In the ever-evolving landscape of the global stock market, investors are constantly seeking insights to make informed decisions about their portfolios. One company that has garnered attention is Wipro Limited, a leading global information technology, consulting, and business process services company. As investors look ahead to the future, a critical aspect of their strategy involves predicting the share price trajectory of Wipro over the coming decades.

This comprehensive analysis delves into the potential Wipro Share Price Target 2024, 2025, 2030, 2040, and 2050. To form a well-rounded perspective, we’ll consider various factors that influence stock prices, including market trends, industry dynamics, company performance, technological advancements, and macroeconomic indicators.

Join us on this journey as we explore the intricacies of Wipro’s past, present, and future, aiming to equip investors with valuable insights to navigate the complexities of the stock market and make informed decisions about their investment strategies.

About Wipro Ltd.

Wipro Limited is a prominent technology services and consulting company, operating through two key segments: Information Technology (IT) Services and IT Products.

Within the IT Services segment, Wipro offers a comprehensive array of IT and IT-enabled services, encompassing digital strategy advisory, customer-centric design, technology consulting, custom application design, maintenance, systems integration, package implementation, cloud and infrastructure services, business process services, and research and development. Additionally, the company provides hardware and software design services.

In the IT Products segment, Wipro offers a diverse range of third-party IT products, allowing the provision of integrated IT system integration services. These products span computing, platforms, storage, networking solutions, and various software products.

Wipro’s services cover a broad spectrum, including Applications, Artificial Intelligence, Business Process, Cloud, Consulting, Data & Analytics, Digital Experiences, Engineering, and Sustainability.

Founded in 1945, Wipro Limited has been a significant player in the technology and consulting industry. The company is listed on the National Stock Exchange (NSE) with the symbol “WIPRO.” Mr. Thierry Delaporte serves as the Managing Director of Wipro Limited.

Wipro Company Profile

| Founded In | 1945 (79 years old) |

|---|---|

| Ownership | Public |

| India Employee Count | 1 Lakh+ |

| Global Employee Count | 10,000 – 50,000 |

| Headquarters | Bangalore/Bengaluru, Karnataka, India |

| Office Locations | Hyderabad/Secunderabad, Mysuru/Mysore, Lucknow, 21+ more |

| CEO | Anis Chenchah |

| Founders | Azim H. Premji |

| Type of Company | Indian MNC |

| Nature of Business | Service, B2B |

| Company Email ID | [email protected] |

| Company Contact No. | 8028440011 |

| Website | wipro.com |

Wipro Ltd. Vision

Contribute to global e-society, where a wide range of information is being exchanged beyond time and space over global networks, which breaks down the boundaries among countries, regions, and cultures, allowing individuals to take part in various social activities in an impartial, secure way. Continous effort to enhance people’s lifestyle and quality by means of developing new technology in wireless communication.

WIPRO LTD.

Wipro Lt. Brand Values

Wipro, an Indian multinational corporation that provides information technology, consulting, and business process services, is guided by several core values that shape its corporate culture and operations. These brand values are:

- Integrity: Upholding the highest ethical standards in all interactions, transactions, and communications.

- Customer Focus: Placing clients at the center of everything, striving to understand their needs and delivering solutions that exceed expectations.

- Innovation: Embracing creativity and continuous improvement to drive technological advancements and provide innovative solutions.

- Respect for Individuals: Valuing diversity, treating everyone with dignity and fairness, and fostering an inclusive work environment.

- Excellence: Pursuing excellence in all endeavors, setting high standards, and continuously striving to improve performance.

- Teamwork and Collaboration: Promoting collaboration, synergy, and teamwork across all levels and functions within the organization.

- Responsibility: Taking ownership of actions and decisions, and contributing positively to the communities and environments in which Wipro operates.

These values guide Wipro’s business practices, decision-making processes, and interactions with stakeholders, helping the company maintain its reputation as a responsible and ethical global corporation.

Wipro Share Price Target 2024, 2025, 2030, 2040, 2050

Predicting the future is a tricky business, especially when it comes to the stock market. However, by analyzing expert opinions, technical indicators, and fundamental factors, we can paint a picture of what the future might hold for Wipro Ltd., a leading Indian IT services company. Let’s embark on a journey through time and explore potential share price targets for Wipro from 2024 to 2050.

Wipro Share Price Target 2024

| Year | Wipro Share Price Forecast 2024 |

| 2024 | ₹583 to ₹595 |

For 2024, analysts remain cautiously optimistic. Wipro is expected to navigate the current economic uncertainties and witness moderate growth. Share price targets range from ₹535 to ₹621, with an average expectation of ₹583 to ₹595. This signifies potential upside but also acknowledges the headwinds the company faces.

Also Read: Infosys Share Price Target 2023, 2024, 2025, 2030, 2040, 2050

Wipro Share Price Target 2025 to 2030

| Year | Wipro Share Price Forecast 2025 |

| 2025 | ₹1035 |

The next five years are crucial for Wipro. The company’s focus on digital transformation, cloud computing, and automation is expected to pay dividends. Analysts predict a steady rise in share price, reaching ₹1035 in 2025 and potentially crossing ₹3475 by 2030. This growth hinges on Wipro’s ability to capitalize on emerging technologies and secure large-scale contracts.

| Year | Wipro Share Price Forecast 2030 |

| 2030 | ₹3475 |

Also Read: SBI Share Price Target 2024 to 2050

Wipro Share Price Target 2040

| Year | Wipro Share Price Forecast 2040 |

| 2040 | ₹6500 |

By 2040, the world will be vastly different. Technological advancements will reshape industries and redefine business models. Wipro’s success will depend on its ability to adapt and innovate. Analysts predict a significant jump in share price, potentially reaching ₹6500 or even higher. This optimistic outlook assumes Wipro remains a leader in emerging tech domains like AI, cybersecurity, and blockchain.

Wipro Share Price Target 2050

| Year | Wipro Share Price Target 2050 |

| 2050 | ₹16000 |

Predicting the future beyond 2040 becomes even more challenging. However, by considering long-term trends and Wipro’s commitment to sustainability and social responsibility, we can envision a promising future. Analysts suggest a share price target exceeding ₹16000 by 2050, highlighting Wipro’s potential to become a global technology giant.

Also Read: Polycab Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analysis

Wipro Ltd. Fundamentals

| Wipro Ltd. Fundamentals | Value |

|---|---|

| Market Cap | ₹ 2,53,644.73 Cr. |

| Enterprise Value | ₹ 2,54,298.43 Cr. |

| Number of Shares | 522.44 Cr. |

| P/E | 28.38 |

| P/B | 4.57 |

| Face Value | ₹ 2 |

| Dividend Yield | 0.21 % |

| Book Value (TTM) | ₹ 106.35 |

| Cash | ₹ 4,527 Cr. |

| Debt | ₹ 5,180.70 Cr. |

| Promoter Holding | 72.93 % |

| EPS (TTM) | ₹ 17.10 |

| Sales Growth | 13.73% |

| ROE | 15.82% |

| ROCE | 19.85% |

| Profit Growth | -24.38% |

The company’s market capitalization is ₹2,53,644.73 Crores, and it has an enterprise value of ₹2,54,298.43 Crores. The number of shares is 522.44 Crores, with a P/E ratio of 28.38 and a P/B ratio of 4.57. The face value of each share is ₹2. The dividend yield is 0.21%, and the book value (TTM) is ₹106.35.

In terms of financial position, the company has ₹4,527 Crores in cash and ₹5,180.70 Crores in debt. The promoter holding is at 72.93%. The company’s earnings per share (TTM) is ₹17.10, and it has shown a sales growth of 13.73%. The Return on Equity (ROE) is 15.82%, and the Return on Capital Employed (ROCE) is 19.85%. However, there has been a negative profit growth of -24.38%.

Wipro Ltd. Share Price Chart

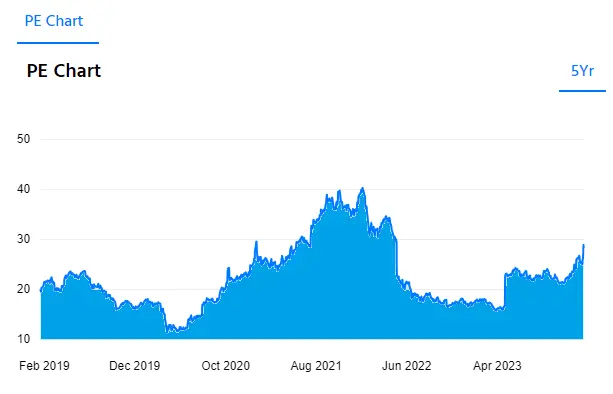

Wipro Ltd. P/E Chart

Wipro Ltd. Balancesheet

| Equity and Liabilities | MAR 2021 (In CR.) | MAR 2022 (In CR.) | MAR 2023 (In CR.) |

|---|---|---|---|

| Share Capital (Cr.) | 1,095.80 | 1,096.40 | 1,097.60 |

| Total Reserves (Cr.) | 44,145.80 | 53,254.30 | 61,664.70 |

| Borrowings (Cr.) | 14.10 | 5.70 | 0 |

| Other Non-Current Liabilities (Cr.) | 2,300.80 | 2,799.40 | 3,635.70 |

| Current Liabilities (Cr.) | 18,132.40 | 23,173.70 | 18,842.80 |

| Total Liabilities (Cr.) | 65,688.90 | 80,329.50 | 85,240.80 |

| Assests | MAR 2021 (In CR.) | MAR 2022 (In CR.) | MAR 2023 (In CR.) |

|---|---|---|---|

| Net Block (Cr.) | 7,288.10 | 8,037.70 | 8,824.70 |

| Capital Work-in-Progress (Cr.) | 1,848.00 | 1,584.50 | 603.80 |

| Intangible Work-in-Progress (Cr.) | 0 | 0 | 0 |

| Investments (Cr.) | 8,206.70 | 16,557.20 | 19,372.80 |

| Loans & Advances (Cr.) | 2,336.50 | 1,577.60 | 1,780.80 |

| Other Non-Current Assets (Cr.) | 630.10 | 800.30 | 680.90 |

| Current Assets (Cr.) | 45,379.50 | 51,772.20 | 53,977.80 |

| Total Assets (Cr.) | 65,688.90 | 80,329.50 | 85,240.80 |

Wpro Ltd. Profit & Loss

| PARTICULARS | MAR 2021 (In CR.) | MAR 2022 (In CR.) | MAR 2023 (In CR.) |

|---|---|---|---|

| Net Sales (Cr.) | 50,299.40 | 59,574.40 | 67,753.40 |

| Total Expenditure (Cr.) | 38,553.90 | 47,266.80 | 56,087.80 |

| Operating Profit (Cr.) | 11,745.50 | 12,307.60 | 11,665.60 |

| Other Income (Cr.) | 2,691.20 | 4,809.70 | 2,824.30 |

| Interest (Cr.) | 402.60 | 367.40 | 628.90 |

| Depreciation (Cr.) | 1,349.30 | 1,485.70 | 1,592.10 |

| Exceptional Items (Cr.) | 0 | 0 | 0 |

| Profit Before Tax (Cr.) | 12,684.80 | 15,264.20 | 12,268.90 |

| Provision for Tax (Cr.) | 2,623.90 | 3,128.90 | 3,092.20 |

| Net Profit (Cr.) | 10,060.90 | 12,135.30 | 9,176.70 |

| Adjusted EPS (Rs.) | 18.36 | 22.14 | 16.72 |

Wipro Ltd. Cash Flows

| WIPRO Cash Flows | MAR 2021 (In CR.) | MAR 2022 (In CR.) | MAR 2023 (In CR.) |

|---|---|---|---|

| Profit from Operations (Cr.) | 12,684.80 | 15,264.20 | 12,268.90 |

| Adjustment (Cr.) | -693.50 | -2,131.50 | 825.70 |

| Changes in Assets & Liabilities (Cr.) | 3,012.30 | -3,802.60 | 277.30 |

| Tax Paid (Cr.) | -2,275.90 | -2,089.60 | -2,180.30 |

| Operating Cash Flow (Cr.) | 12,727.70 | 7,240.50 | 11,191.60 |

| Investing Cash Flow (Cr.) | -1,282.80 | -12,620.30 | -4,759.10 |

| Financing Cash Flow (Cr.) | -12,105.70 | 494.70 | -6,803.60 |

| Net Cash Flow (Cr.) | -660.80 | -4,885.10 | -371.10 |

WIPRO Ltd. Financial Analysis

Investing in stocks requires a thorough analysis of a company’s financial data, typically involving an examination of its profit and loss account, balance sheet, and cash flow statement. However, this process can be time-consuming and complex. A more convenient approach to assessing a company’s performance involves looking at key financial ratios, which help investors make sense of the wealth of information in financial statements.

Here are some essential tools that should be part of every investor’s research process:

- PE Ratio (Price to Earnings): The PE ratio, indicating how much an investor is willing to pay for a share in relation to its earnings, is a crucial factor. Wipro’s PE ratio stands at 28.36, suggesting a relatively high valuation and potential overvaluation.

- Share Price: Wipro’s current share price is Rs 485. Utilizing valuation calculators can help investors determine whether the share price is undervalued or overvalued.

- Return on Assets (ROA): ROA measures a company’s efficiency in earning a return on its investment in assets. Wipro’s ROA is 11.08%, signaling potential concerns for future performance.

- Current Ratio: The current ratio gauges a company’s ability to meet short-term liabilities with short-term assets. Wipro boasts a current ratio of 2.86, indicating stability in handling unforeseen challenges.

- Return on Equity (ROE): ROE evaluates a firm’s ability to generate profits from shareholders’ investments. Wipro’s ROE is 15.82%, reflecting a positive indicator for its performance.

- Debt to Equity Ratio: This metric assesses a company’s capital structure and performance. Wipro’s low D/E ratio of 0.08 signifies a minimal proportion of debt in its capital.

- Sales Growth:Wipro reports a sales growth of 13.73%, indicating a modest performance in relation to its growth potential.

- Operating Margin: The operating margin, showcasing operational efficiency, stands at 17.22% for Wipro in the current financial year.

- Dividend Yield: The current dividend for Wipro is Rs 1, resulting in a dividend yield of 0.21%, indicating the dividend in relation to the stock’s price.

Does Wipro Ltd. Pays Dividend?

Yes, Wipro Ltd. does pay dividends to its shareholders. They have a Dividend Distribution Policy in place, which outlines their commitment to returning 45%-50% of their net income cumulatively on a block of 3 years period through a combination of dividends and/or share buyback and/or special dividends.

- Dividend declared: ₹1 per share, representing 50% of the company’s net profit.

- Current share price: ₹484.10

- Dividend yield: 0.21%

- Dividend track record: Consistent payouts for the past 5 years.

Recommended Articles:

- IRCON Share Price Target 2024, 2025, 2030, 2040, 2050: A Complete Analysis

- Bajaj Auto Share Price Target 2024, 2025, 2030, 2040, 2050: A Comprehensive Analyst Report

- Adani Power Share Price Target 2024, 2025, 2030, 2040, 2050: A Strategic Guide

- Praveg Share Price Target 2024, 2025, 2030, 2040, 2050: A Complete Stock Price Guide

Disclaimer: Dear Reader, Please don't consider these projections as a advice. This is based on my fundamental and technical analysis, but the actual growth of any company and stock contain many factors. So, Do your own research before taking any investment decision.

FAQs

Q. When will Wipro share price reach ₹1000?

Analysts predict 3-5 years, but market conditions and company performance play a major role.

Q. When will wipro Ltd. share Price hit ₹5000?

Wipro Ltd. share price will be expected to hit ₹5000 in 2035.

Q. What will be the wipro share price target in 2025?

₹1000 – ₹1035: Based on expected digital business growth and market expansion.

Q. What will be the wipro share price target in 2030?

₹3500 or higher: Optimistic predictions, but consider the uncertainty of long-term forecasts.

Q. What will be the Wipro Ltd. Share Price Target in 2040?

₹9,000 – ₹11,000 (optimistic): Highly uncertain due to long timeframe and numerous influencing factors.

Recommended Artcles:

- Waaree Share Price Target 2024, 2025, 2030: A Fundamental Analysis

- Hindalco Share Price Target 2024, 2025, 2030: A Strategic Analysis

- Amazon stock forecast 2023, 2024, 2025, 2030, 2040, 2050

- MULN Stock Forecast 2024, 2025, 2030: Is Muln Dead?

- [JIOFIN] Jio Finance Share Price Target 2024, 2025, 2030, 2040 & 2050: A Complete Analysis Report