercury EV-Tech Share Price Target 2024, 2025, 2030, 2040, 2050: A Detailed Analysis

JSW Infrastructure Share Price Target 2028

| Year | JSW INFRA Share Price Target 2028 |

| 2028 | ₹795 – ₹935 |

JSWINFRA’s projected share prices for 2028 exhibit a consistent pattern, starting with a target of ₹795 in January and peaking at ₹805 in February. Subsequently, the targets stabilize around the ₹850 to ₹935 range from April to December, reflecting a period of consolidation with slight fluctuations. This steady performance underscores the company’s resilience and the favorable market conditions driving its price trajectory throughout the year.

Also Read: Wipro Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analysis

JSW Infrastructure Share Price Target 2029

| Year | JSW INFRA Share Price Target 2029 |

| 2029 | ₹940 – ₹1090 |

The initial price target for JSWINFRA in 2029 is projected to be ₹940. With favorable market conditions, the mid-year price target could reach ₹1090. By the end of 2029, the price target is expected to potentially reach ₹1090, considering bullish market trends.

Also Read: Orient Green Power Share Price Target 2024, 2025, 2030: A Strategic Analysis

JSW Infrastructure Share Price Target 2030

| Year | JSW INFRA Share Price Target 2030 |

| 2030 | ₹1100 – ₹1500 |

The initial price target for JSWINFRA in 2030 is projected to be ₹1100. With favorable market conditions, the mid-year price target could reach ₹1500. By the end of 2030, the price target is expected to potentially reach ₹1500, reflecting optimistic market trends.

JSW Infrastructure Share Price Analysis Report: Buy Or Sell?

Assessing a company’s financial health and performance is vital for investors, often involving meticulous analysis of various financial statements. However, employing financial ratios simplifies this process.

Here are essential tools for investors:

- PE Ratio: JSW Infrastructure’s high PE ratio of 773.01 suggests overvaluation.

- Share Price: Currently, JSW Infrastructure’s share price stands at Rs 246.90.

- ROA: With an ROA of 1.37%, JSW Infrastructure’s efficiency in generating profits from assets appears concerning.

- Current Ratio: JSW Infrastructure’s robust current ratio of 9.32 indicates stability in meeting short-term obligations.

- ROE: The ROE of 4.48% signifies JSW Infrastructure’s capability to generate profits from shareholder investments.

- Debt to Equity Ratio: JSW Infrastructure’s D/E ratio of 2.03 highlights a significant proportion of debt in its capital.

- Inventory Turnover Ratio: JSW Infrastructure’s high inventory turnover ratio of 339.90 demonstrates efficient inventory and working capital management.

- Sales Growth: The reported sales growth of 12.38% for JSW Infrastructure indicates a sluggish performance.

- Operating Margin: JSW Infrastructure’s operating margin for the current financial year is 40.98%, reflecting operational efficiency.

- Dividend Yield: JSW Infrastructure’s current year dividend is Rs 0, resulting in a 0% yield.

👍Strengths

- Over the past 3 years, the company has demonstrated robust revenue growth of 23.16%.

- Maintaining an impressive average operating margin of 42.15% over the last 5 years showcases the company’s operational efficiency.

- With a Cash Conversion Cycle of 57.31 days, the company exhibits efficient cash flow management.

- Possessing a healthy liquidity position, the company maintains a current ratio of 9.32.

- The company’s cash flow management is commendable, evident from its CFO/PAT ratio of 1.71.

- A high promoter holding of 85.61% underscores strong confidence in the company’s prospects.

- Notably, promoter stake has surged from 0% to 85.61% in the last quarter.

👎Weakness

- Despite revenue growth, the company has experienced poor profit growth of -20.11% over the past 3 years.

- A low tax rate of -27.27% raises concerns about the company’s tax management practices.

- Trading at a high EV/EBITDA ratio of 100.53, the company’s valuation appears relatively steep.

JSW Infra Latest News

Disclaimer: Dear Readers, Please note, stock price projections for JSW INFRA in 2024, 2025, and 2030 are based on factors like past performance and market trends. However, investing involves risks, and past performance doesn’t guarantee future results. These projections are for informational purposes only and aren’t financial advice or guarantees. It’s essential to research and consult with experts before making investment decisions.

FAQs

According to analysis, JSW Infra share price could possible to reach INR 1000 at the end of the 2029.

There is a number of stock brokers in india that provide online broking services:

Zerodha, 5Paisa, Angel One, Dhan and More Stock Brokers.